YIELD CURVE INVERSION - MARKET CRASH AHEAD?

There’s currently a lot of commotion with regards to the yield curve. With large investors focusing on the inversion of the 2 year and 10 year government bond spreads, it’s worth discussing the importance of this event because the yield curve has been used for decades as a leading indicator of economic outlooks.

The inversion of the 2 year to 10 year spread – which is when the 2 year government bond yields a higher return than the 10 year government bond – is seen as a harbinger for recessions. This is because the inversion has predicted the previous recessions of 1981, 1991, 2001 and 2008. An inverted yield curve is an unusual event because logically investors should want to receive a higher return on long term investments than on short term ones.

However, when investors begin to have a negative outlook on the economy it causes them to starting parking their money in bonds which pushes the yields down. More specifically, investors start buying up longer term bonds. The logic behind this is that recessions last an average of 18 months and therefore investors can at least theoretically guarantee an income over that period.

Does an inverted 2 year and 10 year spread guarantee a recession? The answer is no because the yield has inverted twice without it between followed by a recession.

HOWEVER!

Although most investors continuously watch the 2 and 10 spread, they often overlook the spread between the 3 month and the 10 year bonds.

Unlike the 2-10 spread which has been wrong twice, a 3 month and 10 year inversion has NEVER been wrong so far. All 7 of the recessions in the US since 1970 (up through 2018) have been preceded by an inverted yield curve (10-year vs 3-month).

Over the same time frame, every occurrence of an inverted yield curve has been followed by recession as declared by the NBER business cycle dating committee. This statistic is important because the 3 month and 10 year yield has already been inverted since March of 2019.

Although nothing is ever for certain in the world of finance, the odds don’t look too promising. Bull markets can’t last forever, they never have and they never will. The fact that we are seeing rate cuts and quantitative easing this late into an expansion cycle doesn’t exactly scream that the economy is strong.

With historical lag times of 8-18 months from inversion to the beginning of recessions, investors should enter 2020/2021 with extreme caution.

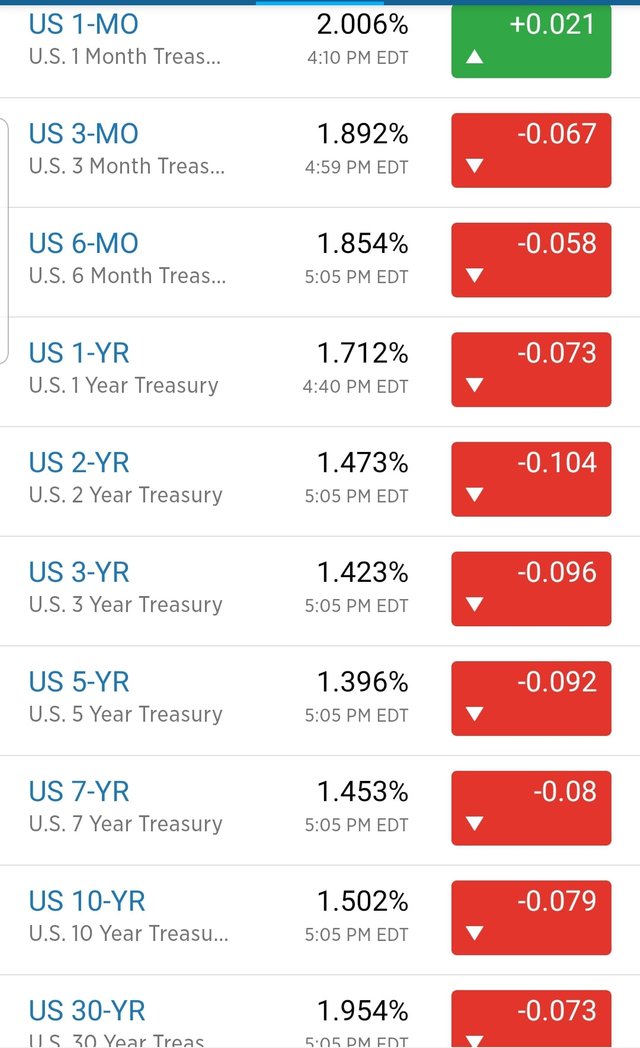

Here are the US treasury yields as of August 15, 2019. 10 year bonds inverted the 2 year on August 14th. (they are not inverted at the current moment but that can change at any time). The 30 year has also inverted the 1 month. We can expect more inversions to occur as time goes on.