How Buffett Influenced The Race Of The 1st Trillion Dollar Market Cap Company

Over the last five years, the FANG stocks + Apple are up over 500% and 200% in the last three years. Apple was the first company to reach the $700 billion, $800 billion, and the $900 billion market cap mark. CEO Jeff Bezos is now the world’s richest man, with a personal wealth of over $100 billion. Based on these two amazing feats, the only two real contenders for the 1st company to reach the one trillion dollar market cap are Apple and Amazon.

However, lets talk about the honorable mentions since they are a part of FANG and in their own right have had one hell of a run the last several years as well.

Facebook has seen its stock rise from $42 during the IPO in 2014 to a high or $192.94 as of yesterday. But with a market cap of $558 billion, the stock price would have to rise to $345 in order to reach a one trillion market cap. It ain’t happening anytime soon.

Many years ago, I bought some put options and made some profits on Netlfix. Next thing I knew, Carl Icahn made the headlines when it bought Netflix in Oct of 2012…I call it the Icahn bounce. Netflix’s stock price went on a tear and rose from $12 to $365 in a little less than 6 years. But with a market cap of $159 billion, the stock price would have to rise to $2295. It ain’t happening anytime soon.

I remember when Google went public in 2004. I told my cousin, I’m not buying a stock for $85. I have to laugh because that $85 has now seen a more than 17X return. Google has a printing money machine in its Google Search to pour money into the latest technological advances. But with a market cap of $784 billion the stock price would have to rise from $1151 to $1448. Google has averaged 23 percent year-over-year growth for 33 quarters, or more than eight years, according to RBC Capital, so it’s hard to count them out of the race. And although they are at the forefront of AI, AI is still too new for Google to be a real threat in reaching the market cap of $1 trillion first.

This brings us back to Apple and Amazon. Which one of these companies will reach the $1 trillion market cap first?

$100 invested in Amazon’s IPO would be worth over $100, 0000 today. Originally the company was registered as Cadabra, but a lawyer misheard it and said, "cadaver?" Jeff Bezos then came up with the name Relentless.com. People thought it sounded a little sinister, but Bezos liked it so much that he still bought the URL and to this day Relentless.com redirects to Amazon.com

Bezos settled on Amazon so that it would appear early in alphabetic order and "Amazon" was the river he considered the biggest in the world, as he hoped his company would be one day. Yes, Amazon is relentless and big, but its main revenue stream comes from Amazon Web Service (AWS), its cloud base service. AWS sales have gain 48% in the last 12 months and this is expected to continue in the years to come. However, AWS’s operating income equates to more than 60% of the operating income for the entire company. I don’t think this is enough to getting the job done in being the 1st trillion dollar market cap company. Amazon’s stock price would have to rise from $1696 to $2061. A very realistic milestone, but I don’t think it gets there before Apple.

I believe Apple will be the clear winner of the 1st company with a $1 trillion market cap. Since 2013, Apple has shrunk it shares outstanding from 6.6 billion shares to a little 5.0 billion shares. Higher earnings mean a lower P/E, which means a lower valuation relative to other companies, which means attractive to investors. Companies that consistently buy back their shares can grow EPS at a substantially faster rate than would be possible through operational improvements alone.

Apple is the biggest company in the Standard & Poor 500, the Nasdaq 100 and the Dow Jones Industrial average. With the introduction of index funds in the 1970s with the goal of achieving returns in line with the Market and introduction of ETFs in the 1990s that track major indices, any flow of money into these EFTs, means Apple shares are being bought.

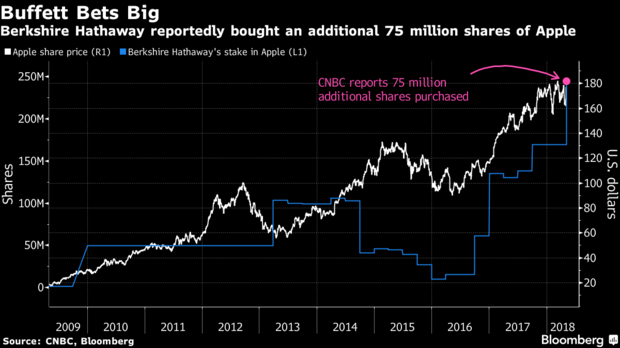

However, I think the real edge Apple has over Amazon is the Buffett Affect. In early March, Warren Buffett announced he bought an additional 75 million shares in Apple. Buffett later went on CNBC and stated he wanted to buy the entire company….LOL. Also, there are fund managers that mimic every move Buffett takes, this means millions of more shares were purchased that week by those managers. The chart below shows what happens to the stock price when Buffett buys Apple stock.

Since the announcement at the beginning of May, Buffett has not only lifted the Markets, but Apple’s stock price has risen from 176 to 193 or 10% and only has $10 to reach $1 trillion market cap.

So what do you think, who do you think will be the 1st trillion dollar market cap company?

This post is my personal opinion. I’m not a financial advisor, this isn't financial advise. Do your own research before making investment decisions.

Upvoted ($0.20) and resteemed by @investorsclub

Join the Investors Club if you are interested in investing.

I don’t think any will make it this year given the valuations and the over-optimism currently in the market. I honestly do not trust Apple’s financial reporting as they have been beating estimates with some weird accounting. However, I have been wrong about the direction of this market since last year... Great post!

Thanks. As Alan Greenspan stated the Markets are in irrational exuberance, thus I think Apple has a shot of getting there within the next couple of months.

Very interesting article and analysis. Thanks for sharing. I agree with you that the first company to get at 1 Trillion USD Market Cap will be Apple, as it is so close that it will get it. In the mid / long term my prediction is that Amazon will overstep Apple Market Cap.

Thanks and I totally agree with your comment. I think Apple wins the 1st leg in the race, but Amazon will be the winner of the marathon.

My Apple story will make you shudder. I persuaded my fund manager to buy Apple at $38 - before the split. Over time he accumulated 2100 Apple shares. This became too large a relative holding in the portfolio and he started selling off.

I took over the portfolios and started writing covered calls against what was left and was assigned a few times. I now have no Apple shares. That 2100 shares would now be worth $2.8 million and would be more than 60% of my assets

I do not go back and look at how many Amazon and Google shares I bought in 1999 in the DOT COM boom. That would disappoint me as they all got sold before the collapse in 2000

The beauty of the Markets is it always gives us opportunity. The thing that is against us is time.

PS - where did you learn how to trade? I read your post every day and you are well versed in the Markets.

I have been investing over 30 years. I trained as an accountant and worked as a management consultant - that gives good tools. Instarted trading froex and did a lot of Learn to Trade courses here in Australia. I then did the whole training series with Trading Pursuits and was mentired by Brad McFadden for nearly two years from Daily Trading Report. A lot of my thinking coems from his experience.

Writing up 245 of these posts has taught me a lot too.

I have to admit that you did a great analysis and that it is hard to pick a clear winner.

Apple is the favorite because the are the closest to the trillion but I do think that they will suffer from the declining interest in the iphone (too expensive). Also when an economic set back will happen they will suffer more than Amazon will. Amazon has a much broader offering the Apple, you is more focused on the niche tech markets, which do great when it goes good with the economy but will crash hard when there is an economic set back. You just can't justify it to yourself to spend in those days to purchase a $1K phone. At least I can't.

Because I like betting on the dark horse, I will go for Amazon!

Thanks and totally agree with your comments...long term, reminds me of the rabbit and hare race story.

Nice post. There is obviously high expectation for Apple to be the first trillion dollar market cap company. But can it continue to grow after to sustain a trillion dollar cap is another question.

Thanks and I agree with you and @fullcoverbetting. I don't see much innovation in the pipeline, but as long as they keep buying back shares, it will remain valuable to investors and thus push the stock higher.

Get your post resteemed to 72,000 followers. Go here https://steemit.com/@a-a-a