Low PE Stock YTD Performance (F, VIAB, & M)

Index - https://steemit.com/tax/@alhofmeister/3ibscz-accounting-and-finance-blog-index

Introduction

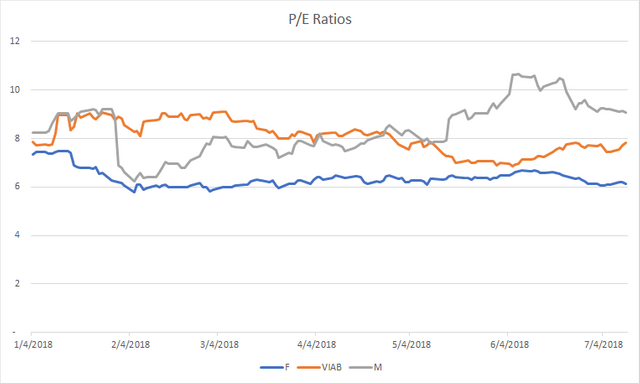

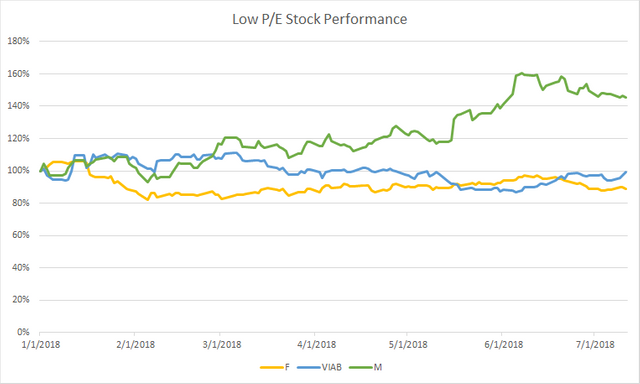

In this post, I wanted to present two graphs. The first graph shows the price to earnings ratio for companies that have low P/E ratios. The second graph shows the year to date performance of each of the 3 companies (current market cap / market cap as of January 1). As demonstrated by the second graph, Ford has performed fairly well since the beginning of the year whereas Viacom has a loss in value and Macy's is up about 60%.

P/E Ratio

YTD Performance

References

https://www.zacks.com/stock/chart/F/fundamental/market-cap

https://www.zacks.com/stock/chart/VIAB/fundamental/market-cap

https://www.zacks.com/stock/chart/M/fundamental/market-cap

https://www.zacks.com/stock/chart/F/fundamental/pe-ratio-ttm

https://www.zacks.com/stock/chart/VIAB/fundamental/pe-ratio-ttm

https://www.zacks.com/stock/chart/M/fundamental/pe-ratio-ttm

@contentvoter

#nobidbot