Forex trading vs Stock trading

A major difference between the forex and equities markets is the number of trading alternatives available: the forex market has very few compared to the thousands found in the stock market. The majority of forex traders focus their efforts on seven different currency pairs. There are four "major" currency pairs, which include EUR/USD, USD/JPY, GBP/USD, USD/CHF, and the three commodity pairs, USD/CAD, AUD/USD, NZD/USD. Don't worry, we will discuss these pairs in detail in the next portion of our forex walkthrough. All other pairs are just different combinations of the same currencies, better known as cross currencies. This makes currency trading easier to follow because rather than having to pick between 10,000 stocks to find the best value, the only thing FX traders need to do is "keep up" on the economic and political news of these eight countries.

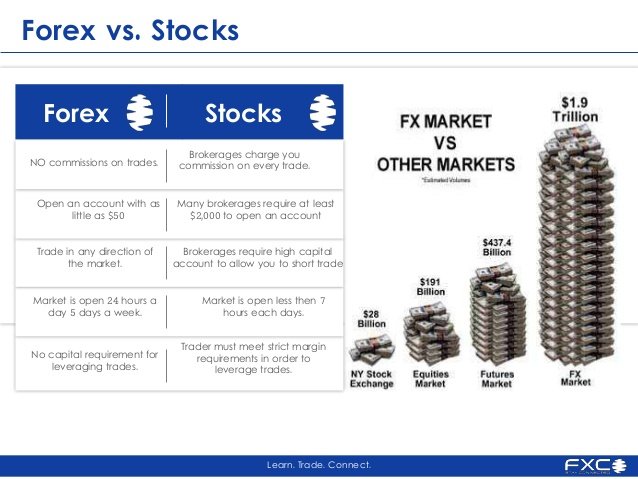

Quite often, the stock markets can hit a lull, resulting in shrinking volumes and activity. As a result, it may be hard to open and close positions when you'd like to. Furthermore, in a declining market it is only with extreme ingenuity and sometimes luck that an equities investor can make a profit. It is difficult to short-sell in the U.S. stock market because of strict rules and regulations. On the other hand, forex offers the opportunity to profit in both rising and declining markets because with every trade, you are buying and selling at the same time, and short-selling is, therefore, a part of every trade. In addition, since the forex market is so liquid, traders are not required to wait for an uptick before they are allowed to enter into a short position, as is the rule in the stock market.

Due to the high liquidity of the forex market, margins are low and leverage is high. It just is not possible to find such low margin rates in the stock market; most margin traders in the stock market need at least half of the value of their investment available in their margin accounts, whereas forex traders need as little as 1%. Furthermore, commissions in the stock market tend to be much, much higher than in the forex market. Traditional stock brokers ask for commission fees on top of their spreads, plus the fees that have to be paid to the exchange. Spot forex brokers take only the spread as their fee for each trade. (For a more, see Getting Started in Forex and A Primer On The Forex Market.)

By now you should have a basic understanding of what the forex market is, how it works and the benefits and dangers all new forex traders should be aware of.

In my opinion if you don't have any experience trading, forex is a bit like gambling. Stock market is easier to start with :)

Forex trading is much bigger industry than stock market. I love forex trading. It has many advantages.

Most investors rely on brokers to provide them with accurate and timely information about their investments and related costs. The best broker forex can increase transparency by providing detailed reports on commissions, investment performance, and potential conflicts of interest. They should also communicate regularly with their clients and be available to answer any questions they may have.

Forex trading is simpler because you only focus on a few currency pairs instead of thousands of stocks. You can profit whether the market is going up or down, and it’s easy to trade quickly due to high liquidity.

Stock trading gives you more options with different companies and sectors, but short-selling is tougher, and the fees are higher.

But if you want to boost your trading strategies, take a look at https://www.clickcapital.io/tradingview-indicators