US Capital Markets Review 2/16/18

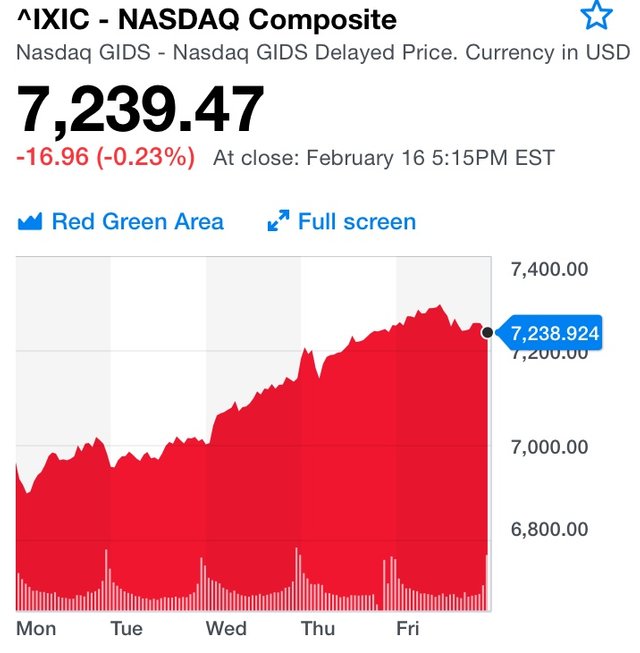

This week saw a snap back towards the upside for the US capital markets after last week’s large losses. The major indices advanced more than 4% for the week, with the NASDAQ leading the way at 5.3%. The indices are back in the black for the year by around 2%, and the weekly advance was fairly evenly spread across sectors and market caps.

4th quarter 2017 results continue to come out strong, and the companies in the S&P 500 have earnings growth greater than 15% compared to the same quarter last year, with around 80% of companies reported. Commodities has a good week overall as well, with oil posting a 4% gain and settling at $61.65 per barrel.

In economic news, the Bureau of Labor Statistics reported inflation numbers which were ahead of expectations, and leading the ways was core inflation (which excludes the cost of food and energy) which was up 1.8% over the last 12 months. However, the numbers did little to slow down the weekly advance.

In political news, the Winter Olympics in South Korea continue to play out with no problems from the North Koreans. Special Counseler Mueller, charged with investigating Russian interference in the US Presidential election, handed down 14 indictments related to the investigation, most of which were against Russians in the US, but the issue appears to be of little concern to the capital markets, and not directly related to President Trump. However, news continues to come out about a payoff President Trump made (we now know through his attorney) to a former porn star, but the reason for the payment remains unclear. While this news is not something that would normally affect the markets, President Trump continues to be a wildcard, and should something happen to end his presidency early, the markets would likely respond negatively given the political uncertainty.

Overall, my outlook on the US capital markets remains positive and I continue to be fully invested.

Good luck,

Brian

Great analysis. I'm monitoring the markets way more closely than I normally do, I'm still highly invested in U.S. equities. I have added some All World Ex US (VEU) funds and a gold commodity ETF as a hedge, but the majority of my investments are still in U.S. stocks.

Given that we blew through any inflation concerns, I think the biggest thing to watch is the corporate bond yield gap. As long as that stays narrow relative to treasuries, investors are still clearly confident in the corporate debt markets (and corporate trajectories). If that starts to widen, I may start to try to diversify out.

Solid analysis, I converted more of my cash portfolio into Equities this week after the crash, I don't plan on touching it for at least 3 years.

Agree with the Trump wildcard angle, what's worse is it is highly unlikely he would be replaced with anyone with a more deregulatory stance, could cause a hard market sentiment shift. Anyway it's a risk I'm prepared to accept at this point!

Excellent report @brian.rrr as every week always very successful. If the light economic recovery was felt, and with regard to the news of President Trump, for me it is only a distraction, something to speak of only as a scandal, I am amused. Thanks for your weekly report.

It’s so nice to see the sea of green this past week and I’ve got my fingers crossed it stays that way. It's almost as if the US markets have somewhat mirrored the Crypto market. Or vise versa. It would be interesting to see if that is a trend that in any way continues. I doubt it due to the continued volatility of the Crypto market but a fun thing to watch out for.

The Crypto market has had some smooth positive growth. Slow gains each day. I listened to a podcast today where the speaker was talking about the gains and forecasting we could be at the Trillion dollar market cap within the next 60 days. As much as that would be amazing I think it would be the climb before another big fall. The market can’t sustain gains at that rate. The same would be in the case of the US market gaining that quick. I'd rather be the wealthy tortoise.

I haven't really changed my strategy either. It's always nice to hear someone else is also holding on. :) I think the market has more left in it. We're at optimistic/speculative levels for some things, but if you're well diversified and have hedged against that, you should be able to handle a temporary downturn.

That's right, the Olympics are happening. Forgot about that. :)

I would say that these are strategies used by President Trump, besides the US markets will not be affected and they will establish several factors to be able to destabilize them.

@calitoo

Let's hope the trend continues! Thanks @journeyfreedom

We going all the way to heaven with these charts ;0

thanks for sharing us the review of the market very informative post

Trump is a wildcard to say the least, nothing would surprise me about him anymore...

Been watching a few cannabjs stocks stay pretty low, I'm curious if the market with rebound shortly in such a new and volatile sector. Looking for just the right time to invest. Hoping your future analysis may help inform this decision.