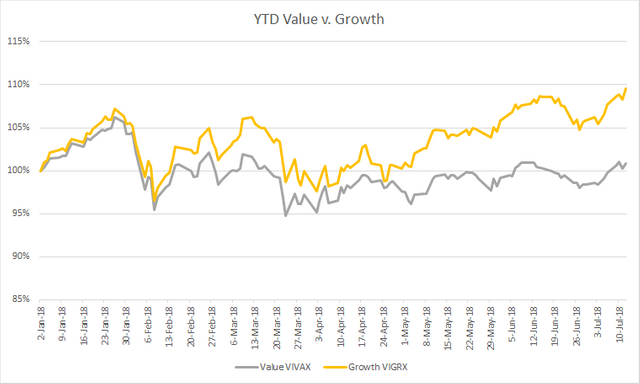

Growth v. Value YTD Performance (VIVAX & VIGRX)

Index - https://steemit.com/tax/@alhofmeister/3ibscz-accounting-and-finance-blog-index

Introduction

The purpose of this post is to demonstrate the YTD performance of growth and value stocks by comparing various Vanguard index funds. As demonstrated by the graphs, growth stocks have outperformed value stocks so far this year. Growth stocks are companies whose price is largely driven by expected future earnings while the price of value stocks is driven by solid fundamentals (price/earnings ratio, yield, etc.). I will continue to track the progress of these index funds in future posts.

YTD Performance

Note - Chart also reflects the periodic dividends paid by the various funds (stocks - quarterly)

References

https://finance.yahoo.com/quote/VIGRX/history?p=VIGRX

https://finance.yahoo.com/quote/VIVAX/history?p=VIVAX

@contentvoter

#nobidbot

Get More Upvote - FREE