6 Stocks That Will Rise With the Global Economy

Against a background of increasingly rosy forecasts of coordinated GDP growth around the world, investors have been piling into industrial stocks, hoping to ride the crest of the economic wave. As a result, from a recent low on November 15, the S&P 500 Industrials Select Sector Index (IXI) has surged by 10.2% through February 16, compared to a 6.5% gain for the broader S&P 500 Index (SPX) during the same period, per S&P Dow Jones Indices. Big increases in earnings estimates have been driven by rising commodities prices and the falling value of the U.S. dollar, Barron's reports.

However, Julian Mitchell, an analyst at Barclays, believes that all the good news that has been propelling industrials is about to shift into reverse, and thus he gives the sector a neutral rating, per Barron's. However, he mentioned six industrials on which he has overweight ratings, because they represent "truly sustainable market themes," as Barron's puts it.

Barclays' Picks

These are Mitchell's six recommended industrial stocks, with their one-year and year-to-date 2018 price changes, as well as the future gains implied by the consensus price targets on each, per Barron's. As points of comparison, the one-year gain on the S&P 500 is 16.4%, and the YTD gain is 2.2%.

Emerson Electric Co. (EMR): +17.9% 1-year, +4.7% YTD, +5.4% to target

Honeywell International Inc. (HON): +23.7% 1-year, +0.4% YTD, +12.7% to target

United Technologies Inc. (UTX): +15.3% 1-year, +1.3% YTD, +17.2% to target

Ingersoll-Rand PLC (IR): +12.4% 1-year, +2.1% YTD, +14.3% to target

Allegion PLC (ALLE): +12.9% 1-year, +4.0% YTD, +12.2% to target

Danaher Corp. (DHR): +16.0% 1-year, +5.1% YTD, +9.9% to target

The two lesser-known members of this group are Allegion and Danaher. Allegion manufactures security-related products such as locks. Danaher derived 78% of its 2017 sales from its life sciences, medical diagnostics and dental segments, per its 2017 earnings release, and thus actually is in the S&P 500 health care sector, per TradingView.

Mitchell cites Emerson and Honeywell for their exposure to automation, United Technologies and Ingersoll-Rand for exposure to "buildings end-markets," while noting that Allegion and Danaher have been overlooked by investors recently since they did not get big benefits from tax reduction. Despite his neutral rating for the industrial sector, he expects profit margins to increase even in the face of rising inflation.

Goldman: Time for Cyclicals and Industrials

In fact, Goldman Sachs Group Inc. is recommending cyclical stocks, including industrials, as a group that typically benefits when inflation and interest rates are rising. Additionally, they note that, since 1976, industrials and materials have been the two best-performing sectors in the three months following a non-recessionary stock market correction of 10% or more. (For more, see also: 12 Stocks To Buy For Market's Upturn: Goldman Sachs.)

Also, industrials and financials are Goldman's only overweight sectors right now. They forecast global GDP growth rates of 4.0% in 2018, 3.9% in 2019, and 3.8% in 2020. This is in line with the International Monetary Fund (IMF) projection of 3.9% growth in world output for both 2018 and 2019, per their January World Economic Outlook Update. Additionally, U.S.-based industrials should get an earnings boost from the falling U.S. dollar, which Goldman expects to decline by 2.0% on a trade-weighted basis in 2018, followed by further drops of 1.0% in 2019 and 1.2% in 2020, per their Where to Invest Now: Year 2 report from late January. (For more, see also: 10 Stocks That Can Outperform in 2018: Goldman.)

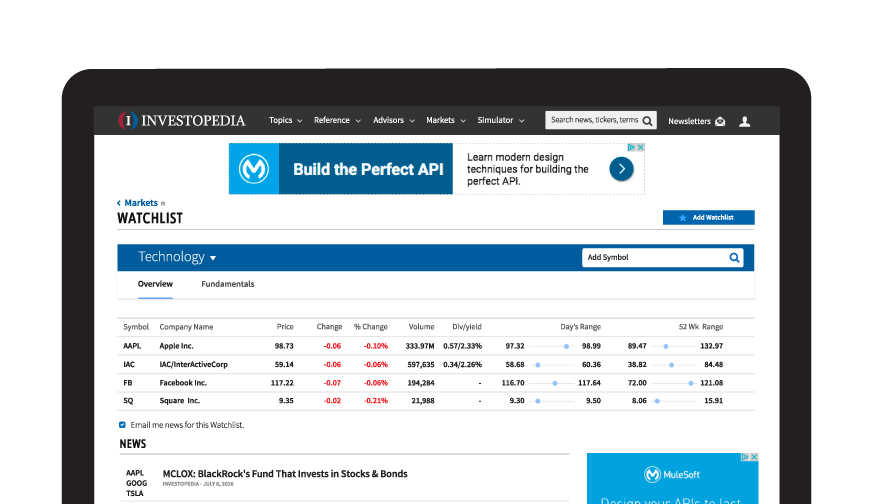

Apparently buoyed by these confidence-building GDP forecasts, Investopedia's millions of readers worldwide are registering low levels of concern about the global economy. However, they indicate extremely high anxiety regarding the securities markets, as measured by the Investopedia Anxiety Index (IAI).