Tokenomics 101

This is a post I've been thinking about for over a week now. I guess you can call this more of a draft. I'd been trying to think of not only how to describe this idea, but also how to illustrate it. I figure it's better to just get something down and I can refine it later.

With SMT's on the horizon I want to share some thoughts about Tokenomics as I understand them and hopefully help people understand what we already have with Steem Engine, as well as what's coming down the pipe in the supposedly more powerful form of SMTs.

Intro done.

Tokens are tools. The most fundamental use case for a token is as a medium of exchange.

They don't have any inherent value. For that matter neither does any medium of exchange, although this is debatable.

Tokens only acquire value when people buy them. Their value is then defined by the laws of supply and demand. To simplify, the token value will be defined by what people are willing to pay for them, and what people are willing to sell them for.

So with that understood, if the goal is to get a tokens value to increase, then buying needs to be incentivised. On Steem, the tokens are all inflationary, that means new tokens are being created all the time. This reduces the value of individual tokens as the same value is spread across more tokens. The other mechanism that will lower the token value is the selling of the token for lower and lower prices.

So in order to have the price of the token increase, buying has to outpace selling and inflation.

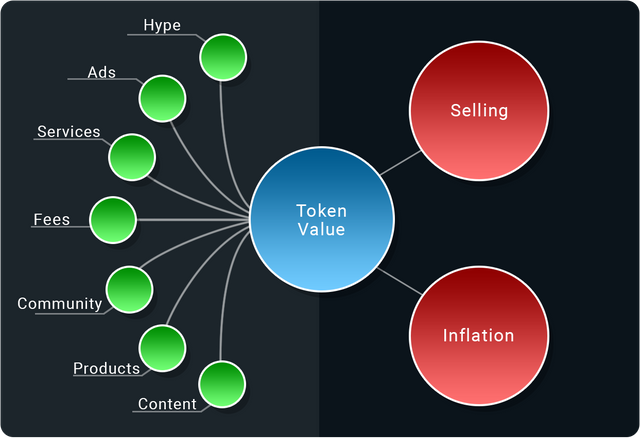

In this graphic, the left green circles are things that can add value to a token, some of these things are interdependent, for example content adds tangible value by increasing traffic which is monetizable in a number of ways, most simply via advertisements. With that in mind, lets go through them.

Hype

- Hype is actually all many cryptocurrency projects are running on. Many don't have any usable product much less something that's profitable. The creators have simply been successful at creating a narrative around their token that drives positive sentiment and incentivises people to buy it.

Ads

- Ads are the tried and true monetization strategy of the web if you're monetizing traffic. The sharing of ad revenue is a very promising value source for tokens on Steem and in general.

Services

- If you offer some form of labor and collect your token as compensation this can also add value to your token by removing those tokens from circulation. An example of this is the tribe setup process offered by Steem Engine.

Fees

- If you have an application that provides some valuable service, it makes sense to collect a fee for that service. If the fee is collected in your token, it can serve as a mechanism to add value to the token by removing tokens from circulation. An example of this is the fee collected by Steem Engine for deposits and withdrawals.

Community

- If you have a vibrant and robust community then they can create value in a variety of ways. Onboarding new users, creating traffic for ads, buying services, etc. In the end, without a community around your token, the other value adds are meaningless.

Products

- If you sell a product or allow your community to sell products, you can use this as a mechanism to add value to your token by collecting your token as the medium of exchange.

Content

- Content can be monetized via ads and can help to grow the community. If you have great content as well as great tools to connect people to the content relevant to them, this can add a lot of value to your token.

These are a few examples, but the fundamental idea here is that without any green circles, the only future for your token is to slowly or quickly become worthless. Also, even if you have one or two green circles this still may not be enough to outpace selling and inflation

I purposely made this graphic simple and left out details that also influence the price like staking, inflation reward pools, and burning. This is the high level pass. But an important detail that I may need to work into this graphic to make this more understandable is that the most direct mechanism for those green circles to affect token price is through "burning" the tokens.

Burning tokens refers to taking tokens out of circulation therefore reducing the supply. It's basically the opposite of inflation. This is done by sending the tokens to the @null account, which is an account that no one has the keys to.

People holding or staking tokens also relieves selling and inflationary pressure, but if there is no value coming into the token, there is no incentive to hold it. Whatever value the tokens currently hold, they will lose over time. So to incentivise holding you'd need to create positive sentiment(hype) that your tokens value will increase in the future, otherwise it makes no sense to ask people to hold it, they'll just be losing value.

It's up to whoever created the token to be creative and innovative in finding as many green circles as possible, inventing new ones, and working to constantly improve the effectiveness of the ones they already have.

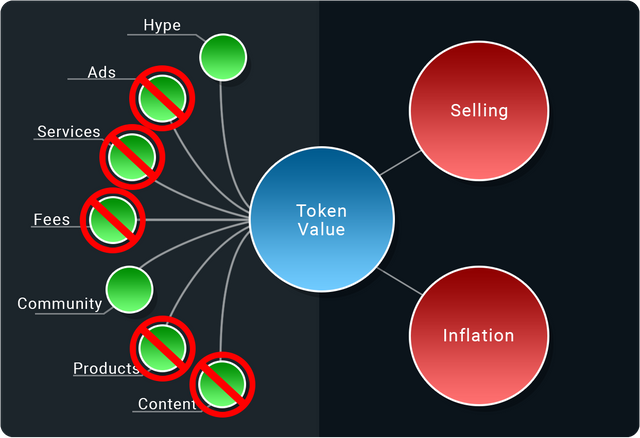

This is the current set up for many of the tokens on Steem Engine. Hype dies down over time unless you're constantly marketing and selling which most aren't doing, or they're simply not doing it well since they aren't really offering anything that people think will increase the value of the token. It's not surprising that the prices have fallen as they have. There is initial hype when something new is created, but once selling and inflation start to kick in and there's nothing to oppose them, the price will fall continuously. Some have enabled Ads, and this is a great start to offset inflation and selling but should only be the beginning.

Bringing this back to the beginning, tokens are tools. They are creating money out of thin air, but they don't create value out of thin air. The value is what makes the tokens useful as a medium of exchanging that value.

So that's a basic breakdown, that still seems a bit convoluted, so I'll keep working to polish this explanation. What do you all think? How many of you really "get" the idea of tokens and SMT's? Do you feel like you have a strong grasp on what they are and what you'll be able to do with them? Let me know in the comments.

P.S. At some point in this post everything got center justified and I couldn't figure out why. I didn't just decide text in the middle was cool half way through the post.

Regards esteemed friend @midlet

I really liked your interpretation and analysis. While managing simple language, you managed to convey key points about tokens in general. Your idea of green circles is very practical and I really believe that it involves the main aspects that can add value to any token, whether these are SMT or not.

When you talk about inflation, I imagine you mean Steem Blockchain. Since SMT tokens are based on a fixed amount of supply. But since its value is tied to Steem, then yes, we have inflation for them too.

Announcements: This new modality will definitely bring added value to the tokens. We already have tribes that are implementing them.

Community: Without an activity or theme that manages to group the members of tribes or users of the tokens around their common interests, there will simply be no activity around the token and it will disappear. So for me, the community is the main factor in these green spots. Not for nothing is the most difficult factor to keep positive.

Creating and maintaining a community is an activity that requires time and constant feedback. For this, meeting spaces must be provided, communication channels, activities and, above all, motivate and reward the most active members.

Content: Although lately the quality of content has been abandoned replacing it with card games, bets, sports activity reports and others. Quality content remains the factor that will add great value to any publication and therefore to the token that rewards these publications.

The interdependence between the green dots, is another aspect that we must take into account. If we manage to create a balance between two or more points, we could have the key to success in our hands.

Thank you for your valuable post.

With your permission, I´ll resteem it.

Your friend, Juan

Thanks @juanmolina, glad you liked it. So when I spoke about inflation I meant the SMT tokens as well. They will work similarly to STEEM with some customizable parameters, but they will be inflationary. There is a max supply which is common in just about all cryptocurrencies including STEEM so they won’t inflate forever, but most are set up to inflate for decades if not centuries, for example the last bitcoin will be mined in 2140.

Thanks for responding, you are very kind.

The inflation of the steem blockchain is based on the creation of new tokens every certain number of blocks.

I didn't know that SMTs also created more tokens over time. This is very interesting for me.

Thank you for sharing your knowledge with me.

Thank you for posting from the https://steemleo.com interface 🦁

To listen to the audio version of this article click on the play image.

Brought to you by @tts. If you find it useful please consider upvoting this reply.

Thank you so much for participating in the Partiko Delegation Plan Round 1! We really appreciate your support! As part of the delegation benefits, we just gave you a 3.00% upvote! Together, let’s change the world!