What kind of Gold/Silver Stacker do you want to BE?

With any investment it is important to have a plan and go in with your eyes open. So if you’re interested in stacking some Precious Metals and are inexperienced then it can be useful to ask yourself some of the pertinent questions to make sure you’ve thought things through. To get you started here is some of the typical “5W” questions that you can ask yourself that will get you thinking about what sort of Stacker you want to be.

Source

Source

Seems like a good place to start. If you read my article about the Price Drivers of Gold you might already have a good idea where you fit. Maybe you just want a Safe Haven for your Crypto profits. Perhaps you just like shiny things and have always been a bit of a collector but want to collect something of value. It could be concern about possible war with North Korea, more escalation in the Middle East or even a bigger conflict with Russia, China and/or Iran. Maybe you don’t like President Trump and think he will cause the collapse of civilisation. You might be wanting an Inflation Hedge because you are concerned about Money Printing and the likely Inflation that might come from the ever increasing debt and spending? It could even be all of the above…

Source

There are so many choices for different Precious Metals to stack. If you’ve had a read of my article about the different Categories of Precious Metals you might have some ideas already. I’ve listed this at #2 because it is ultimately a very important question, but it really should be the question you finally answer last once you have a good idea of Why, Who, Where and When.

Source

You will need to buy your Precious Metals somewhere so it is worth figuring out who you are going to buy them from and then have a look at what is on offer. You might live in a bustling metropolis where there is a Local Bullion/Coin Shop that you pass on the way home from work or you might need to travel some distance. You might prefer to order online from a reputable Bullion Dealer, where savings can be made but you need to think about postage options and expenses. Or you might be able to get what you want from a Secondary Market. I’m going to write an article this weekend about the Secondary Market I use (so stay tuned!)

Source

Do you have access to a Bank Vault? Maybe a Safety Deposit Box, or even a Private Vault are secure options. If you want to keep your Precious Metals close at hand you might need a Personal Safe in your home. Or maybe you intend to Bury it in the backyard or put it on Display for your visitors to marvel at. Whatever the option there are some risks involved. Whether it be Counterparty Risk or Theft Risk, it is important to weigh the Risks up.

Source

Often this is the unanswered question for many Stackers. Some people just stack like methodical hoarders and never sell. Are you looking for the next Mania in Gold and Silver to sell at a good price? Perhaps you are waiting for that Hyperinflation or Default to hit and then some kind of Normalisation of the financial system. Maybe you’re saving for that Crisis or Collapse and intend to spend your Precious Metals as Currency. Or maybe you never intend to sell and you are buying Precious Metals to pass on as Inheritance and leave a nice legacy for your kids.

There are a few things to think about and these are just some of the reasons why people stack and maybe some of them sound ridiculous to you, but that’s part of the reason why you should think about it before buying. Are you a Stacker because you’ve thought it through and are of sound, rational mind?

Source

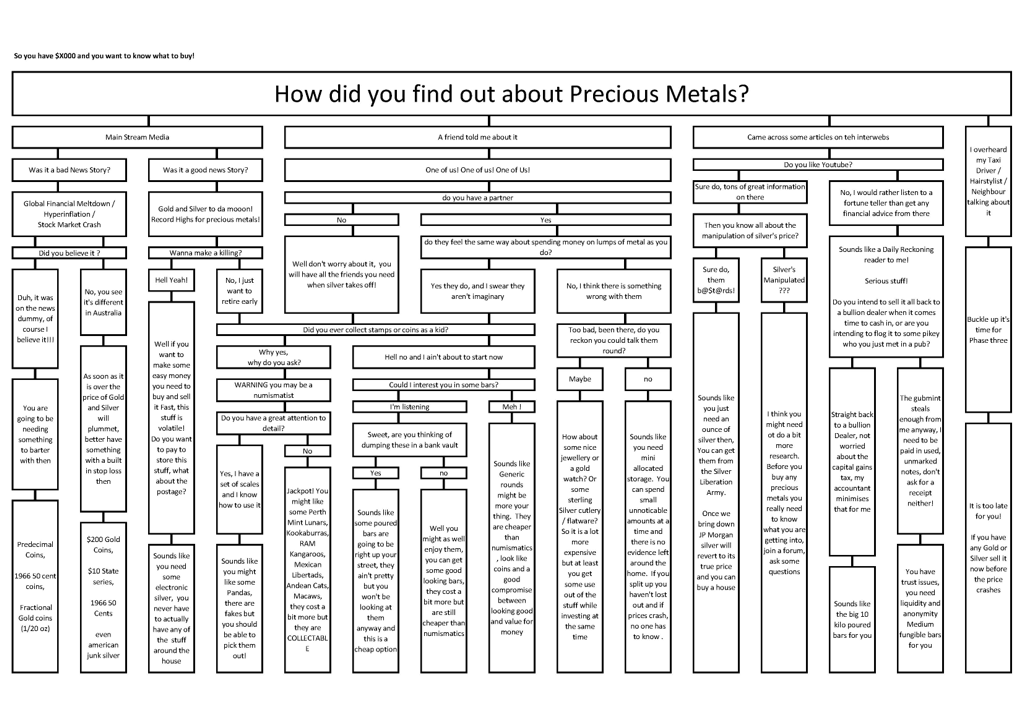

I’ll finish off with a bit of humour which I lifted (with permission) from a Stacker who goes by the alias of JisLizard from the great Australian Stacker community at www.silverstackers.com. I apologise for the low resolution, you might need to click on this image to expand it to read it properly, but it’s good for a laugh and it will also get you thinking about what to stack.

http://comicbook.com

https://news.goldcore.com

https://www.youtube.com

http://www.silvermonthly.com

https://www.custodianvaults.com.au

https://www.businessinsider.com.au

https://www.silverstackers.com

Great post. Love that chart! I've been stacking since the mid 90's

I too started out as a coin collector and branched out into stacking silver.

Junk silver is my first love, but since coming to @steemsilvergold, I've developed quite a taste for poured silver and mini-mintage rounds.

Nice post bugged out.

I've been a stacker for a few years now, nearly 9 years I guess. But was a bit of a collector before that. The big questions I've asked myself are:when to buy, when to sell, and how to store it. The rest can figure itself out, in my mind.

I wish it was as simple as this, but this is what I lime to say...

Buy when nobody wants it. Sell when everybody wants it. And store it where nobody can find it.

In reality though, I want to retire some day in the not too distant future, so I want gold for my golden years.

That, and gold and silver is literally the only investment that you can look at, touch and hold, smell, hell, taste if you want, I ain't gonna judge...

Fuckin’ A fat-e!

9 years in the stacker game is longer than me! I'm still learning myself, just sharing what I've learnt.

Thanks for sharing. I reckon everyone should be saving for those Golden years. Bit of a double meaning there ;)

Wow good information ..

Awesome post man, very comprehensive. I love the flow chart and interestingly enough I landing right in collector!

Appreciate it. I first saw that flowchart years ago when I was figuring things out, but it stuck with me.

For this year probly a slow consistent Stacker, I accumulated a lot last year I think I can slow down now and probly diversify in other investments...great post...upvoted and resteemed

Thanks for the resteem, really appreciate it.

WHY: Wealth preservation

WHAT: Generic silver all sizes and shape (except 100 oz bars), foreign govt minted silver (full tubes only!) with $.99 or less premium per ounce (it's out there, just have to find it), SAE with $1.79 premiums or less. Some graded Kruerrrands, big mistake!

Gold purchases are primarily govt minted 1oz pieces as there is not much of a premium difference at the 1 oz price between generics. I have lucked into 1/10 oz GCML and GAE under spot price using discount codes from different vendor. Pre-33 gold Double Eagles MS63 or MS64

WHO: Whoever has the best price.

WHERE: Right next to the gun safe. Self directed and possessed PM IRA (Only US minted coins are allowed)

WHEN: Selling when certain collections are complete (IE Queen's Beast), Checking full govt minted tube for any possible numismatic coins, when the bottoms drops out of the market.

Great answers and very detailed! Sounds to me like you've really thought it through and you know what you're doing. Congrats.

I don't have enough to rent a safe deposit box, I plan on getting more with crypto profits. Paper cash seems like it could have issues with counterfeits, bars of silver are harder to fake. Like if i want to stash it all away for 30 years, at that time the bills are going to look old and funny, silver is still silver,

Silver can develop Milkspots and Tarnish from oxidation, so it is important to keep them air tight and clean. Gold is actually better than Silver for long term storage.

Hypothetically, if you have gold and need to change it into fiat quickly, how easy is this? And do you have to show ID?

Good question. I know that Bullion Dealers require ID for purchases over $5K AUD but I am not sure about selling back to them. For the right price you can usually sell off stuff on the secondary market like www.silverstackers.com within a few days without needing ID.

Warren Buffett has said that he doesn't understand why people buy gold and silver.

We pay people lots of money to dig it out of the ground, then we pay other people lots of money to exchange it, and finally we pay yet other people lots of money to bury it back in the ground so nobody can touch it.

Kinda makes you think.

Buffet is an old school value investor and its worked well for him, but Gold and Cryptos and other non-yielding assets are outside his domain.

When you boil down a lot of human behaviour it sounds pretty silly so wouldn't expect this to be any exception ;)

👍

may i ask somthing if i bought gold and saved will be better than saving money?

Nobody can know for sure and anyone who claims they do is not worth trusting. It depends on a lot of things, what country are you from?

Ill be waiting for the next episode?

I am interested in Gold investment.

Still researching!

I consume every article I can find.

Thanks for this

You're welcome. I'll try and get the next one out tomorrow :)