Stacker or Collector: An Internal Struggle

Hello gold and silver stackers, flippers, and collectors here on steemit, just a little background of my silver journey.

As a youth I collected coins. I got started around 8 years old when my Grandfather gave me a Morgan silver dollar from a slot machine payout from a trip to Vegas. I was captivated with the history behind that coin. I would examine its wear marks, and dream of the people, maybe famous, who had once owned the coin. Yet, are we truly owners of these coins?, or are we just the temporary vessel for them to travel thru the ages? I collected what I thought looked cool. I had a few Mercury dimes, a handful of Kennedy halfs, a few bi-centennial IKE dollars and quarters, and baggie full of wheat pennies. Also, living in the southwest, I had a good amount of Mexican coins. It was a great hobby, that earned this former cub scout a merit badge. Then around 12 years old our house was burglarized and that ultimately ended my coin collecting hobby.

In 2012 I became medically retired from teaching. After a couple years, and a gradual breakdown of my body and stamina; working in my home workshop became unbearable for any reasonable length of time; this fact now also prevents me from driving. A month or so of daytime television almost destroyed my brain function too. Haha, so much crap out there. I told my wife I needed a hobby; she told me I should clean out the closets and get rid of all the business attire that I would probably never wear again; I was one of those math teachers who wanted the professional look that a shirt and tie presented. Well not only did I donate clothes, but I also found a treasure trove of forgotten electronics; cell phones, scientific calculators, and mp3 players. I had my daughter take me to a pawn shop, but I knew they were worth more than the $5 they offered for the whole box. While there, I was able to peruse their modest coin inventory. I hadn't much thought of coin collecting since those many years past. On the way home my daughter reminded me that I had an ebay account that I hadn't used in years, and maybe I should try to sell them there. So, I did. My modest listings made me around $400 in around 3 weeks. That trip to the pawn shop got me interested in coins again. While surfing around on ebay I started "window" shopping. Having spent all those hours watching TV, I also wasted some time watching Youtube, but I also knew that there was lots of valuable research info there too. I would see a coin listed, then go do some research; the internet is my friend. This was the summer of 2014, and probably the heighth of video blogging and unboxings by the robust youtube silver stacking community. I was hooked, shiny new silver coins and bars. I immersed myself in researching the various forms of silver; bullion, rounds, bars, junk silver, numismatic, grading services, and on and on. I decide I would start with silver bars. I had my ebay money sitting in my paypal account, and saw that JM Bullion accepted paypal. They also seemed to have the best deals. I took the plunge, and ordered 5 oz of Walking Liberty Silver Bars. I made 4 more orders that July that totaled around 48 oz of generic silver bullion, 1 silver eagle, and a 1/10 oz gold eagle. After about 8 months or so I was able to stack around 200+ oz. I enjoyed hearing the delivery guy knock on the door with a new package, unboxing, then opening up my spreadsheet to add to my totals. I would not have been able to save that much value in a regular saving account; fiat is to liquid for me and I don't have the willpower to leave it there.

About 10 months in we had a financial emergency, and I told my wife that were going to be fine. That was one reason for the stack, an extended savings account. I grabbed a 20 oz tube of Sunshine rounds and we headed out to a local coin shop. Now, I was in too much of a hurry to really think about the spot price of the moment or what I would ultimately be paid. It was the first silver transaction where I was the seller. Boy was I blown away, that tube had cost me $21.29 an oz, and I was able to haggle to sell at $16 an oz; call me naive, but I expected more. Luckily, I had enough to cover the unexpected bill and actually enough to purchase another silver eagle; hey he had a low premium on them that day, and if I remember correctly it was $20.50. Haha, always stacking even if it is 1 oz at a time.

On my way home I reflected on my investing strategy, and decided to make some changes. I had been in the camp of low premiums, and that semi numismatic or graded coins were for fools. Although I thought many of those coins were absolutely stunning, I could not see paying that kind of premium for 1 or 2 oz of silver. The internet to the rescue. I was not about to buy without doing my due diligence. I decided to diversify my stack. I started with ebay auctions, looking for dealers with a large number of past sales, with 99.5% plus customer ratings; I had heard the ebay horror stories. Auctions were one way to cut into the premium markup of online dealers and local shops. My first grandson was born in 2014, so I decided to make the Perth mint 2014 1 oz Lunar Horses my first high premium coins. It took awhile to collect the 2014 series, but I did; luckily, all were won via auction, well below dealer premiums.

Here is that collection

I also acquired some graded versions of the different varieties of the 1 oz coin

This one with the Bavarian Lion privy has a population of only 13 in this condition from PCGS

Now I may get some blowback from some out there; I always do. If I had an ounce of silver for every comment I have ever read stating that "one day you will need that silver round to buy your neighbor's chicken," I could retire to Hawaii. If my strategy does not work for you, DON'T DO IT. If I spend $300 for a coin, it is no skin off of your back; am I right?

Basically this is my strategy

Generic silver

I like to hold cheap generic silver bars for quick cash; no rounds, I like how bars feel in my hand and are easy to stack in my safe. This is basically my savings account. It is easy to liquidate, but not as easy as spending from my checking or savings account; keeps me from impulse purchases when shopping. It takes a little effort to cash out. I don't really care if I lose a little in the transaction price, usually a little below spot; but, things eventually even out for me. I also like having poured bars. These bars you can pick up on sale once in awhile from online dealers, and usually carry a nice premium when reselling. I mostly try to hold on to my poured bars.US or Mexican "junk" silver

Mercury dimes and Franklin half-dollars are my go to coins; sometimes Washington quarters are in the mix. I am lucky to have a local coin shop, who has awesomely low premiums. The only issue, is he can't keep junk silver regularly in stock. I always go in prepared to buy a roll or two, just in case he has some in stock. This is my "flipping" silver. With my low purchase cost I can easily flip $1-$3 face value lots on ebay and still make a healthy profit, even after ebay/paypal fees. These profits go directly into my "coin collecting" fund.Government issued silver coins

These types of coins I have in 2 different categories; low premium, and high premium.

LOW PREMIUM would be US silver eagles, CA maple leafs, UK britannias, and Perth silver kangaroos. For me, these sort of fall in the same category as silver bars. The difference is, I will never sell these for less than spot. I need a little "sugar" to make the sale.

HIGH PREMIUM coins in my stack include CHN panda, SOM elephant, lunars and kooks from the Perth Mint, and Mexican Libertad coins. These are long term investments for me. If I do sell them I normally make the initial premium back or even a little more. I can usually make a little profit selling these, but like I said I prefer to hold these in my collection. Notice, I said collection not stack. This is where I differentiate from the 2.Oddball purchase because I like it.

These coins also fall under my collection. These are high premium coins that I find to be little works of art. These are my "show" coins; the "I have one and you don't" coins. I don't have many of these, but if I can find an awesome deal, and it is something I have been shopping for then I will pull the trigger. This includes proof coins, boxed sets, graded coins, and limited editions. These are also my long term investments. These are coins I will eventually pass on to my grandsons.Historical coin (not necessarily silver)

These coins fall into the fun, hobby part of my collection. Much of my joy comes from the "hunt." This is where my academic side comes out. I thoroughly enjoy researching coin types, value of, availability, rarity, and eventually actually adding the coin to my collection. The feeling of winning an auction or finding that deal is beyond compare; there's nothing like putting in all that work and adding a little treasure to the collection. Also for my grandsons.

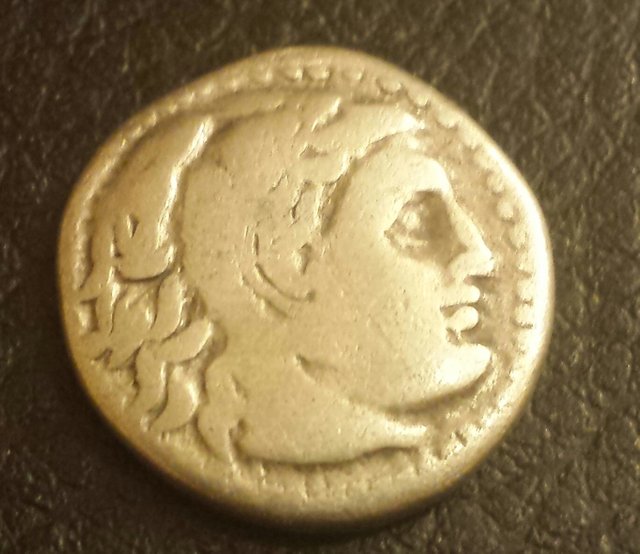

Here are some of my prized historical coins. I plan on blogging about them in the future.

Alexander the Great silver dracma 330-300 BC

A history of US issued half-dollars

1910 20 franc gold "Rooster" coin

World War I era 1914-1917 Italian silver 2 lire

Now remember, I am not telling anyone to follow this plan. I just wanted to enlighten the community with what I do. You do, what you do, for you....

I am planning on creating more blogs introducing coins from my collection. So I hope you follow me @oakleyshark and return for more. I would like to meet more of you in this great community. Please don't forget to upvote me and I will do the same

Thanks a bunch.

Wow some beautiful items on display here! Thx for sharing your story and be sure to check out my posts. I showed what I've been into lately. Cheers

Welcome to the #steemsilvergold community! Enjoyed reading about your method to your madness (we all have our own methods)

Looking forward to future posts and thanks for sharing!

That's a great strategy. Never lay your eggs in one basket. I'm 75% stacking and 25% collecting.