Campbell Harvey…The Father Of The Inverted Yield Curve???

Campbell R. Harvey is Professor of Finance at the Fuqua School of Business, Duke University and a Research Associate of the National Bureau of Economic Research in Cambridge, Massachusetts. He served as President of the American Finance Association in 2016.

Professor Harvey obtained his doctorate at the University of Chicago in business finance. He has served on the faculties of the Stockholm School of Economics, the Helsinki School of Economics, and the Booth School of Business at the University of Chicago. He has also been a visiting scholar at the Board of Governors of the Federal Reserve System. He was awarded an honorary doctorate from Svenska Handelshögskolan in Helsinki. He is a Fellow of the American Finance Association.

Harvey serves Partner and Senior Advisor at Research Affiliates, LLC who oversees over $200 billion in client funds as well as Investment Strategy Advisor to the Man Group plc, the world’s largest, publicly listed, global hedge fund provider.

Harvey is also known has the father of the inverted yield curve.

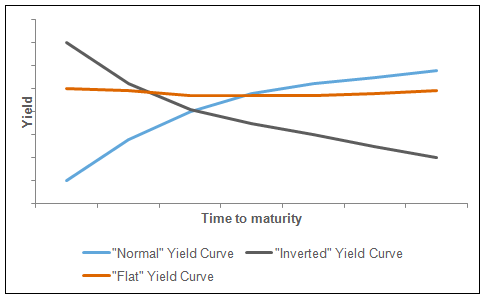

The term yield curve refers to the relationship between the short- and long-term interest rates of fixed-income securities issued by the U.S. Treasury. The financial theme in 2019 has been the inverted yield curve. Why is it so important…it’s only predicted the 5 or 6 recessions, meaning it has given no false signals going back 50 years.

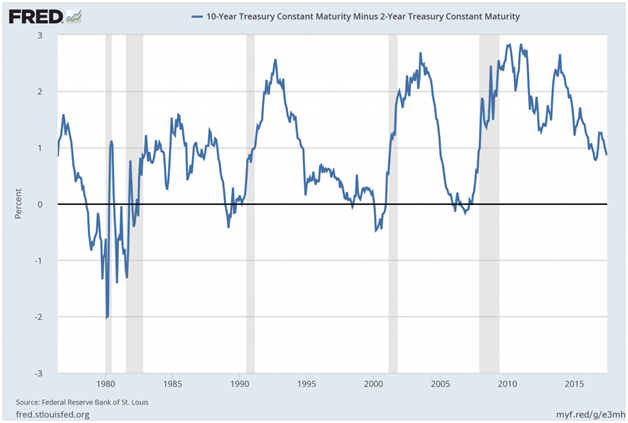

During his research, first revealed in 1986, he found that an inversion between the 3-month and 10-year Treasurys has foretold the past seven recessions since 1950. At that point, there had been four successful cases; since then, three more have occurred.

Harvey’s conclusions about the yield curve dovetail with a 1996 New York Fed paper that also saw a relationship between inversions in the 3-month/10-year part of the curve and recessions. Subsequently, the curve also inverted before the financial crisis that exploded in 2008.

In the most recent cycle, that part of the curve first inverted briefly in March then turned lower again in May where it has stayed since.

Harvey said the curve needs to stay inverted for three months to be reliable, so in this instance the duration means the indicator is “flashing code red” for a recession.

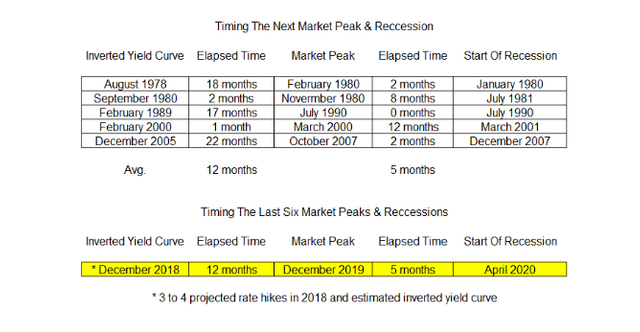

The technical definition of a recession is defined as two consecutive quarters of negative GDP growth. But when that happens, it will be too late. The stock market tops out and begins to decline before the economy rolls over. This is the reason why the inverted yield curve is so powerful, it’s a leading indicator and will give you forewarning to reposition your portfolio for tougher times.

In March of 2018, I looked at the past several recessions relative to the inverted yield curve and based on my assessment, I thought the yield curve was going to occur in December of 2018. I was off by three months, as the first yield curve inverted in March 2019. During that same assessment, I said we would be in a recession by April 2020. That’s about six months away. Whether I’m right or not, you have been warned by Campbell Harvey.

This post is my personal opinion. I’m not a financial advisor, this isn't financial advise. Do your own research before making investment decisions.

Thank you for posting from the https://steemleo.com interface 🦁