Blockchain's Killer Apps

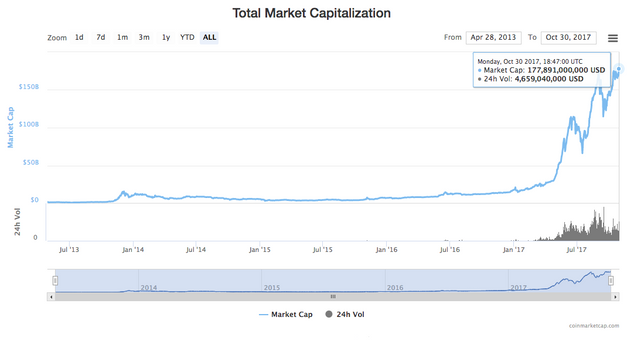

In the last year, interest in cryptocurrencies has skyrocketed. The public cryptocurrency market cap has surged to highs of over $170B. With over 1.5B raised through ICOs in 2017, over 70 crypto exchanges open for business, and crypto hedge funds and VCs popping up left and right, it seems that everyone is clambering to get a seat on the rocketship.

In all this frenzy, nobody is asking about killer apps anymore.

I believe this is a mistake.

As a consumer technology, cryptocurrencies are a hot mess. They’re extremely difficult to purchase, the networks are slow, the transaction fees are high, the community is full of trolls, hackers, and scammers, it’s far too easy to lose your funds or have them stolen, and even if you win the battle to secure your funds or use a custodial service like Coinbase, merchant acceptance is scarce.

The developer tools are even worse. The cryptocurrency ecosystem is fragmented and territorial. The tooling, documentation, and developer education are shoddy to nonexistent.

Cryptocurrencies suck for both users and builders. Yet, despite these glaring problems, the demand and hype only go up.

This should strike you as alarming. If it doesn’t, you’ve fallen asleep at the wheel.

What does this mean?

To make sense of this phenomenon, you’re forced to one of two possible conclusions.

The first is that the value of crypto is entirely in speculation.

The other possibility is that crypto’s underlying value is in something other than the user experience. But this seems to belie everything we know about how technological value creation takes place.

There are four killer apps for blockchains:

- Dark web and black market payments

- Digital gold

- Payments (macro and micro)

- Tokenization

Killer app #1: Dark web and black market payments

Market size (approx.):

Billions to 10s of Billions USDWhat’s blocking this?

Privacy-coin development, scaling.

Killer App #2: Digital Gold

Market size:

Trillions+ USD.What’s blocking this?

Volatility, consumer awareness.

Killer App #3: Payments (macro and micro)

Market size:

Hundreds of billions USD.What’s blocking this?

Adoption, ease of use, scaling.

Killer App #4: Tokenization

Market size:

???What’s blocking this?

Regulation, legal frameworks.