How Abra Smart Contracts work

Get $25 free in bitcoin by Signing Up Here

Abra recently announced they are allowing users to buy stocks and ETF's with BITCOIN!

That sounds crazy!! How are they able to do this??

They use something called Collateralized contracts that are similar to Smart Contracts. Abra then hedges away their risk to ensure they have the funds to give you your gains.

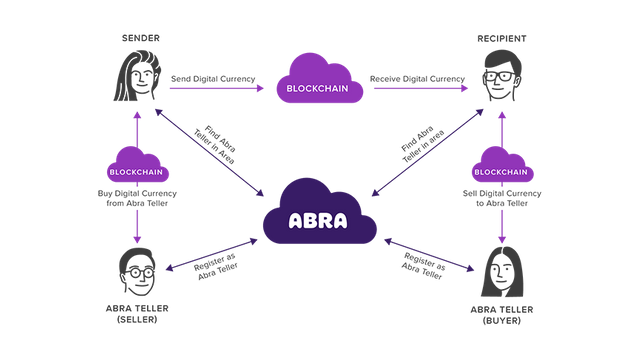

Here's how it works straight from them:

How are we able to do this?

The Abra app already offers 80 different assets for investing — 50 fiat currencies and 30 crypto currencies. We have extended the same crypto collateralized contract model that we use for these assets to work with traditional assets such as stocks and commodities. This is a huge breakthrough and a first of its kind application for cryptocurrencies.

We believe this technology is one of the best applications of crypto and could be the ultimate on-ramp to get a billion people into crypto without them even knowing that they’re using it!

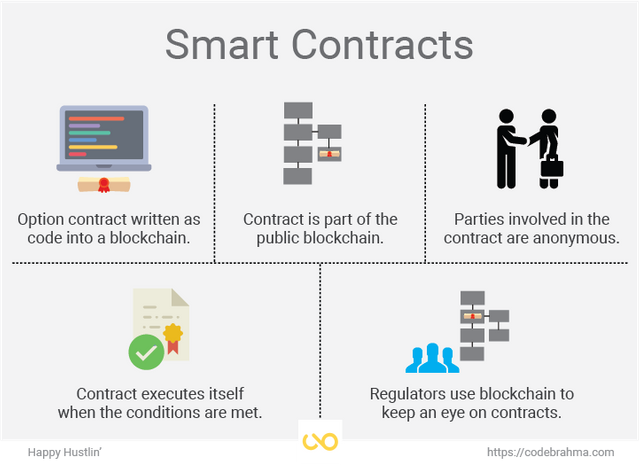

So what are these crypto collateralized contracts?

Crypto-collateralized contracts (C3) allow an investor to easily gain investment exposure to any asset, such as a stock, bond, another cryptocurrency, etc., by simply using bitcoin as the underlying technology for the investment. In other words, if you want to invest $1,000 in Apple shares you will place $1,000 worth of bitcoin into a contract. As the price of Apple goes up or down versus the dollar, bitcoin will be added to or subtracted from your contract. When you settle the contract — or sell the Apple investment — the value of the Apple shares will be reflected in bitcoin in your wallet which can easily be converted back to dollars, or any other asset for that matter.

When you enter into a C3 , you’re effectively creating a smart contract which automatically determines — based on the price of the Apple shares — whether you have made money or lost money. The underlying bitcoin collateral then adjusts itself accordingly to be equal to the value of the Apple shares.

That begs the question, “If the value of the underlying bitcoin collateral adjusts itself who is taking the risk on these contracts when the price of Apple goes up?” Simply put, Abra is taking that risk. However, Abra hedges away our risk on these contracts in the open market at the moment the consumer creates the investment. Abra has already successfully processed hundreds of millions of dollars worth of these investment contracts and has never lost money on them.

Crypto-collateralized contracts leverage the programmable aspects of bitcoin to create a new universe of secure and decentralized finance.