Could South African sovereign risk cause an explosion higher in platinum prices?

South Africa’s potential to create explosive price increases in Platinum

Intro

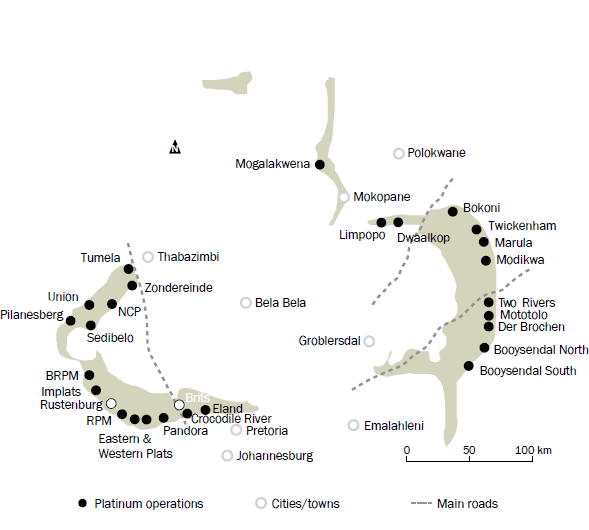

To understand the platinum market there is one country we must understand - South Africa.

Why? The Bushveld Complex hosts 80% of known platinum group metal bearing ore which is located the northern part of South Africa. This geological structure has for many years produced more than 75% of the world’s platinum output.

)

) The murky past to murky present

Prior to the ANC taking over the government in the 1994 elections the platinum sector

was held in the Afrikaners hands. After the ANC came to power it was clear that this was

set to change. The mine owners wanted to keep hold of these companies but nationalization

was a real threat. Their strategy to prevent nationalization was 2 fold

Strategy 1: Corrupt the Government - VERY CONTROVERSIAL

I will just explain the facts and let you draw conclusions

The new government brought in a new policy called BEE (Black Economic Empowerment) which was supposed to spread the wealth of the country a little more fairly. The policy was to encourage mines as well as other businesses to transfer some ownership to the previously disadvantaged people.

As with most government projects in South Africa most of the early BEE deals went to the Government officials or their family and friends.

How did these deals work?

The rough idea was the miners would give amazing loans to the powerful government official or their “friends” to buy huge amounts of the mining company’s shares. The dividends would pay the loan back and the politician would be left with a huge chunk of a very valuable company basically for free. That wasn’t corruption, it was GOVERMENT POLICY in SA for a while.

Why did the miners give part of their company away for free?

By making a powerful person a major shareholder in your company you are linking their financial wealth to that of the company. If the official supports nationalization they will lose their new found riches.

It also helped having influence in the government. They would also get deals on new mining permits at bargain prices

Strategy 2: Take the assets take the assets off shore

The miners moved their primary listings offshore (London) This made it much harder for nationalization to take place as the companies could sue the SA government in the UK to recoup their losses

Labour Risk is bigger than soverign risk

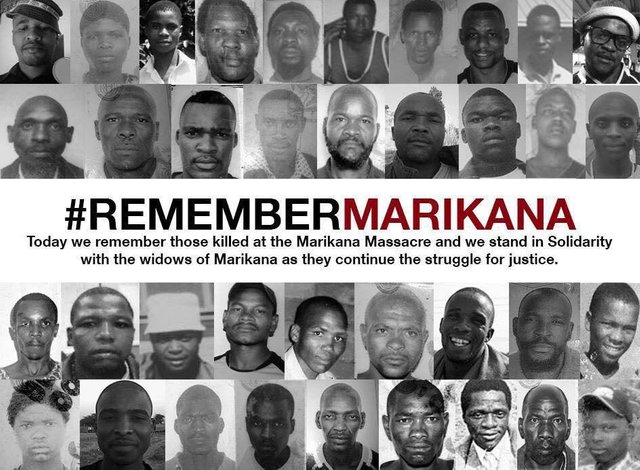

The Marikana massacre, which took place on 16 August 2012, was the single most lethal use of force by South African security forces against civilians since 1960 with 47 dead. This was at the lonmin mine (Read more about Marikana massacre). On January 2014 thousands of employees of the platinum mines followed and went on strike, demanding a basic salary of $880. It is estimated that the miners lost a minimum R10 billion in salaries due to their strike which lasted more than five months. The strike, the longest in the history of South Africa, ended in late June 2014 when the mineworkers union signed a 3-year settlement deal. This deal has now expired.

Platinum Conclusion

My conclusion can be summed up in one sentence - Physical platinum over mining shares

The combined strategies put in place to bring in the powerful shareholders and offshoring the companies has reduced chances of nationalization by the current government. If power shifts to the EFF Sovereign risks will increase.

In my opinion labour poses the greater risk. Another 5 month strike would be crippling.

Physical platinum has no nationalization risk and potential upside if the labour unrest resumes

My strategy:

Very slowly build to my physical position. I have no holdings in any platinum miner. I will invest when I see a bull trend forming.

What would you like me to write an article on next (let me know in the comments)

1 An analysis of the big 3 platinum producers,

2 The South Africa and Russia platinum group metals cartel

3 The state of the platinum supply vs demand?

This is a really good piece. Where are the comments?

I'd like to hear about the South Africa and Russia platinum group metals cartel if you get time :)