Forex trading Support & Resistance (the truth)

I'm sure you've probably heard stuff like...

“The more times Support is tested, the stronger it becomes”

“You should place your stop loss at Support & Resistance”

“Support & Resistance are lines on your chart”

But is this true?

Given the amount of noise out there, it's near impossible to figure out what's real or not.

So today...

I’ll reveal the truth about Support & Resistance (SR) that goes against what most gurus are telling you.

You ready?

Let's begin.

Truth #1 - The more times it’s tested, the weaker it gets

Here’s why…

The market reverses at Support because there is buying pressure to push the price higher. The buying pressure could be from Institutions, banks, or smart money that trades in large orders.

Imagine this:

If the market keeps re-testing Support, these orders will eventually be filled.

And when all the orders are filled, who’s left to buy?

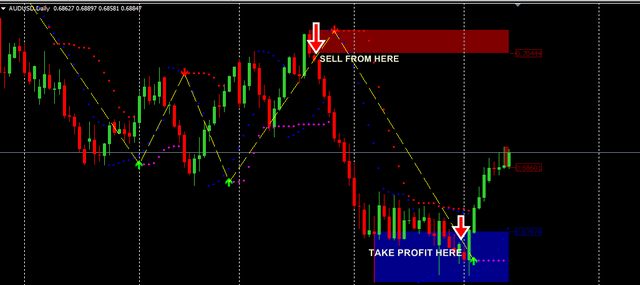

Truth #2 - It is an area on your chart, not a line

I’ll explain…

Traders with the fear of missing out (FOMO) would enter their trades the moment price comes close to Support.

And if there’s enough buying pressure, the market would reverse at that location.

On the other hand, there are traders who want to get the best possible price, so they place orders at the low of Support. And if enough traders do it, the market will reverse near the lows of Support.

But here’s the thing:

You’ve no idea which group of traders will be in control (whether it’s FOMO or Cheapo traders).

Thus, Support and Resistance are areas on your chart, not lines.

Truth #3 – It’s the WORST place to put your stop loss

Imagine this:

You manage a hedge fund and you want to buy 1 million shares of ABC stock. You know Support is at $100 and ABC stock is trading at $110. If you were to enter the market you will likely push the price higher and get filled at an average price of $115. That’s $5 higher than the current price.

So what do you do?

Well, you know $100 is an area of Support, and chances are, there will be a cluster of stop-loss underneath (from traders who are long ABC stock).

So, if you can push price lower to trigger these stops, there will be a flood of sell orders hitting the market (as traders who are long will exit their losing position).

With the amount of selling pressure coming in, you could buy your 1 million shares of ABC stock from these traders. This gives you a better entry price, instead of hitting the market and suffer a slippage of $5.

In other words, if an institution wants to long the markets with minimal slippage, they tend to place a sell order to trigger nearby stop losses.

So the question is…

How can you avoid it?

Don’t put your stop loss just below Support or above Resistance.

Hi @fiicjames

Thank you for following @haccolong account. As a follower of @haccolong, this post has been upvoted by @hoaithu's Curation Trail.

This is free upvote first when you follow @haccolong . Although it is quite small, I hope you enjoy them.

To earn more rewards with your Steemit account. Check through some of the ways at this post.

I will continue with random upvotes in the future & wish you lots of luck. :)

Thanks for your support

Posted using Partiko Android

To listen to the audio version of this article click on the play image.

Brought to you by @tts. If you find it useful please consider upvoting this reply.