Steemit Crypto Academy CONNECTION BETWEEN "INTEREST RATE AND CRYPTO"

CONNECTION BETWEEN "INTEREST RATE AND CRYPTO"

Introduction:

Cryptocurrency, once a niche digital asset, has gained significant attention and adoption in recent years. Simultaneously, traditional financial markets are closely influenced by central banks' interest rate policies. But is there a connection between these two seemingly disparate worlds? In this post, we will delve into the relationship between interest rates and cryptocurrency, using flowcharts and diagrams to illustrate key concepts.

Overview of the Interest Rate-Crypto Connection

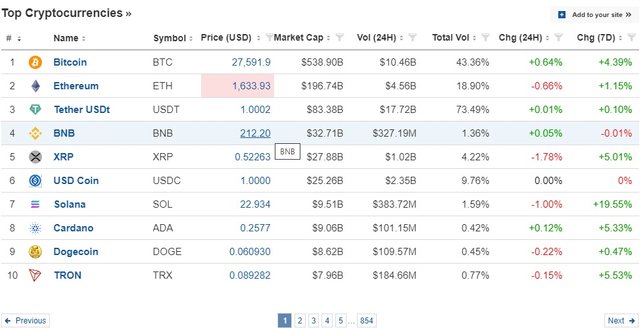

Source: Federal Reserve Bank of St. Louis

This flowchart provides an overview of the key elements in the relationship between interest rates and cryptocurrency. It starts with central banks' decisions on interest rates and branches into various pathways that affect the crypto market.

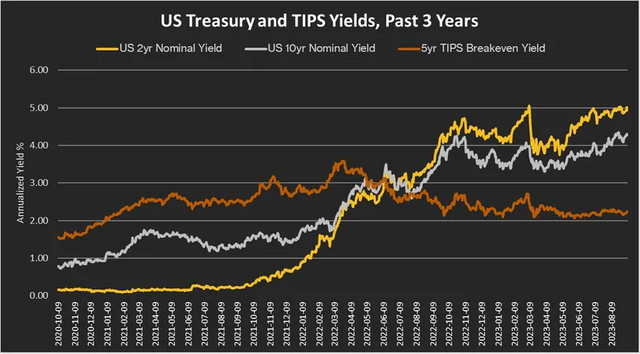

Higher rates and recession fears losing effect on the market

While the Fed has already raised rates eleven times during this tightening cycle, it’s easy to spot when markets really sat up and took notice that the central bank wasn’t kidding that it was about to recalibrate monetary policy. It was November 2021 when cryptocurrency and many of the riskiest stocks peaked.

Interest Rate Changes and Their Impact on Crypto Prices

Yield Farming and DeFi

What is Yield Farming?

Yield farming is a way for cryptocurrency investors to earn rewards by providing a decentralized finance (DeFi) platform with liquidity. Depending on the platform protocol, rewards can either be financial or non-financial.

Diversify across cryptocurrencies

Add large-cap or small-cap cryptocurrencies.

If you own mostly Bitcoin, consider investing in emerging cryptocurrencies. If you own only small-caps, perhaps add Bitcoin or another large-cap token to your portfolio.

Buy different types of tokens. Your portfolio can expand to include stablecoins, utility tokens, governance tokens, and other coin types.

Diversify across sectors. A diversified crypto portfolio may include tokens that span industry sectors such as gaming, file storage, environmental protection, and finance.

Expand across geographies. You can grow your crypto portfolio to include tokens that are primarily used within specific geographic regions.

Invest in different blockchain protocols. A diversified crypto portfolio may include coins that use different consensus mechanisms such as proof-of-work and proof-of-stake.

Support DeFi projects. Investors interested in the democratization of money may choose to own digital tokens associated with one or more decentralized finance projects.

Invest in blockchain scaling solutions. Those aware of the challenges that can arise from crypto network congestion may be inspired to buy the digital tokens of a blockchain scaling solution.

Conclusion:

The relationship between interest rates and cryptocurrency is complex and multifaceted. Central bank policies, institutional adoption, inflation, and investment strategies all contribute to this connection. As interest rates continue to play a pivotal role in global financial markets, understanding their impact on the crypto market becomes increasingly crucial for investors and enthusiasts alike.

#burnsteem25 #academysummary-s12w4 #cryptoacademy-s12w4 #summary #steemexclusive #club75 #club100