BITBOND- lending investment utilizes blockchain technology

Almost any person be engaged in business because it gives them a lot of benefits and has a vast ecosystem, but in the business world, competition is very heavy, in digitalization era like now the business world becomes increasingly polarized especially after the introduction of blockchain technology makes many companies use blockchain technology as a transaction system , the business world is sometimes very unfair where many small business people are not able to compete with big business people, due to equipment, technology and capital problems. capital problems become a problem that is often encountered and experienced in the business world.

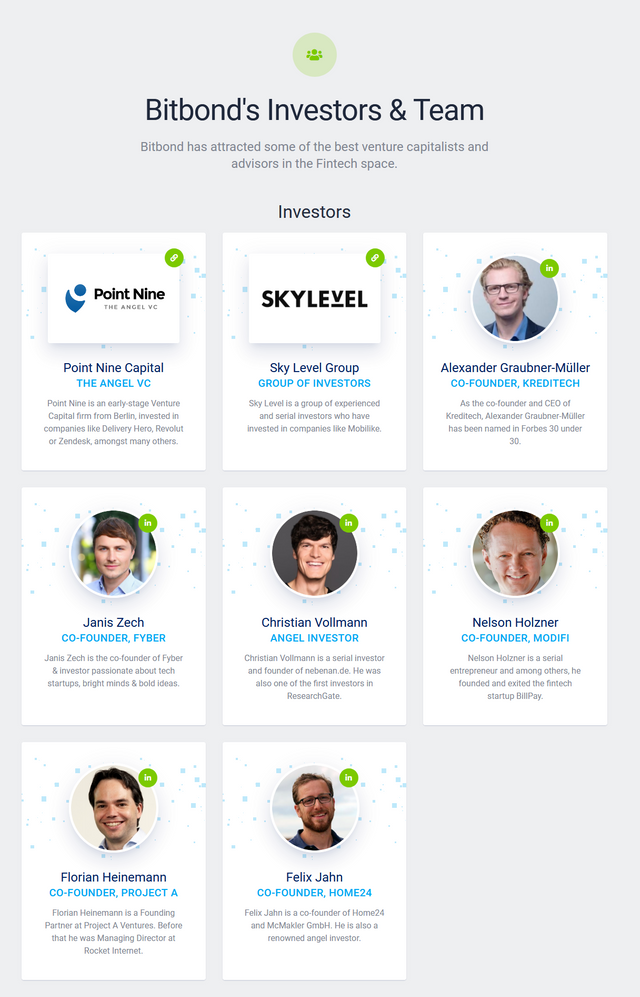

my article this time about the loan investment platform that utilizes blockchain technology in implementing its services, this platform is called Bitbond, see the full discussion below

About Bitbond

Bitbond is the first decentralized business lending platform operating world wide which is officially registered in Berlin (Germany) and beneath the German Banking Act, built in 2013, Bitbond now facilitates more than $1 million in business loans every month

currently, many small and medium-sized busines entrepreneur is faced with the lack of adequate funding for adequate funding to grow their business, they seek financial assistance from various banks or other financial institutions. Which in turn do not always have the opportunity to support every businessman.

Bitbond offers a modern concept by utilizing blockchain technology through smart contracts to eliminates this problem, helping to develop small and medium-sized businesses in all corners of the world by means of high-tech tools with the aim of to develop business lending to small and medium-sized businesses became more affordable.

Bitbond is a regulated financial institution and is supervised by the German financial regulator BaFin. mission is to make investing and financing globally accessible using the BB1 nutility token, BB1 is Germany's first security token and makes business lending globally accessible. It will be capable to allow each the professional and the personal investors to be in a position to effortlessly invest in the early stage companies, therefore, be capable to supply the startup agencies with handy get entry to to the capital markets.

The Bitbond has so a long way been accepted as being an asset broker, this is beneath the German Banking Act, this is for their lending commercial enterprise that is blockchain based, and it has been the very first monetary service institution of this kind that has been served through the BaFin.

Bitbond is currently in the context of conducting the STO program, this program is intended for investors and businessmen to more easily have BB1 tokens that will provide benefits and make it easier to get loans in the future.

join: https://www.bitbondsto.com/?a=TLRJOS

.png)

If you want to get more information about BITBOND, please visit some of the sites below:

Website: https://www.bitbondsto.com/?a=TLRJOS

Prospectus: http://bit.ly/2vmcdVV

Lightpaper: http://bit.ly/2vmcdVV

Ann Thread : http://bit.ly/2VrF4Xp

Twitter Page: https://twitter.com/bitbond

Telegram Group: https://t.me/BitbondSTOen

Facebook Page: https://www.facebook.com/Bitbond/

tdjancuQ

https://bitcointalk.org/index.php?action=profile;u=2515905