On Days Like Today, It Pays to Be a Boglehead

In the aftermath of a near 3% collapse in world stock markets yesterday, we felt it was appropriate to revisit this oldie but goodie that was originally published here. Those that were holding individual positions yesterday had a high likelihood of getting wrecked. Those invested in index funds felt a little bit less of the sting. And for that the industry has only one man to thank. This retrospective is what we wrote when that man ceased accumulating earlier this year. Of course, that man is

John Bogle

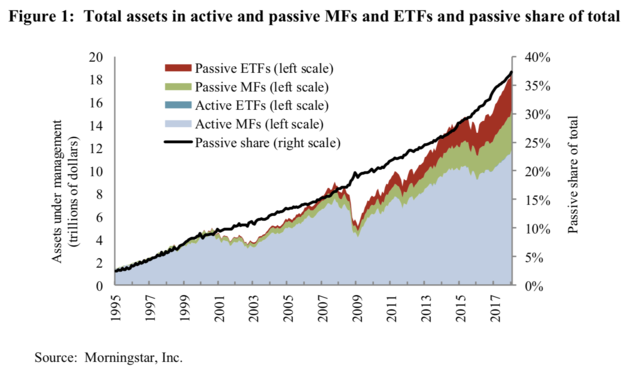

The Boston Fed released a report in August 2018 that noted, by the end of 2017, that 37% of all retail fund investment in the United States was in passive investing strategies, representing more than $18 trillion of wealth. That figure was up from a scant 3% in 1995. On January 16, 2019, the man that singlehandedly created this gargantuan, and still growing, part of the financial services industry received his last promotion.

Those of us in the financial services industry like at Konstellation and DarcMatter know that Bogle forever shaped the financial services landscape. We will therefore forever be in his debt. It is a rare species of man on Wall Street that is commended by Nobel laureates for changing “a basic industry in the optimal direction.”

Mr. Bogle Revolutionized the Fund Management Industry

John C. Bogle passed away peacefully at his home in Bryn Mawr, Pennsylvania. Generations of middle-class investors and a whole host of fintech startups like Robinhood and Konstellation owe him a debt of gratitude. He dedicated his life to reducing the fees charged by Wall Street and returning them to the people who truly need it.

Sixty-seven years ago, back in 1951, John C. Bogle looked at the investment fund landscape that faced him as a college student at Princeton and asked a simple question: How could he bring the most value to everyday investors? At the time, the mutual fund industry was just beginning. Fees were high. Investor access was low.

His senior thesis was based on the basic premise that, in the long run, active investment managers do not beat the benchmark that they are given by which to measure their investing success. He reasoned that investors would therefore be better off investing in a broad basket of stocks that replicated the returns of the stock market overall. Prominent industry pioneer Wellington Fund hired him “largely as a result of his thesis.”

It was a startlingly simple concept that the entire industry initially balked at. “You can’t make money without charging exorbitant fees,” they said. “You won’t even be able to keep the lights on for a year,” they warned. It even took his mentors at Wellington 25 years, and a failed merger spearheaded by Bogle that led to his dismissal, to even support the strategy.

He persevered.

He was proven right.

Today, the exact number is certainly debated, but most people agree that between 80% and 98% of active fund managers fail to beat the market rate of return over the long term. Vanguard, the firm he founded in 1976, has become very successful as a result of his intuition. They now have almost $5 trillion in assets under management (AUM) and retain more than a quarter market share in the passive investing industry. Their flagship product, based on the S&P 500 index, is an industry standard that is widely copied by Vanguard’s competitors.

As a 21-year-old in an age without Big Data and massive computer processing power, somehow Mr. Bogle discerned this simple truth and recognized it as a massive opportunity. Today, it’s easy to pull up some returns data on a Bloomberg terminal and quickly build an investment thesis backed by all sorts of fancy graphs and pie charts. But to do that in the 1950’s is absolutely incredible.

Six decades later, the fund that hired Bogle right out of school is still reaping the rewards of making the prescient decision to hire him. Though the investment management company, Vanguard, that Bogle founded in 1976 dwarfs his former firm, Wellington receives about a third of its AUM from a legacy agreement with Vanguard.

What started as a senior thesis became a very profitable revolution for Bogle.

Bogle Philosophy Is As Important Today As Ever

DarcMatter and Konstellation were founded on fundamental principles similar to Bogle. As such, we kind of feel an intellectual kinship. Our platform and Konstellation Network ecosystem both aim to provide increased access to more investors in a transparent and efficient manner. In this millennium, we believe that having access to alternative investments can provide potentially life-changing investments to those investors willing to put in the time and effort to find them.

Our job is to make that process easier.

In Bogle’s time, he correctly believed that “the most fundamental decision of investing is asset allocation.” He often repeated the trope that 94% of the differences in total returns achieved by fund managers had to do with this most basic decision. When he started his crusade, he aimed to simplify investment for the masses.

He wanted them to have to make only one decision:

What was the ratio investors should hold between cash, stocks, and bonds?

In today’s financial services landscape, according to KPMG and others, we must add a fourth category to this essential asset allocation strategy — alternative investments. Although passive investment strategies currently do not provide adequate exposure to this asset class, DarcMatter believes that driving the costs down for investing in alternatives by creating a robust blockchain-based ecosystem that supports alternatives is an important first step.

Implications for the Future of Investment

Bogle was known as a perpetual source of quotable quotes. But we will leave you with what we believe is the most relevant one.

“In investing, you get what you don’t pay for. Costs matter. So intelligent investors… will stay the course.” — John C. Bogle

Bogle’s career proved that effective investing can be attained with resolve, grit, and a long-term, diversified strategy. As financial markets are increasingly marked by volatile price action, sufficient diversification across all asset classes becomes more and more critical to long-term investment success. Stable income streams and proven alpha-generating strategies can provide investors with much sought-after uncorrelated returns, so long as they are willing to stay the course.

In concert with Bogle’s ideas, the DarcMatter platform provides investors with the opportunity to both align with and reflect Bogle’s long-term investing values in a space that was previously inaccessible to the average investor. As we continue to evolve and solidify ourselves as a global fintech service provider, we are certain that we are also here to stay the course.

Godspeed John Clifton Bogle. Your career will always serve as inspiration to those of us at DARC as we continue on our own journey to bring more potentially life-changing investment opportunities to the common investor.

If you are interested in DARC tokens, they are trading now at exrates and P2PB2B exchanges.

Please follow our social media:

Congratulations @darc! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

You can view your badges on your Steem Board and compare to others on the Steem Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPVote for @Steemitboard as a witness to get one more award and increased upvotes!

@darc, thank you for supporting @steemitboard as a witness.

Click on the badge to view your Board of Honor.

Once again, thanks for your support!

You got a 1.72% upvote from @minnowvotes courtesy of @darc!