In 2019, the Fed Is Still the Market's Fuzzy Warm Blanket

When I was young, I had this tremendous blanket. I carried it around with me wherever I went. I was a lot like that character Linus from the Charlie Brown cartoons:

What I remember most about that blanket is that it had these reddish pink flowers on it and was sewn together in sections. Two layers, with a smattering of soft something in the middle. Perhaps it was down, but probably just cotton. It was a cheap blanket, but whatever there was inside made you want to hold it between your fingers and rub it forever. There was something oddly soothing about that.

It was distinctly yellowish, but not exactly yellow. Whether the designer chose this color on purpose or it became severely off-white through age, who knows.

I always had this blanket with me. Yes, it was an inanimate object, but there was a time when it was my best friend. I even called it Lovey. I needed it. If ever I didn't have it, I would stalk around the house obsessively repeating: "Where is it? Where is it? Where is it?" Stomp. Stomp. Stomp.

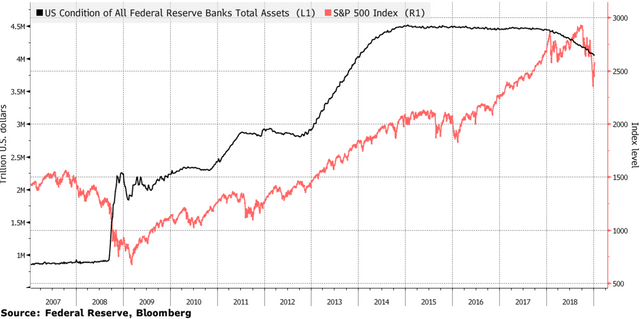

You may ask what does a child's blanket have to do with the stock market? First, let's take a look at this chart:

This chart tracks the S&P 500 index, widely seen as the best proxy for the US stock market, versus the growth of the Federal Reserve balance sheet via its purchases of U.S. Treasury securities, a practice which is part of the modern monetary toolkit popularized by Bill Bernanke and known popularly as quantitative easing (QE). Without even running a proper regression, you can see that the correlation is startlingly high, which proves one thing without a doubt:

Mr. Market loves the Fed.

And the Fed loves Mr. Market.

For years, the Fed was the main bidder for Treasury assets at auction, which turned out to be a great way to increase the money supply while simultaneously keeping interest rates down! At its peak, the Federal Reserve was HODLing $3.3 trillion of assets it had bought at auction. According to FRED, it still has approximately $2.8 trillion on the books. That means that since the beginning of 2018, when interest and maturing bonds stopped being reinvested back into assets, the Fed has only rolled off about $500 billion worth of assets, or a little over 15%, from its balance sheet. No wonder former chairman of the Federal Reserve Ben Shalom Bernanke is pictured on the note below:

On October 29, 2014 Janet Yellen announced the end of the last of the Fed’s asset purchase programs, otherwise known as QE3. Starting from a few weeks before this widely anticipated announcement, the 50-day moving average of the Chicago Board Options Exchange Market Volatility Index, more popularly known as the VIX, steadily increased.

Back when I first posted this missive way back in 2015, here is the action on the VIX (in blue), sometimes referred to as the fear index, along the course of a year, highlighting where Ms. Yellen started messing with the market's beloved QE blanket:

The placid trading waters of the summer of 2015 were characterized by a VIX that never crossed 15. Churn increased throughout the autumn, moving its simple 50-day moving average to above 15. But once the Fed started talking about taking away the punch bowl, the VIX crossed the critical threshold of 20 three times in January, which is the exact number of times that market volatility spiked above 20 during the whole of 2014. Like a little kid angry with his parents for not giving him donuts at 10:00 at night, the market starts to get fidgety in a volatile way when it starts to look like it may not get the monetary accommodation it constantly seeks.

Stomp. Stomp. Stomp.

Linus is not happy. He is going through withdrawal.

As you can see from the past year's action on the VXX, an ETF full of VIX futures contracts, that volatility has been a hallmark of trading all throughout 2019.

Peaks and valleys have become the norm. It looks like Mr. Market has entered an amusement park. Up. Down. Up. Down. Whee! I love roller coasters (not really)! No wonder that dude is crazy.

But that’s what happens when you take a child’s favorite blanket away from him. He becomes increasingly unstable and his parents can only but anxiously await the next breakdown. The good news is that the Fed has lots of room to implement more monetary accommodation. Jay Powell can go down to zero! Or shoot, he can go to negative rates even, just like Japan and Europe have done.

One thing is for sure: This stock market is entirely driven by monetary policy. Little else matters. That's not exactly healthy in the long run.

To listen to the audio version of this article click on the play image.

Brought to you by @tts. If you find it useful please consider upvoting this reply.

Thank you so much for participating in the Partiko Delegation Plan Round 1! We really appreciate your support! As part of the delegation benefits, we just gave you a 3.00% upvote! Together, let’s change the world!

The punch bowl is almost empty, once gone, people will run out of the party house.

Oh, c’mon we have a couple hundred bips left. Would be a shame to waste them!

Posted using Partiko iOS