Sweetbridge Crowdsale - “money for nothing” & A new OS for the world economy - liquid frictionless environments

+++ This is not financial advice or tax advice. +++ Do your own research before you invest! +++ The author holds a small position (<10k USD) in Sweetcoin. +++

PART 1: WHAT IS Sweetbridge ABOUT?

Sweetbridge is an extension module for the existing economy. It will serve as a liquidity provider and analytical resource for the vast network of global supply chains. It will …

- Unlock the trapped value that is stuck in 700 trillion USD of valued assets worldwide and 123 trillion USD of trade for goods & services in the global economy by tokenizing the assets and “giving yourself a loan” vs. the collateral value.

- Help businesses and individuals to create wealth. Acquire assets without spending large sums for interest rates. Especially increase the financial capabilities of smaller companies that often pay up to 20% for their loans.

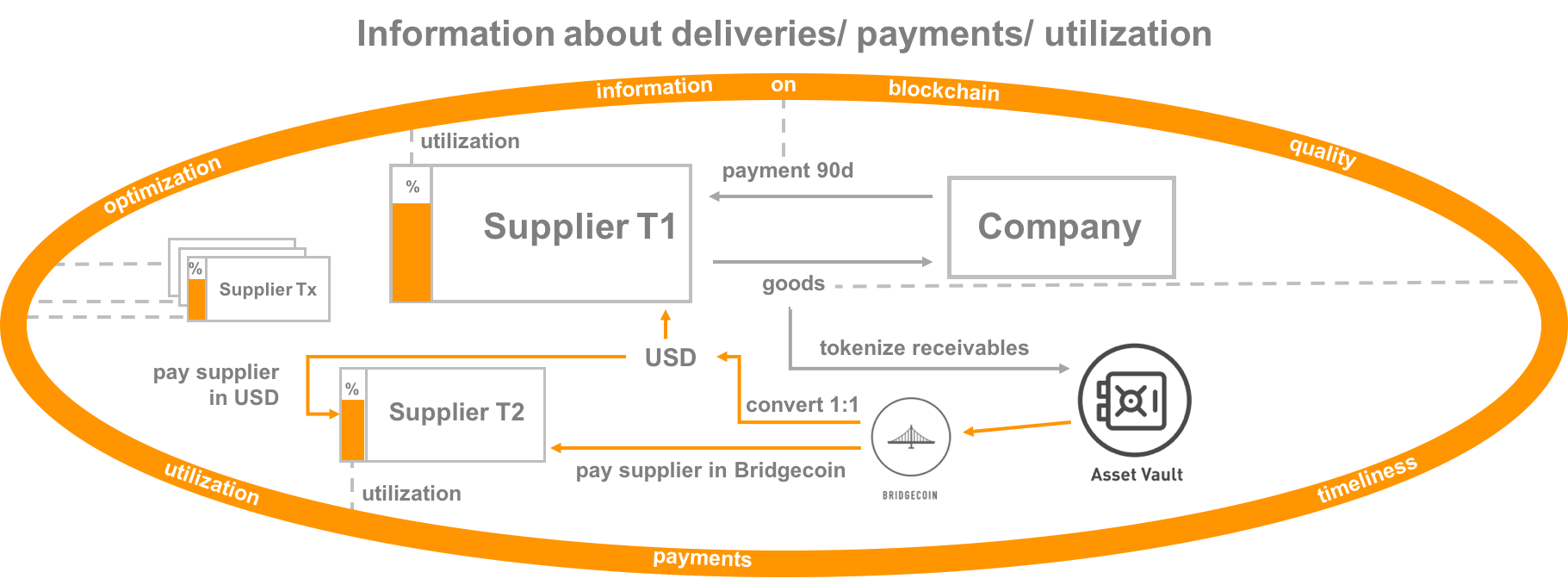

- Decrease counterparty risk in the supply chain by providing the history on counterparties and their delivery history on the supply chain. Bypass bad actors.

- Increase the efficiency of business by providing information on the utilization of resources therefore reducing the need of costly sales reps.

What will Sweetbridge provide?

PAYMENTS

- no banking fees

- no credit card fees

LOANS

- up to 0% interest rate

- no counterparty approval

- just takes a minute

FUNDING

- you don’t have to sell your assets

SUPPLY CHAIN

- increase cash on balance sheet

- decrease capital required

- improve profit (>2%)

- increase transparency of supply chain

PART 2: WHO IS THE TARGET CUSTOMER? WHAT IS OFFERED?

In phase 1a only crypto investors and miners will be the target customers.

Both don’t have to sell their Bitcoin or Ether to receive about 50% of its value in Bridgecoin. They can use the liquidity to buy more crypto tokens or spend the money on e.g. a new computer.

Important: As the crypto assets are not sold no taxable event is triggered.

In phase 1b when Sweetbridge adds other asset classes like stocks, bonds, receivables etc. the target customers range widens. Basically, every owner of tokenizable assets in need of liquidity is a target customer.

As Sweetbridge provides additional value in cross border business, all internationally acting companies can be considered as core target group, especially those with large fungible assets.

In a phase 2 Sweetbridge will add the Sweetbridge Settlement Bus which will introduce tools for efficient settlement of transactions in Bridgecoin and without using fiat currency. The Settlement Bus fees will be lower than credit card and bank settlement fees while providing an additional revenue to fund the Stability Pool (See later).

In phase 3 Sweetbridge will provide the Sweetbridge Accounting Protocol. This uses the information generated by the Settlement Protocol to provide transparency into changes in the financial strength of supply chain participants

• transparency of a company’s own economics and financing capacity

• risk management by assessing financial risks associated with any specific entity

• auditability by providing a detailed, permanent audit trail of all transactions completed

In phase 4 the Resource Sharing Protocol uses the data generated by the three lower layers of the Sweetbridge protocol stack enabling supply chain entities to plan and execute more profitably through collaborative use of shared resources such as factories, warehouses, and heavy equipment.

In phase 5, the optimization & liquid talent, a company can hire an external specialist to analyze its supply chain data and suggest improvements. If the improvements result in a better performance this will automatically show in the Sweetbridge protocol. The specialist is then automatically paid the fixed sum, e.g. a percentage of the savings achieved, executed by a smart contract.

For a full description of the various services layers please read the Protocols Page (https://sweetbridge.com/protocols).

Here a small graphic (nothing official) that I drew up to get a better picture of the Sweetbridge universe:

PART 3: HOW DOES IT WORK (Phase 1)?

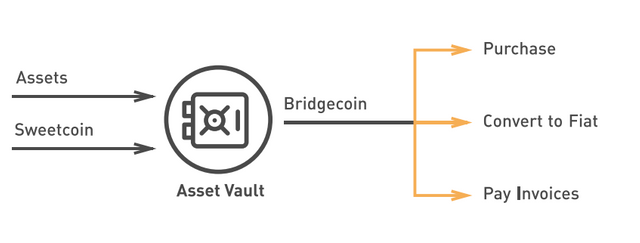

You need a tokenized asset like Bitcoin (BTC) or Ether (ETH) or Sweetcoin (SWC) as collateral that can be directly acted on by a smart contract. You lock these in the asset vault and get a loan based on the collateral value of these assets, e.g. about 50% for BTC or ETH.

Afterwards your Bridgecoin Tokens will be created and you will receive the equivalent Bridgecoin tokens (1:1 pegged to the USD) and will be able to

(a) pay invoices within the Sweetbridge economy with these tokens

(b) buy other cryptocurrency assets on a crypto exchange

(c) convert the Bridgecoin to USD and pay your normal fiat based invoices

Official graphic from Sweetbridge:

If you simply lock BTC and ETH in your individual asset vault you will pay an interest rate of about 6%. If you own and active enough of your Sweetcoins this will drop down up to 0%. Each Sweetbridge token has a loan-reduction-value of USD 0.06 to 0.07 per month.

When you pay back your loan to yourself the Bridgecoins will get burned.

For a full description please look at the Product Page (https://sweetbridge.com/product).

2min. product video:

Adding other assets types: In later stages the customer will be also able to use receivables, stocks, bonds, real estate etc. as collateral. In later stages Sweetbridge will also provide other Bridgecoin tokens that will be pegged 1:1 to EUR, YEN etc.

What happens to assets, that fall below a borrowing capacity threshold value? Like with a normal bank the customer will be reminded to increase his collateral value when the value drop below the threshold. When everything comes to the worst and the assets prices drop again, you would be warned of an approaching liquidation level and the need to increase the collateral value stored. If it comes to the worst the assets will be sold by a licensed Sweetbridge entity according to the individual national jurisdiction. These entities will have signed on a common constitution and ethical rules. Judging from the Core Beliefs of Sweetbridge (https://blog.sweetbridge.com/sweetbridge-philosophy-and-core-beliefs-on-economics-part-1-of-11-dd478c261efd) you will be better off then with the typical banker. But of cause Sweetbridge must protect the community.

PART 4: TOKEN ECONOMICS

Each token owner can activate his Sweetcoin and use them to reduce the interest rates of his loan and in later stages also other service fees like the usage of the Sweetcoin Settlement Bus.

50% of the revenue of the Sweetbridge network (interest rates, royalty fees) go to the Sweetcoin token holders who activated their coins and reduce their interest rates. This discount grows as the network grows.

In the crowdsale only the revenue attributed to the fair value of Sweetcoin is used to fund the Sweetbridge development and operations, whereas the rest of the revenue will be dedicated to fund mechanisms driving system stability and liquidity.

PART 5: WHY A STABLE CURRENCY AND HOW?

Companies don’t want to speculate in crypto currencies but want a stable reliable currency. Mostly their profit margin doesn’t allow for e.g. a daily 5% swing (as it is easily the case in the crypto currency world).

The stable coin “Bridgecoin” is an indispensable ingredient of the system. Given the nature of business facilitated by the currency, Bridgecoin will make sure that it doesn’t fluctuate by more than plus/minus 0.1% (unlike other stable currencies like MakerDAO and basecoin). This is critical for the adoption of the system.

Sweetbridge will provide a Fiat Exchange which will provide a limited exchange of Bridgecoin for USD on par. You will be in the first row if you have your Sweetcoin activated and the fee will be lower. Sweetbridge provides an unlimited availability to buy Bridgecoin for USD on par.

The Liquidity Pool is a fund of USD that is used to offer free redemption services to Sweetcoin holders. The requirement is to specify a mechanism that fairly and responsibly determines how much Bridgecoin can be redeemed by a user who has activated Sweetcoin in her account. It is funded by Bridgecoin that was created but not redeemed in the prior periods. The pool is augmented by revenue generated during tranche sales where the market price exceeds the fair value of Sweetcoin.

The Stability Pool is a pool of Bridgecoin. These funds will be used to subsidize parties doing business in Bridgecoin (keeping the value in Bridgecoin) and as payment to market makers and other parties whose activity is deemed beneficial to stabilizing the value of Bridgecoin.

Bridgecoin USD is backed by values worth more than 100% of 1:1 equivalent of Bridgecoin in US Dollars.

20% of the Bridgecoin assets are backed by fiat money. This is 2-3 times the percentage a typical bank has as backing (fractional reserve lending system). In the case of Bridgecoin USD it is backed by US Dollar. Bridgecoin EUR will be backed by EUR etc.

This means that 20% of Bridgecoin can exit to fiat without a change of price in Bridgecoin/USD! Try this with another crypto asset.

The other 80% of the value is backed by collateralized assets that are parked in their asset vaults. As the collateral value is less then 100% the value of the total assets is larger than the mentioned 80%.

Sweetbridge will strive to achieve a fast diversification off asset classes particularly among uncorrelated risks. As Sweetbridge supports more asset types the system will become more stable.

Primary stabilization mechanisms to keep the 1:1 peg of Bridgecoin to USD:

- When Bridgecoin price falls to < 1 USD on the markets, then everyone has an incentive to buy Bridgecoin on any exchange listing it below par and to use it at an effective discount to repay loans created and spent at a time when the Bridgecoin price was above par. Additionally, Bridgecoin can be directly sold to Sweetbridge that offers to buy Bridgecoins on par.

- When Bridgecoin rises above 1 USD on the markets, there is an incentive to borrow Bridgecoin from a vault contract and sell it on exchanges for an effective gain with respect to the fiat value of the collateral locked. Additionally, there is an incentive to directly buy from Bridgecoin for par value directly or buy Bridgecoin directly from Sweetbridge and sell it on the markets.

Secondary stabilization mechanisms to keep the 1:1 peg of Bridgecoin to USD:

Market Makers are active traders that stabilize the market by purchasing and reselling an asset on the open market while taking short-term financial risks. Anyone can act as a market maker, but some entities will receive a portion of the Sweetbridge Stability Pool if they adhere to some general guidelines, such as consistent presence on the market and a code of ethical conduct.

Trust intermediaries make money through fees that come from the Stability Pool, while retaining a cash equivalent asset on their balance sheet. Large companies can use access cash to anchor their supply chain with liquidity to increase Sweetbridges stability to loan money to its suppliers.

Risk Managers receive a fee for serving as a buffer against collateral price drops. They will be responsible for selling or risk-managing assets crossing the sell line, and will be taking risks in the process. To incentivize these services, Sweetbridge will pay such entities from the Stability Pool.

Sweetbridge will have its own exchange, exchanging Sweetcoin to Bridgecoin and vice versa.

Source: Whitepaper “Sweetbridge Liquidity Protocol” (https://sweetbridge.com/whitepaper)

PART 6: WHAT DID SWEETBRIDGE ACHIEVE ALREADY?

- The Sweetbridge team took a very thorough approach to ensure that all requirements of the single national jurisdictions are met. Therefore, they have a rigorous KYC procedure.

- Sweetbridge is talking to Global500 companies. Some of them are interested.

- Sweetbridge assembled a lot of partners in the supply chain and blockchain ecosystem (see later)

- Sweetbridge is working on money transmission licenses that are necessary to loan on real world assets in 9 of the largest 10 economies of the world.

- Sweetbridge set up legal entities in 11 countries to be ready for business.

- Alpha version of the Sweetbridge Asset platform (see screenshots on Product Page: https://sweetbridge.com/product)

PART 7: NEXT STEP

June 2018 – Launch of their “give yourself a loan” offer with BTC or ETH as security.

They will quickly move to real world assets (receivables, stocks, bonds, real estate ...)

PART 8: TEAM

As written by Smith + Crown in their ICO review (https://www.smithandcrown.com/sale/sweetbridge-cryptoasset-based-lending-pathway-supply-chain-transformation/) the Sweetbridge team is very experienced “..the leadership of a highly experienced industry team that has assembled around it an array of competent partners and supporters.”

CEO Scott Nelson founded Trax Technologies and was CEO of this large freight audit and payment company. Trax offers a cloud platform that assures logistic data can be trusted. He has more than 35 years of experience in the supply chain industry. He is a visionary thinker who is able to see the implications of technologies. https://www.linkedin.com/in/scott-nelson-46025b73/

President Mac McGary has long year experience and has been part of the management team of several supply chain companies. https://www.linkedin.com/in/mac-mcgary-3792131/

COO Glenn Jones has served as CTO and in other leadership roles for various supply chain companies. https://www.linkedin.com/in/glenn-jones-8438a3/

Senior Smart Contract Developer Micha Roon has founded a data management start up. He has developed the wallet and parts of the smart contracts of Oz-Coin Gold, the wallet for SOAR Coin, smart-contracts for a commodity ad network and trained developers to build tested apps. He is member of the Blockchain Advisory Board of IIB Council and blockchain advisor to SwissBorg and Contract Vault. https://www.linkedin.com/in/micha/

CFO David Henderson has extensive supply chain experience and worked together with Scott at Trax Technologies for 17 years in various roles in Client Services, Finance, Marketing, and as Regional Head. Before he worked at other companies in the field of Supply Chain as Financial Controller and Logistic Finance Manager. https://www.linkedin.com/in/davidbbhenderson/

PART 9: THE SWEETBRIDGE ECOSYSTEM

Sweetbridge has gathered an extensive list of logistics, business, and blockchain advisors. This ensures that the company will be able to access the expertise needed to the challenges that will arrive.

For a listing of the members of the Alliance please look at the Alliance Page (https://sweetbridge.com/alliance).

Sweetbridge doesn’t want to go the way on its own but builds market-focused ecosystems to apply decentralized, blockchain-based solutions to solving complex problems. Each ecosystem is a community of communities, consisting of companies both large and small, industry experts and technology solution providers that share a common purpose of enabling liquidity and a faster, fairer value exchange for the benefit of all participants.

These ecosystems break down complexity so that the right combination of open source protocols and decentralized solutions can be built or integrated to fit the specific needs of an industry or region.

Sweetbridge starts with the two ecosystems “Supply Chain & Logistics” and “Legal Contracts & Compliance” (bringing together legal and smart contracts). Others are already planned as listed on the Ecosystem Webpage (https://sweetbridge.com/ecosystems).

Sweetbridge offers a platform for likeminded projects that want to go the “value membership route”. Sweetbridge will provide these with their extensive legal knowledge and stable money. Bridgecoin can be used as crowdsale currency. It will create a fair pipeline where users who deposit Bridgecoin early receive priority to participate in these offerings.

In case Sweetbridge is used as crowdfunding platform Sweetbridge will receive royalty fees based on revenue and the crowdsale funds. These will flow back into the pot that (partly) lowers the service fees for the active members of the Sweetbridge-community (members that activated their Sweetbridge coins).

Some projects are already in the pipeline. Two of them:

Binkabi – A blockchain-based barter solution for emerging markets. Trade agro commodities. Global. Direct. Secured. Fair. Seller sees proof of payment from

buyers before shipping. Buyer sees pre-shipment inspection and bill of lading before initiating payment. http://www.binkabi.io/

OpenPort - Blockchain logistics solutions that deliver supply chain transparency for the world's largest companies. Asia's only multinational digital logistics provider, creating direct relationships between shippers and transporters in the supply chain. https://openport.com/

PART 10: TOKEN OFFERING

Total no. of tokens: 100,000,000

Initial Token Crowdsale: 20,293,557 (stage 0-4, currently stage 4)

Initial Fundraise Goal: 65,100,695

Price: USD 3.00 (at start of stage 4)

Circulating Supply: 65,000,000*

Team & Advisors: 11,000,000**

Non-Profit: 10,000,000***

Reserve: 9,000,000

Alliance: 5,000,000

- The other remaining 44.71 million tokens will be drip-released in later stages. Measured release of Sweetcoin based on network growth, which will fund (1) adding new types of Bridgecoin pegged to other fiat currencies and commodities (2) creating new country-specific treasuries (3) additional Bridgecoin liquidity. Price: Market USD Value — 10%.

** 4.7 million SWC — Available immediately to cover any salary costs and advisor expenses 6.3M million SWC — Released over time in vesting contracts and held back for future expenses

*** 10 million tokens released in proportion to public float as funding for non-profit causes that create sustainable economic activity in depressed economic environments

You can’t use your Sweetcoins or transfer them until stage 5 is reached when the full functionality of the Asset Vault system is launched.

See: https://sweetbridge.com/public/docs/Sweetbridge-Crowdsale.pdf

Additional information:

Type of Token Utility Token

Blockchain Ethereum (ECR20 token)

Consensus Method Proof of Work

PART 11: SHOULD YOU INVEST?

My conclusion: Sweetbridge has a high likelihood of finding considerable success and making a meaningful real-world impact, on a global scale.

Of cause, you can speculate that the number of activated tokens will be the larger portion of the total coin supply (as anybody who wants to receive their services is incentivized to buy and activate Sweetcoins), thus lowering the number of tokens available on the market thus increasing the price of a token.

But this is just half of the story.

You should think about Sweetcoin as a community. You can activate the Sweetbridge tokens and get a 0% loan. The value you get from this will increase the total value you receive:

higher value of token over time + lower interest rate during that time

If you are looking for a great blockchain project that has best chances to change the world for the better and would be interested in receiving a 0% loan you should think about Sweetcoin.

My 2 cents for the larger picture and the future of Sweetbridge:

We will see many companies, especially from the import and export business to adopt the system.

Why pay the bank 10% or even 20% of interest if you can give yourself a loan for free? This will noticeably impact the profitability of the companies joining Sweetbridge. Most likely to get on board first are the import-export companies that sit on lot of locked assets. It is just a question of some years until Sweetbridge will be facilitating business in the billions and in some more years trillions.

+++ This is not financial advice or tax advice. +++ Do your own research before you invest! +++ The author holds a small position (<10k USD) in Sweetcoin. +++

As you will have noticed already: I am not an English native. Sorry for any grammar mistakes etc.

SOURCES to dig deeper:

Website: https://sweetbridge.com/

Whitepapers: https://sweetbridge.com/whitepaper

You Tube Channel: https://www.youtube.com/channel/UCXCj5zuPcLWp6euuGKZEzdA

Video with Scott (CEO) and Vinay Gupta:

Scotts presentation in Hong Kong Feb. 6th:

Saubere arbeit , werde selber Investieren.

thx!

saubere Arbeit.. TOP!

thx!

Good informatiom

thx!

Coins mentioned in post:

Very informativ, will keep an eye out for it when the first mile stones are achieved!

thx!

An example on the value of the token offsetting interest rates:

"For example: with $14,000 in Sweetcoin (SWC) I can borrow up to $200,000 in BRC-USD, interest Free!

In order to borrow this $200,000 I need to lock up $400,000 in crypto (BTC, ETH, SWC initially) as collateral."

Just corrected the percentage for Bridgecoin in the article from 1% to 0.1%. See interview with Scott: