Stratfor's Oil Price Analysis

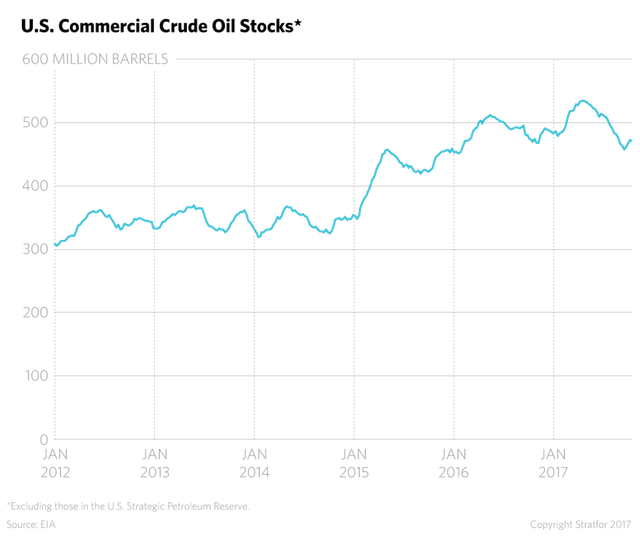

The world's oil stockpiles are declining, but not quickly enough for global producers' liking. In the United States, one of the most closely watched markets in the industry, crude oil inventories totaled 471 million barrels (about 24 percent higher than the five-year average) as of Sept. 22. Such gluts will spur the strongest advocates of production cuts — Saudi Arabia, Russia and Venezuela — to redouble their efforts to extend the quotas among OPEC members and non-OPEC states beyond March 2018. At the same time, they will ratchet up pressure on exempted OPEC members Libya and Nigeria, which have increased their collective output by 622,000 barrels per day since the fourth quarter of 2016, to join the pact. However, these states are unlikely to sign on. And if the cuts are extended, it won't be long before compliance among existing signatories starts to weaken.

The United States, for its part, continues to see its output climb. But by the end of June, U.S. crude production reached a little under 9.1 million bpd — just 27,000 bpd higher than its February total. This suggests that the recent growth in U.S. output is not as resilient as industry experts initially expected. And though the country's production will keep rising slowly throughout the quarter, it will not be cause for debate and contention among the global producers trying to counter the persistent oversupply in the oil market.