Where do 'Fallen Angels' Dwell? MCD #2

Manual Curation Digest #2

“More money has been lost reaching for Yield

than at the point of a gun.” — Raymond DeVoe, Jr

(source)

Steemit: 'Fallen Angels' in "Diabolical Ecosystem"

After my previous post dedicated to  Steem Power

Steem Power  , I have been reading more on the matter. Apparently I am not the only one who is interested in it, there are a lot of people who post and discuss this at great length, with quite a lot of debates ongoing.

, I have been reading more on the matter. Apparently I am not the only one who is interested in it, there are a lot of people who post and discuss this at great length, with quite a lot of debates ongoing.

Particularly here is one such related discussion (with over 300 comments, few by Ned too) worth reading: Why I Advise Against Linear Reward. some interesting points made there, one is by @knircky has got my attention:

The hardest thing to do for a cryptocurrency is to distribute its supply among many users in a fair way that generates value... Out of a million users not even 300 reallly matter and if we had 10 million more that won't actually change...

So since the problem we have right now is that SP is too concentrated among few users. I mean 0.1% hold all the relevant SP. If we have nonlinear distribution than those %0.1 just get even more power than they already hold...The reason why content is not rewarded right now is because we have not actually built a platform for content...

If we want to reward content we need to build on having a system that focus more on content discovery and rewarding good content. Simply making distribution less fair is not going to turn this platform in a content platform... so that more coins get distributed among users that create great content...

This corresponds with my own thoughts and conclusions, which I have expressed more than once already: that it is System which is made that way! that it is NOT focused on rewarding for discovery (curation) and creation of GOOD Content. actually perhaps Content doesn't even matter at all. more like it is just some tool or "factor of interest" to keep people Engaged in ... this ROI or HYIP-like GAME! 😄

Author of that post (who is himself a Witness), @teamsteem, answers to him:

The current model advantages the selfish while disadvantaging the selfless. The selfish SP owners will self-upvote as much as possible while the selfless upvote will see their ROI/influence/wealth diminish at the expense of the selfish.

That's right! they are simply being pragmatic and Profit focused. this is just more profitable to do and thus logical. but again: because it is System which is made that way AND encourages, facilitates, motivates and rewards more those who act in that way! It's main or primary objective is: to motivate people to HOLD their STEEM coins Invested into platform for as long as possible - which is done in form of Steem Power.

This concentration of Steem Power on global scale (i.e. in Total across Steemit) achieved through its concentration on personal accounts. But how to convince those Big SP Holders to do so and keep accumulating MORE of it, i.e. Re-Invest? ONLY by giving them MORE rewards! Otherwise why would they keep their Capital Locked-up so? They could for example Trade it on Exchanges and perhaps get much better returns. Therefore the rewards given to them by Steemit (which is sort of a Bank of SP) by logic MUST be lucrative enough to keep them interested and motivated so.

Here is the main thought: that SP Influence which gives to Big Stakeholders higher rewards proportionally to their Stakes size (aka "1 STEEM, 1 vote") is that very mechanism which keeps them motivated and interested enough to continue Stake their Liquid STEEM coins within the System for Longer periods of time. Perhaps can fairly consider it as that "Price Stabilization mechanism" of STEEM Crypto-currency itself.

So, this SP, although not fiat, not Crypto, but rather like some Ephemeral mysterious UNDEFINED clearly thingy (aka "Access Token") - is some sort of an IOU or perhaps rather like a Corporate Bond! (or may be in some sense similar to an Insurance Bond)

To be more precise, it is more like "High-yield Bonds", which "have a higher risk of default or other adverse credit events, but typically pay higher yields than better quality bonds in order to make them attractive to investors...".

IMO comparison to such HYBs does make sense! That's why I have always tried to compare Steemit to HYIPs - which are also High Yield Investment Programs, but also High Risk investments - usually or mostly short-term.

From explanation given in this last quote can surmise that such Higher Yield Corporate Bond is an instrument ("fishing lure" / "fishing bait") to keep all those Investors Attracted and Enchanted by lucrative Interests (especially Compound) and overcome their concern of the Risks involved, which are quite many actually. But all these Corporate Bonds ARE quite Risky indeed: "Compared to government bonds, corporate bonds generally have a higher risk of default"

So, people who Invest / Stake their Capital in such High Yield Investment Platforms do realize those Risks and always aware of them astutely, especially those who are Big Stakeholders. Therefore common and natural thing for such players would be ... Short-Term positions to somehow minimize that Risk. To convince them to stay longer and keep Re-Investing can be done only by providing them BETTER incentives / rewards! proportionally to their Stakes or "Influence", which is MEASURED in ... Steem Power! That's why it is briefly defined in Steemit FAQ as "measurement". while in STEEM Whitepaper it is also defined as "Access Token", because it provides Stakeholders to MORE Influence in proportion to the Size of their SP! here it is said so in Whitepaper:

Existing platforms operate on a one-user, one-vote principle...

Steem operates on the basis of one-STEEM, one-vote. Under this model, individuals who have contributed the most to the platform, as measured by their account balance, have the most influence over how contributions are scored. Furthermore, Steem only allows members to vote with STEEM when it is committed to a vesting schedule...

In other words, the More STEEM coins one has INVESTED into the platform - the more Votes he has (= how many time he may Earn per day as well as how much to Earn per each act of Voting). It is made pretty clear that these STEEM coins MUST be INVESTED. More than that: not just simply invested, but in a LONG-term commitment, i.e. "Powered Up" or converted into Steem Power. That SP is actually what ensures at least 13 weeks of "vesting schedule commitment". Otherwise if one just decides to simply keep Liquid STEEM in his account balance, NOT Invested aka "Powered Up" (= Commited) - then that STEEM doesn't count and doesn't give rewards.

reading furthermore:

In general, there are two items a community can offer to attract capital: Debt and Ownership... Vesting ownership makes a long-term commitment and cannot be sold for a minimum period of time. Liquid ownership requires no long-term commitment and can be sold at anytime...

Steem wants to build a community that is mostly owned and entirely controlled by those with a long-term perspective...

When users vote on content, their influence over the distribution of the rewards pool is directly proportional to the amount of SP that they have. Users with more SP have more influence on the distribution of rewards.

This means that SP is an access token that grants its holders exclusive powers within the Steem platform...

I've got Steem Power!

I've got Steem Power!

Therefore people are MOTIVATED to hold their STEEM Staked into this Investment Platform by those BIGGER incentives, proportional to size of their Stakes. Why? because this kind of a Corporate Bond (and Steemit IS a Corporation) is High Yield but also High Risk asset which normally discourages or averts Investors from Long-Term Capital Commitments. and the only way to convince them otherwise is by yet Higher incentives, which are Measured in "Vests" (and for laymen it is translated in SP).

This whole Investment Platform is made in such a way and focused so: to ensure Long-Term Capital Commitment. For that purpose it rewards more NOT for Content Generation, Discovery, Quality-focused Curation etc. but for BIGGER Stakes and for their LONGER Commitments (i.e. investments). That's why it encourages, motivates, incentivizes and rewards for THAT behavior which HELPS the System to ensure their LONG term Capital Commitment. Since the ONLY way to keep them interested enough to do that is by giving them MORE rewards (thus all the ongoing never ending TALKS about Curation / Authorship rewards) or ... otherwise more opportunities and facilities to get MORE of those Profits by their own actions! which is accomplished through all that "vote-farming", selling their votes to bots and whatever higher bidders, Self-Voting, etc.

SYSTEM is MADE that way and it MOTIVATES them so for its own survival! as plainly stated so in Whitepaper:

Under this model, members have a financial incentive to vote in a way that maximizes the long-term value of their STEEM...

ONLY Maximizing of Profits can convince Stakeholders to Invest More and for Longer terms! and if it is achieved through Bots, Self-Voting, "don't-give-a-flying-F-to-Content" attitude - then SO BE IT! Thus no any number of TALKS and debates and whatever other "Playing in Democracy Games" (i.e. "Vote for Witnesses", who then will "Vote for Change" among themselves, yeah!) are gonna change THAT! Although it certainly does keep the public excited, interested, "Engaged" too. Oh, and BTW, we must not forget to mention: it also helps to "Create More Content", hey! which is about all those talks and debates (eg. as this my post) 😄

which in turn enables more of so called "Curation" of that such "Content" related to those Debates. as well as keeps public Distracted from the doubts and too much worries about Risk of their Capital Investment into such High Yield Corporate Bonds and thus helps to Prolong those Investments.

Whatever it takes to preserve this "Model" (aka "Diabolical Ecosystem") of de facto High Yield Corporate Bonds, which in NORMAL serious professional Economy and Finance are considered as Junk Bonds (aka Non-Investment-Grade Bond, Speculative-grade bond) due to Higher Risks and therefore "rated below investment grade bonds" (aka High Grade or IG).

Junk Bonds, also known as high-yield bonds, are bonds that are rated below investment grade... Junk bonds carry a higher risk of default than other bonds, but they pay higher returns to make them attractive to investors...

When you buy a junk bond, you are typically Lending to the issuer in exchange for periodic interest payments...Junk bonds have a higher likelihood of default than other types of bonds. In the event that a company defaults, junk bondholders are at risk of losing 100% of their initial investment

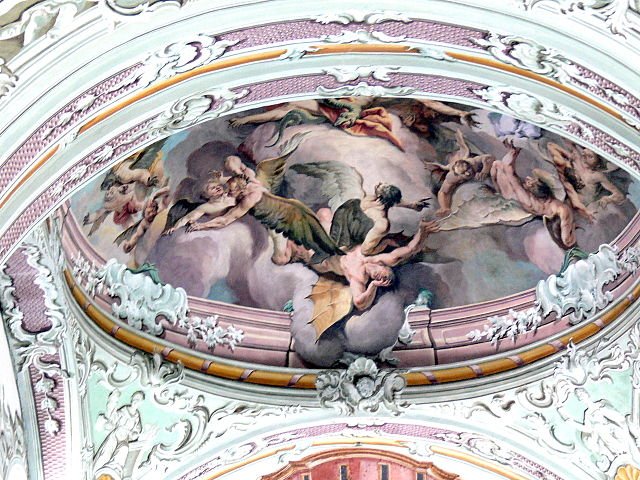

Alternatively known as "Fallen Angel Bonds"...

What is a 'Fallen Angel'

“A fallen angel is a bond that was given an investment-grade rating but has since been reduced to junk bond status due to the weakening financial condition of the issuer...”

(source)

You got voted by @curationkiwi thanks to BitConnector! This bot is managed by Kiwibot and run by Rishi556, you can check both of them out there. To receive maximum rewards, you must be a member of KiwiBot. To receive free upvotes for yourself (even if you are not a member) you can join the KiwiBot Discord linked here and use the command !upvote (post name) in #curationkiwi.