HOW TO FIND MULTIBAGGER STOCKS?

Hello steemits today i am going to discuss about multibagger stocks and how to find them. so lets talk about it

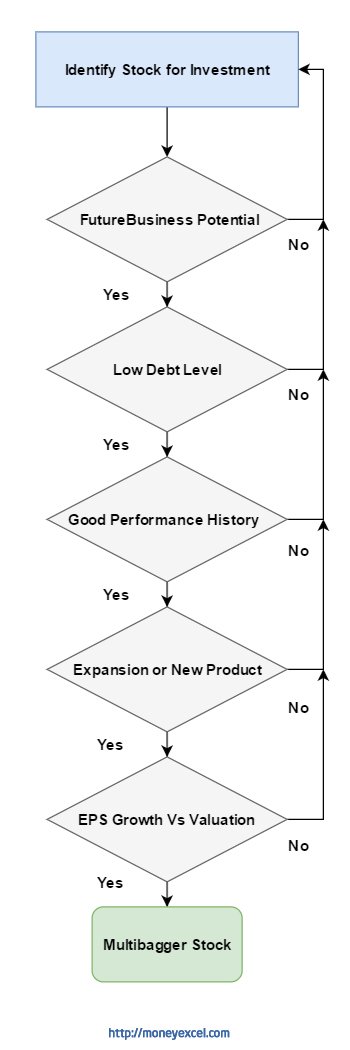

Stocks that multiplies your wealth and give multifold return is known as a Multibagger stocks. Investors are always in search of good multibagger stock for the investment. That is the reason, one of the most frequently asked questions by investor is – How to Find Multibagger Stocks for Investment? In this post I will address your query of identifying good multibagger stock by simple flowchart. In addition to that I will also recommend future multibagger stocks for investment.

The term multibagger is used for the stocks that have a potential to grow multiple times in short period of time. This term is coined from two words multi and baggers. Multi means too many and bagger means bags. So, the stock that gives a return in multiple bags is known as multibagger stock. In my earlier post, I have already discussed about a multibaggr stock that made you crorepati from lakhpati. Today let’s discuss about how to find multibagger stocks for investment.

How to Find Multibagger Stocks for Investment?

In order to identify next multi-bagger stock, you need to follow simple flowchart containing various checks. This checklist will surely help you in identifying a stock that has a potential to become next multi-bagger.

Future Business Potential

The first thing you should check is the future business potential of the company. In order to find future business potential, you should look at product and services offered by the company. If product or service is having future demand company will get future business and make a profit.

If you are looking at the stock of IT Company like Infosys you should look at present demand and potential growth in demand for the IT products or services offered by Infosys.

Low Debt Level

The second check for the multibagger stock is debt level of the company. Ideally a company should be debt free. However, you can also look at a company with low-level debt. The logic behind this check is simple if the debt level is high company will be spending more money for the repayment of high-interest debt.

In order to find debt level, you should look at debt equity ratio. Debt equity ratio of stock should be low. Some examples of low debt or debt free companies are Britannia Industries, Bajaj Corp, and Lupin.

Good Performance History

The third check to identify multibagger stock is performance history of the stock. The company should be a consistent performer in terms of net profit margin and revenue. You can easily find out performance history of the company from quarterly and yearly results.

One very good multibagger stock with consistent performance in profit margin is Eicher Motors where net profit is getting double every year.

Expansion or New Product development

The next check to identify multibagger stock is a business expansion or new products in the pipeline. This point is more or less related to future business growth.

One simple example of business expansion and new product launch is Reliance Industries. The company has invested a lot of money for the business expansion in a petroleum product. In addition to that new product launch Reliance Jio is likely to capture good telecom market.

EPS Growth Vs Valuation

The last check to find future multibagger stock is EPS Growth Vs valuation. The EPS of stock means company’s profit divided by a number of shares. The EPS of the share should be at a reasonable level and valuation of stock should not be very high. If a stock has already given a multifold return and valuation of the stock is very high it is not multibagger stock. That is the reason future multibagger stocks are from small cap and mid cap sector.

In addition to above check you can also look at factors such as dividend payment history of stock, business diversification, structural changes, management and unique business model.

Flow Chart to identify Multibagger Stock

In order to identify multibagger stock for investment you can refer to following flow chart.

I really hope this article help to identify future multibagger stocks and thank you for reading steemits ❤️