3rd/4th day of KuMex simulated trading!

Well... today and yesterday were characterised by some pretty sluggish and flat trading... especially in comparison to the frantic rushes of the days before. In these periods, it is best to play it even safer than before... as you don't want to be caught holding a large bag when a move suddenly breaks out... and it can all be too easy to think you are fine trading back and forth between a narrow range... and buy up too many shorts/longs and be on the wrong direction of a swing with the only option to sell up at a large loss...

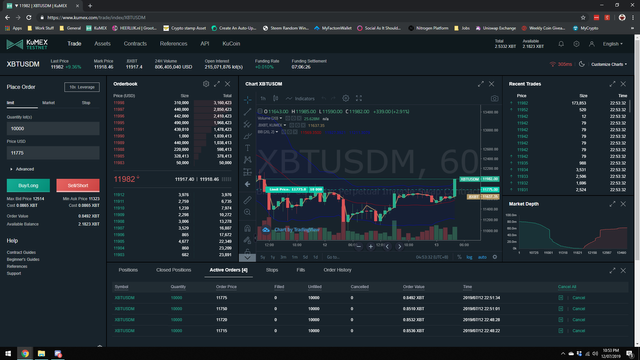

So, with that in mind... I set my stop triggers to try and catch the unwary... and had my spreads constant keeping at least 50 USD back, close enough to catch the large market order or forced liquidation... but far enough to give me time to cancel them quickly if there was a move. However, I was cancelling them more often than I would otherwise... again, the object of these sessions was not MAKE money... but avoid LOSING money.

With the large walls, it is tempting to try and break them... however, you find that you will be incurring taker fees, and possibly be left with no-one to buy the large bag that you've had to hold to break the walls. This means that you are in an incredibly risky situation of an extended position with a starting loss in Realised PNL. Not a great position to be in.... best to let the brave chip at the walls... and maybe collect a small nibble when you are sure that it will go down.

That said... I achieved my objective of not losing BTC and even collecting a small gain. Although, I have to say that most of that small gain was down to sheer dumb luck...

Overnight, I had cancelled my active limit orders... but I stupidly forget to cancel my stop-limit orders that I use as traps for the over-extended.... and of course, overnight... one of my longs had triggered as the price dropped... and kept falling! That meant that I was holding a decent sized bag overnight as the price was down below my entry long price. However, that did mean that I collected several rounds of funding (plus the maker fee), but when I woke up in the morning... I was faced with the choice to sell at a loss, or risk further drops.

Like any other person, I first looked at it and my heart dropped... it was a decent potential paper loss, but not that bad... I wasn't in danger of being liquidated and even if I took the loss as it was, I would still be in overall profit. So, I went to eat breakfast and have a shower... when I came back to it, the price had spiked up above my entry position (not much, but above)! So, not wanting to tempt fate, I immediately closed the position. Taking a small profit, plus the maker fees, plus the overnight funding rounds. HEH Stupid luck FTW!

So, I'm tracking well on the leaderboard, not the top by decently in the top 100. I'm hoping that others will get greedy and get hammered... something that I have to also keep a watch for, for myself!

For a quick post on how to join the KuMex simulated trading (10,000 KCS for ranked traders at the end of the first week) or a chance for a share of 100,000 EUR from the Binance Europe on-ramp read my earlier post here!

Not into reading and stopped listening at the prospect of "FREE" tokens/cash, here are the relevant links!

Kucoin account required for KuMex.

Complete KYC at Binance Jersey

... reading is better!

Coin Tracking

Looking for a quick and easy way to keep track of your cryptocurrencies? Coin Tracking offers a free service that includes manual tracking or automatic tracking via APIs to exchanges, allowing you to easily track and declare your cryptocurrencies for taxation reports. Coin Tracking can easily prepare tax information sheets that are catered to each countries individual taxation requirements (capital gains, asset taxation, FIFO). Best to declare legally and not be caught out when your crypto moons and you are faced with an unexpected taxation bill (unless you are hyper secure and never attach any crypto with traceable personal information, good luck with that!).

Keep Your Crypto Holdings Safe with Ledger

Ledger is one of the leading providers of hardware wallets with the Ledger Nano S being one of the most popular choices for protecting your crypto currencies. Leaving your holdings on a crypto exchange means that you don’t actually own the digital assets, instead you are given an IOU that may or may not be honoured when you call upon it. Software and web based wallets have their weakness in your own personal online security, with your private keys being vulnerable in transit or whilst being stored upon your computer. Paper wallets are incredibly tiresome and still vulnerable to digital attacks (in transit) and are also open to real world attacks (such as theft/photography).

Supporting a wide range of top tokens and coins, the Ledger hardware wallet ensures that your private keys are secure and not exposed to either real world or digital actors. Finding a happy medium of security and usability, Ledger is the leading company in providing safe and secure access to your tokenised future!

Account banner by jimramones

.gif)

I know that heart dropping feeling of waking up in the morning and seeing the bottom dropped out of your plans.

Lol, especially when they weren't plans but an oversight in forgetting to clean up properly!

Nice to hear you're still at it there on KUcoin @bengy, keep up the defensive strategy.