JUST DO IT.

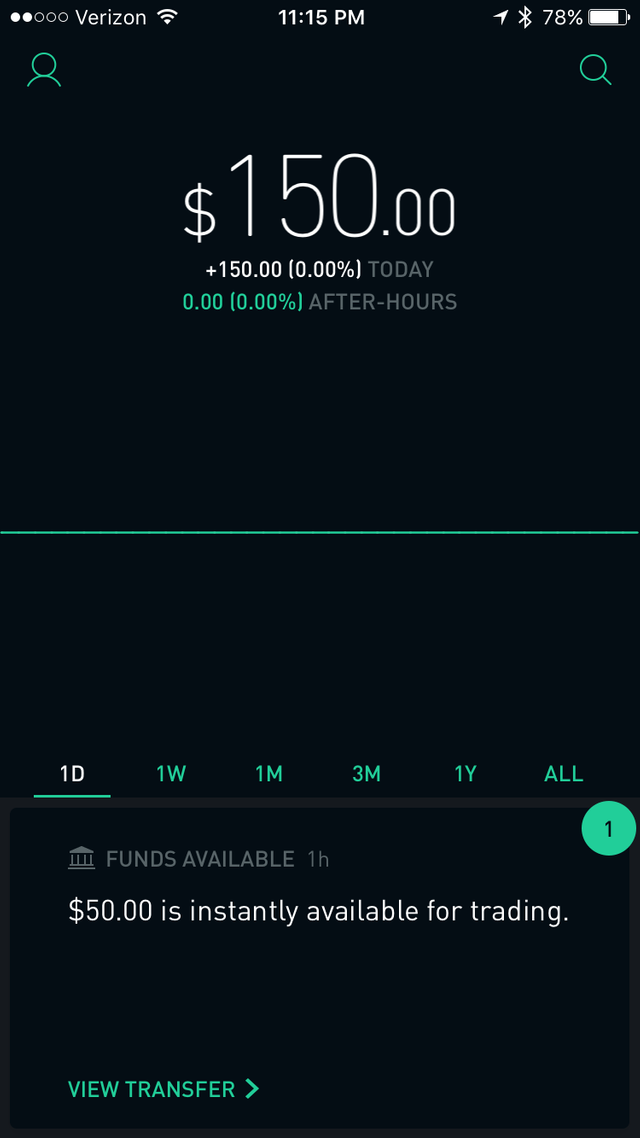

"Where to start - Let's put $150 on red and get the ball rolling."

I made my first deposit into my portfolio account after telling myself I want to try out the  stock market. I have been reading and listening to the news regarding the "rise to 20,000" for sometime and this miracle milestone that is deemed to be reached by the end of the year. Additionally, with the president elect set into place, all one could think about is what is going to happen to the economy and I figured "just do it and get the ball rolling since now is a better time than any time." I am 26, employed, building my 401k and have tried the mutual funds route in 2014 through my credit union and could not face the fact that someone else is managing my money who does not have a similar interest and ideas as I did in the things that I do. I did take into consideration that he had many more years of experience than I did, but who is to say that I eventually won't get there.

stock market. I have been reading and listening to the news regarding the "rise to 20,000" for sometime and this miracle milestone that is deemed to be reached by the end of the year. Additionally, with the president elect set into place, all one could think about is what is going to happen to the economy and I figured "just do it and get the ball rolling since now is a better time than any time." I am 26, employed, building my 401k and have tried the mutual funds route in 2014 through my credit union and could not face the fact that someone else is managing my money who does not have a similar interest and ideas as I did in the things that I do. I did take into consideration that he had many more years of experience than I did, but who is to say that I eventually won't get there.

Finally!!! Let's get into my first investments and the build up that occurred for the decisions made. After reading a few books and watching a few lectures, my initial thought was take the Buffet approach and stick with what you know, however I quickly found out that I clearly didn't know anything and that the Coca Cola bottling co. (NASDAQ: COKE) was different from Coca-Cola $40.17 (NYSE: KO) so looking at the $157.62 for COKE was not an ideal purchase for me as I was looking to build a diverse portfolio not make one purchase with my entire capital. Thinking of the smart move, I went directly to PEPSI CO. (NYSE: PEP) and made the buy for 1 share and a long at $98.80 as Britain announced it's sugar tax plan to be drafted along with other US States beginning to implement their own. Previously in the year I recalled a news report how Pepsi was looking to install healthier vending machine options and reduce sugar levels in their beverages so I saw the decline as an opportunity in addition to reviewing a dollar cost averaging plan.

Next up, Nike (NYSE: NKE) This was primarily an emotionally driven purchase as I have been a Nike fan for quite sometime now. With the release of their self tying shoe, and Jordan XVI to release mid December I feel that the stock would still be able to thrive regardless of tariff decisions and import/export regulations. Nike has been in business for too long for them to be unable to address production/cost concerns. Additional with minimum wages set to increase until 2022 (in California) the culture of shoe collection is not looking to die anytime soon not to mention the culture rise of the healthy/active lifestyles. I feel like Nike was an okay purchase at $51.12 and looking for the dividend growth as I look to purchase more shares of it at a later date.

Last but not least, we have PFIZER Inc. (NYSE: PFE) Purely dividend based and at $0.30 as I continue to look for ways to diversify I looked at it's down trend of 12% from the top end in June as an opportunity to get in. Once again I do not know much about pharmaceuticals and how often they work but I believe I can manage the volatility with this stock as I continue to add capital into my portfolio.

How did you guys do? Leave a comment below.

MY ORIGINAL POST FROM DEC 2nd