The things that matter most in Business - Trading Disney as 'Frozen 2' Hits New Records

Walt Disney (DIS - Get Report) shares were falling Monday, down 1%, despite a robust showing for its new blockbuster hit, "Frozen 2."

It's the latest hit film from the company's studio division this year, but it's unlikely to be the last as its latest installment of the "Star Wars? saga will hit theaters later this month.

Disney stock has been riding high lately, hitting new 52-week highs just last week. While part of that momentum has been helped along by a strong performance at the box office, much of the gains can be attributed to the company's recently launched streaming service, Disney+.

The service is reportedly gaining nearly 1 million new subscribers per day. The perceived momentum in the new service is translating to momentum in its stock price.

Now though shares are selling off on Monday as the broader market comes under pressure amid renewed trade tension. The fact that "Frozen 2" had a record Thanksgiving haul doesn't seem to be helping much. Is the decline enough to force bulls out of the stock and into hiding?

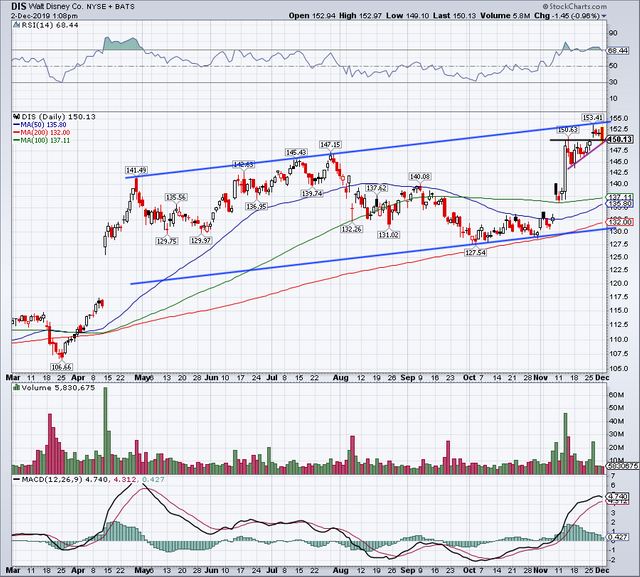

In April, shares gapped higher after the company unveiled its Disney+ platform. For more than six months after that, shares chopped sideways as the stock consolidated the big gains.

Earnings sent shares higher in early November though, before again rocketing higher up toward $150 a few days later. After that big push, $150 was clearly resistance. But that didn't stop the stock from clearing this hurdle after a few weeks.

It brings up the big question of what now?

After seeing Disney stock consolidate below $150 and then claim this level it would be discouraging to see the stock lose this mark. From here it's the line in the sand for bulls, and with Monday's decline shares are dangerously close to ending the session below it.

If it does, it could put the $145 level on the table, as well as the 78.6% retracement down near $142.

Should $150 hold, then bulls can stay long the stock. The first upside target is the 52-week high, up at $153.41. Above that and channel resistance near $155 is the next level to watch.

So what's the bottom line here? Over $150 and it's OK to stay bullish on DIS stock. Below $150 isn't necessarily bearish, but it does signal to investors that it's time to be more cautious and could put additional downside targets back on the table.

To listen to the audio version of this article click on the play image.

Brought to you by @tts. If you find it useful please consider upvoting this reply.