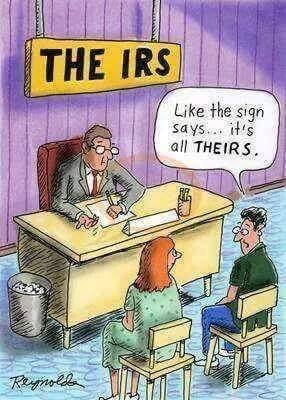

The two dreaded words...Income Tax

The Truth about Income Tax and Crypto In America..

I have been involved with crytpo and steemit for almost 1 year and although this absolutely does not qualify me as an expert I have been blessed to be surround by the smartest and most caring people on the planet involved in steemit and the discord. I have been putting my thinking cap on just trying to think about the best way to handle my own tax situation regarding rewards and income in dealing with crypto. I have yet to pull money out (not that this matters in the eyes of the IRS) so it's only speculation on how I would actually begin to start. The most important thing I am personally going to be doing is once I adapt a system for myself with reporting earnings I will be using a continuous method and not deviate from this once I begin reporting earning.

Most of this is not even going to be questioned and from my experience this is the case. I just like to sleep at night and I feel that once I adapt a system of reporting and stick with it than I will be able to sleep just fine. The IRS can always find a way to call you out and that's why I have always looked at a tax filing as nothing more than an offer. Audits to me are like a counter off and while not having your offer accepted can be unsettling there have been many times where my clients have been better off after the audit than before. Counter offers are part of this game.

I have an office located in California and have been in the tax business my whole life, I worked with my Dad who started his tax practice in 1968 and when I branched off in 2005 I really found where my skills were most useful and that's listening and working hard for my clients to get the best possible outcome for their particular situation, and believe me the range of issues I have dealt with are vast and I continue to learn on a daily basis. I have learned a lot from my clients as well because I like to think that I am working with you and not for you. When you are up at night worrying, I am too.

I had a really great conversation with @aggroed tonight on @msp-waves and never even really thought about combining my tax practise with the steemit community until he mentioned it. I liked his idea of basing my fees on current steem price and while the broadcast was going on @scaredycatguide was mentioning his current fee for tax preperation and how his accountant was unwilling to accept steem and it really made me think. The only person I have ever helped on steemit with taxes I did for no charge and felt good about it, this is a community and a movement worth investing in and I look at my time as an investment as much as my money. There are so many amazing people giving their time to this movement and it makes me think that by holding back my profession it holds back the movement. Isn't this what this platform is really about? Adding value? Giving the best we have in us to the further good of the community. This is how I see it and how I have made my way to discord to network with the most committed steemians in the community.

I don't claim to have all the answers but do feel that by opeining my mouth and offering my services this will also attract other American tax preparers to open up the topic of how we are going to handle the tax implications. I have felt since January 2018 that if there is a general consensus how we as a community think we should be treated regarding taxes that if we make a stand and stick together we will be stronger united than divided. This is what the IRS wants. They are wolves hunting for the lost sheep in the pack and will likely stalk and kill.

I really want to thank @aggroed for the inspiring talk we had tonight on @msp-waves and really look forward to further conversations on the subject as well as hopefully meeting in Poland for the Steemfest 2018 like we talked about. First drink is on me Aggy and I really enjoyed our talk and appreciate all you do for Steemit as a witness #8 and for discords that help everyone so much. Thanks for your support and please visit my discord to talk further on this topic, I welcome a conversation and open dialog among professionals and tax filers as well, reach out to me on my discord with the provided links or engage in the comments. Thank you.

@Vladivostok

Nice to meet Vladivostok on the radio station last night. Good to have some folks with off chain skills. Some folks could use this help and here's a contact for them to do their own due diligence and see if it's a good fit. Glad to have you here bud!

Nice to meet you too Aggy...I have a good time for sure. Appreciate the encouragement about getting a conversation going regarding a subject nobody really wants to talk about but at the same time we are anxiously thinking about and hoping it's not going to be as bad as we think. First way to be un-afraid of the monster in the closet is to open the closet door. This is what I hoped to accomplish in writing this post. Due diligence is going to be the main concern and finding out the correct way to appease the monster now that he is out of the closet ( not in a gay way, not that there is anything wrong with that).. We need to work as a community on Steemit for us all to succeed and I don't think we should be slaying monsters alone either. I am glad to be here and happy to be having this conversation with you. Appreciate your hard work and dedication to building the steemit platform, You are an asset to this platform as witness #8 and I look forward to more conversations.

The money suit is....well, money! When I was playing a lot of poker my best buddy was searching for one of those suits because I said I'd wear it at the poker table if you found one! lol.

Anyway, taxes are certainly something most people need help with (especially related to crypto) so you can definitely do alot of good here.

haha, I love this suit...I wore it out to the ballet with my wife, she told me to wear a suit so I did :) You should have seen people's reaction. Priceless.

The more I start thinking details with taxable events on Steemit is makes me a bit anxious due to the IRC rulings and the gray areas that have been created mostly. Looking for like minded people to exchange ideas to hopefully come to some conclusions on how these grey areas should be treated, It's pretty tricky when you really think about it.

@vladivostok I'm sorry I missed the show. I agree with both @aggroed and @scaredycatguide. This is a topic that steemit could really benefit by having it explained and or services offered because there's a void here around this. Could def be of value. Crypto taxes. They were intentionally targeted to be ultra complicated in December 2017. Like a thief in the night is the saying that comes to mind. You showed me some of your mathematical doodles and I remember also saying posting about that would be valuable to steemians. Truth is, many people are not good with numbers. Accounting and taxes is complicated even without bringing crypto into it.

Btw, should you decide to want to offer tax services on steemit, there's a discord you should join if you haven't, which I can get u a link too. Its specific to people offering services. It's called looking for niche.

Really great post Vlad. Resteemed

I am sorry you missed the show, it was a lot of fun and very interesting that @aggroed and you are on the same page with getting this conversation started. It would be nice to create a tool, there probably already is one....That would at least show earnings and basis, if any. What someone decides to do with this information is a whole other can of worms, but knowing would be nice. I will join the discord you mentioned and look forward to learning and sharing the knowledge we come up with here. It's really important I think.

In theory it would not be considered income until you turn it into a currency that you can use to buy goods and services. Would it not work the same as when you exchange services for services. Would the value of the service be what is considered the monetary value of the currency? So this would be true if you use virtual coin to buy something and that person accepts that payment. It would not be considered until you spend it. Just a thought.

I think that's how crypto was handled prior to tax yr 2017. In December of 2017 the tax reform that was pushed through in America slid in changes to that effectively, potentially making every single transaction taxable. With steemit this is very very difficult because if you upvote, thats a taxable event. Get curation rewards? Taxable event. Exchange sbd for steem. Taxable. Power up, taxable. They changed it in such a way that it's very broad, and vague, and there's no telling how they are actually going to approach it or enforce it, but that there's enough vagueness to leave it open for them to enforce it however they want.

this is exactly correct @phedizzle, tax reform has changed the game for sure. Its not viewed as currency but as property.... They have absolutely created some difficulties for this platform, once we moved from bitcoin into other alt coins the IRS has realized they needed to make changes to at least give us enough rope to hang ourselves, I don't know how much rope yet. Thanks for your two cents here, This is really the conversation here and you nailed it, Now, what to do about it?

We will have to see how this all turns out when it is time to do taxes this year. Maybe they will add an extra form where you need to declare what you started the year with, what you collected and what you spent.

basis will for sure be part of the calculations :)

I am not a tax expert but my experience is that if you report profits, they will tax them without asking too many questions.

The problem could be if you report losses, you'll have to fight to have them recognized.

Good luck will be needed here :-)

IRS doesn't always have all the facts going into an audit, they require the taxpayer to provide information you would think they already have sometimes. I don't think it's just losses that trigger audits. I hope to get a lot of smart minds together and formulate a plan of the best tactic to start and continue with, this is the most important thing IMO. I will take

all the good luck you're willing to give, feel free to stop by the discord to stay in the loop, would love to have you.

dont declare anything! fuck em!

while I see this as what many people will be doing and I can certainly understand this perspective but would like to know exactly how the IRS would like me to handle this and find a comfortable place between fuck them and compliant. :)

in all seriousness you could just deregister yourself, go to spain and register there, and suddenly your just a tourist in your own country :) Im not here on buisness officer, i live in spain, im just on holiday each time im in the usa :)

this is true, things are getting out of hand for the irs. not exactly sure what they are doing, never really can be sure. Just makes me wonder if they have people even half as smart as the witnesses and coders working here, making tools to follow the money would be pretty easy. On steemworld it already shows the earnings and that's all the ammo the devil needs to start asking questions. This is what's on my mind

im just lucky to have vanished so to speak from the fulltime radar but i blog to show that anyone can do it!

all my cash if im asked is from donations on the street :)

This is another consideration, figuring out how to treat the blogging as a profession and possible enabling an alternate tax treatment for the income and at which point it is taxed. So much gray area, this was on purpose.

if they are going to make us pay taxes on it are they also going to accept it as a currency? As a payment or are they going to make us transfer it?

Go self-employed!

Thought provoking article and hopefully the tax community will be proactive. I think it is a difficult subject - but ignoring the matter does not mean answers magically appear.

It will remain difficult to determine capital gains.

I have spent a little time thinking about this. I believe one route could be via regulated exchanges which provide members annual data. What do you think about this?

Wish I could have participated in the radio show.

I think anytime the data is provided for you it's great. Covered securities provide cost basis and gross proceeds on a 1099B and this is very helpful, they do not provide basis on non covered securities and this allows a like wriggle room, there is a lot of wriggle room with crypto in general, but the reward on steemit does make me a little anxious I will admit. I have the feeling that most steemians that had a print out of what was required to be reported would ignore it, so I don't really know what to think in this moment, I have been thinking deeply about it since November 2017 and still I have not yet made any personal conclusions. Hopefully more discussions and tools can be discovered.

The famous quote goes - "In this world nothing can be said to be certain, except death and taxes." It's quite worrying that for many of us, taxes are way too confusing and feel like death is more straightforward/simple.

this is very true, death and taxes...ugh.

I realized I am going to have to come up with something that will work for me personally and

many others I think are bothered by it to the point where they will just do nothing. I am not too sure myself what to do.

Awesome, I was actually thinking of making a post to try and see if I could find any actual tax professionals to weigh in on this question but I didn't because I assumed I would get a bunch of anarchists being like "the government can't tax crypto man!" when we all know that is untrue. Followed.

I remember when I first joined here there was a user call "the taxman" or something like this! what a wanker how dare he!

maybe he was a Beetles fan.

im going to see if he still exists on here , just to be curious what happened to him hahahaha

I would like to group up with some tax pros here too so we can exchange ideas and concept. I would like to at least begin the conversation...

Its so easy to just ignore it because let's face it, It hurts to even think about.

that's an excellent idea, perhaps a #taxpro tag and a discord and whatever else by the same name, I bet it would be pretty popular by April.

I dont lnow when this tax cycle will come to an end. We have to pay taxes everywhere :( I dont find it a good idea to pay taxes for crypto currency, even some countries might take such steps sooner or later.

Well I am not a tax expert, but thats my opinion :)

if we had our choice we would not pay. we don't have our own choice in America, tax avoidance is not illegal but tax evasion is. Best of luck to you