saving accounts = losing money

Put your money in a savings account...

This is a mantra that has been promoted by the politicians and bankers alike for so many years.

I came across an article that accentuated my last post about inflation a bit and put the focus on the Eurozone.

The "tagesgeldvergleich.net" , a german comparison website did the calculations and comparisons for all countries in the Eurozone and came to an astounding conclusion.

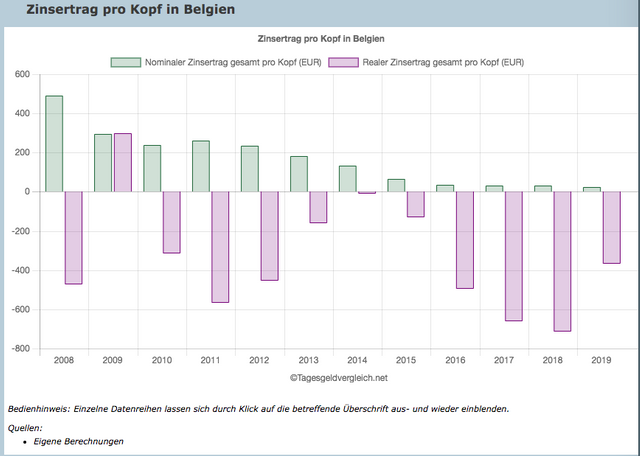

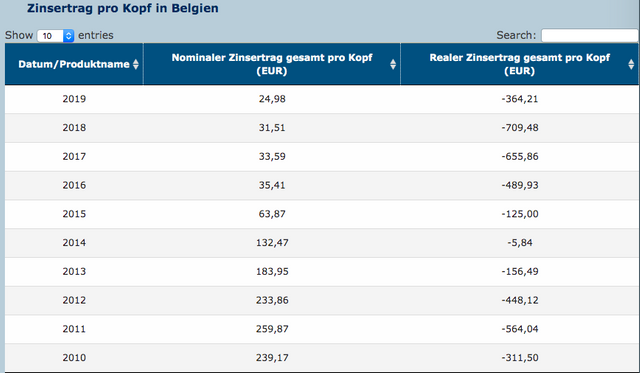

Here I am singling out Belgium since this is my country of origin but it is one of the worst hit countries in Europe. Only the Netherlands and Luxemburg are worse off. I will then also show the stats for Europe as a whole.

Both pics come from the tagesgeldvergleich.net website and you can find your country here:

https://www.tagesgeldvergleich.net/zinsradar/

The first 2 are the same, one is in pretty bars and the other in confrontational numbers.

So if we look at this the average European citizen has been losing a lot of money for the last three years if they had parked it on their savings account.

Now this is just the counting the official inflation rate and the interest on the account. What was not mentioned is:

- account management costs

- costs for the cards

- costs for wire transfers

- the real inflation instead of the official one (check my last post https://steemleo.com/steemleo/@felander/inflated-inflation)

Now if you add on all these hidden costs the amounts are much much higher.

But lets go back to the Belgian numbers. The assumption is that these are averages and that means that the average Belgian citizen has roughly 33000 Euro on their savings account (that includes the 1% that own much much more)

if you take the 364 as an official number that means the average Joe is losing 1.1% of his money per YEAR (double that last year)

And do not forget the saying from Albert Einstein:

This compounding interest also works the other way around.

People are losing so much of their buying power every year its frightening that they do not realise this.

Then again, if you cannot trust the bank and your savings account, what are the alternatives?

- bonds? Negative yielding in the Eurozone

- stocks? going dangerously high to see a decent risk - reward ratio

- precious metals? have been going up and seem to be a safe haven with lots of upside potential

- cryptocurrencies? For sure in my opinion, especially all the DEFI options that are paying 5 -10% interest per year on Stablecoins.

These are the options that you have but then there is also the actions that can be taken by the Central banks and the governments but those seem to be geared at keeping the rich rich and the poor poor.

Savings accounts will always lose value in an expansionary monetary regime like we've been in since 1982 or so. Opt-out and avoid the banks.