Introduction to M-Pesa : Lesson on how Blockchain WILL Disrupt Finance in the Developing World

If anyone had any doubt about how the block chain world is going to take over the financial world, all they have to do is see how mobile money has disrupted the banking system in the emerging markets and the best example is Kenya in the form of M-pesa (pesa is the Swahili word for ‘money’ – mobile money)

M-pesa is a mobile money transfer platform that was launched ten years ago by Safaricom, the largest company in the region. In Kenya, East Africa’s largest economy, the mobile money platform processes nearly $30billion worth of transactions annually, and growing every quarter.

I and millions of people in these regions use mobile money for everything, to pay electricity bills, school fees, taxi to anything else. If you have your phone, you don’t need to have any other wallet. No cash, no cards. After reading how it works, it becomes easy to relate and see how this can evolve to using a cryptocurrency.

So, how does it work?

There are several variations of the mobile money account depending on the service provider, but Safaricom’s M-pesa, accounts for nearly 80% (it is having a dominance problem). So, the steps.

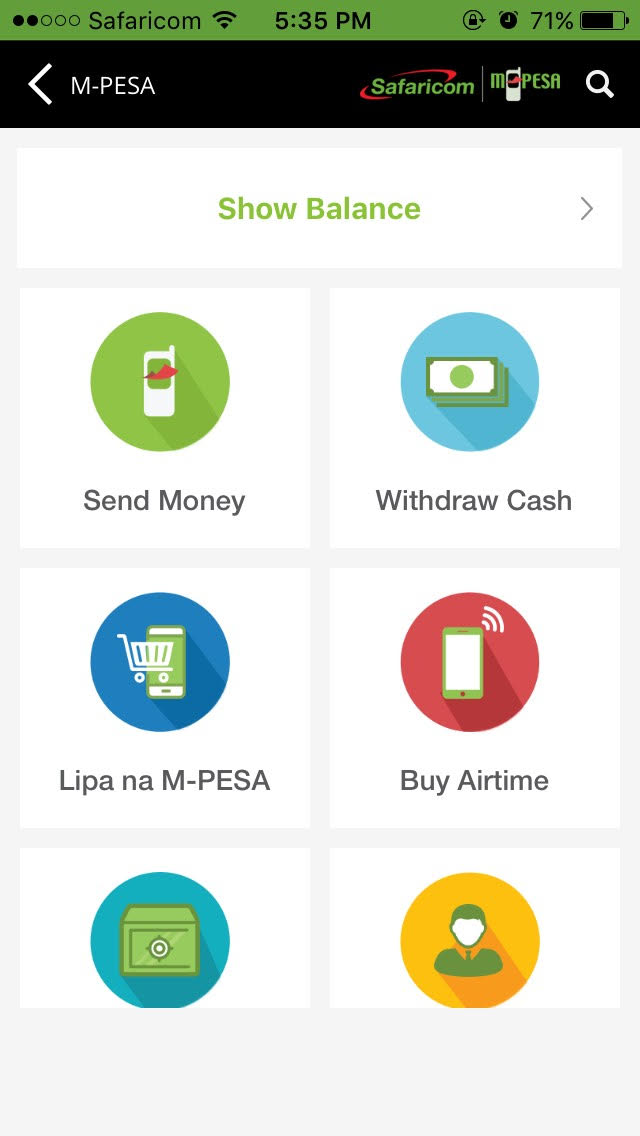

- Activate your account. With the Safaricom SIM card, you create/activate your M-pesa account, create a PIN. - On its 10th anniversary, the company launched a functioning app that works on Android, iOs and Windows, for people who find the USSD codes cumbersome.

- Load Money. Users can load money at any Safaricom M-pesa dealer shops. The level of distribution outlet the company has cannot be rivaled by anyone, make coca-cola. An M-pesa shop is a business opportunity and the owners benefit for facilitating the transactions (kind of like coin mining)

- The fiat currency is transferred to digital mobile money on the phone and can be used virtually anywhere from buying your air-ticket to paying for an orange by the side of the road.

- To Pay using M-pesa: A user can either send money to another user or pay to a business. To send money, all it takes is inputting the mobile number of the other person (they should have mobile money activated on their phones), putting the amount to send, enter the security PIN and send. You will INSTANTLY get a notification saying the money has been sent.

- To pay a business, the process is the same, except instead of the mobile number, you will input the business number and follow the same procedure. This applies to paying for the wide number of bills such as electricity, taxi, school fees, restaurant etc.

- To cash out, all you need is to find an M-pesa stand (again, these shops are everywhere across the country), hit on the withdraw button, put the amount, input the M-pesa shops number, put the security PIN and it’s done. You get your cash from the agent at the M-pesa shop.

The product over the years has been evolving and partnering with other players to give more value to the customers.

One of the products is Okoa Johazi, this applies to pay-as-you-go customers who account for the majority to access credit talk time, which will be automatically deducted at the next top up.

In collaboration with banks, the mobile money service provides a savings account that can be used to take loans depending on the client’s saving and repayment record.

Note: There is an opportunity for developers to see how they can use this information to build applications. There are some players already in the field such as bitpesa.