Steem: Long-Term Potential Worth the Risk?

Steem is one of the three currencies created by the Steemit platform and it presents an interesting investment opportunity.

// -- Discuss and ask questions in our community on Workplace.

While leisurely perusing the Steemit whitepaper, I started seeing something valuable in Steem, despite some extensive downward pressure.

SEARCH

Hacked: Hacking Finance

Hacked: Hacking Finance

ALTCOINSSteem: Long-Term Potential Worth the Risk?Published 3 months ago on November 26, 2017 By Alex Moskov

Steem is one of the three currencies created by the Steemit platform and it presents an interesting investment opportunity.

// -- Discuss and ask questions in our community on Workplace.

While leisurely perusing the Steemit whitepaper, I started seeing something valuable in Steem, despite some extensive downward pressure.

Now, this article isn’t to be taken as investment advice for any short-term or long-term gain, but it will help present a few of the thoughts I had when reviewing this token.

// -- Become a yearly Platinum Member and save 69 USD and get access to our secret group on Workplace. Click here to change your current membership -- //

The Problem:

In order to understand Steem, it’s useful we dive into the Steemit platform and the overall problem Steemit is looking to solve.

The battle for attention:

More than two million blog posts are written and published EVERY DAY, and each has to find a way to break through the noise. Many content creators utilize some sort of combination of owning their own platform (ie. www.alexmoskov.me), guest posting or being a contributor on various other sites.

The onus of content distribution falls on the content creator, and many content creators end up finding that content distribution can take more time and effort than the creation of content itself. Then, you’ve got content creators who operate at a much larger scale and are capable of creating much bigger impressions through the use of different marketing strategies.

This means that the content you see on a daily basis isn’t necessarily the best, but it might be the best marketed.

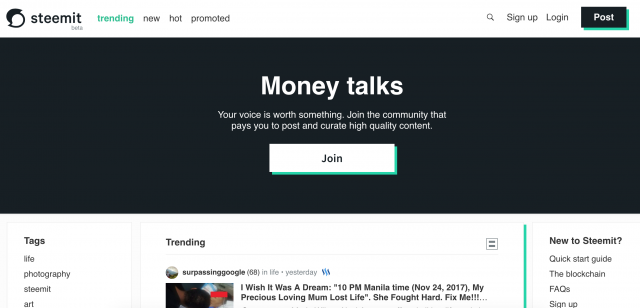

The Steemit platform helps alleviate this problem by rewarding content curators. People who upvote and comment on posts get rewarded. The more Steem Power Units curators have, the more their vote will count, the more influence they will have, and the more they will get paid as well.

The battle for monetization:

Unsurprisingly, The current content dilemma circles around money. The Internet has provided virtually anyone a platform to voice their opinions and ideas.

The digital environment has given multi-million dollar media companies a new outlet, and content creation has developed into a full-time job for many individuals.

The problem with content is how content is monetized. The most viable ways to get paid for content for many media companies and individuals are either through advertising, affiliate marketing, or some sort of payroll.

Creating unbiased content often comes at the expensive of the content creator. The audience expects high-quality stuff but isn’t so keen to pay for it.

The Steemit platform offers a solution by directly rewarding content creators for their content. If a piece of content is genuinely popular and valuable, the writer ends up being compensated. This money comes not from the audience, but from the Steemit network itself.

Steemit: the Solution the Content World Needs

Steemit is an extremely interesting solution. Here are a few quick hits of what you need to know.

SEARCH

Hacked: Hacking Finance

Hacked: Hacking Finance

ALTCOINSSteem: Long-Term Potential Worth the Risk?Published 3 months ago on November 26, 2017 By Alex Moskov

Steem is one of the three currencies created by the Steemit platform and it presents an interesting investment opportunity.

// -- Discuss and ask questions in our community on Workplace.

While leisurely perusing the Steemit whitepaper, I started seeing something valuable in Steem, despite some extensive downward pressure.

Now, this article isn’t to be taken as investment advice for any short-term or long-term gain, but it will help present a few of the thoughts I had when reviewing this token.

// -- Become a yearly Platinum Member and save 69 USD and get access to our secret group on Workplace. Click here to change your current membership -- //

The Problem:

In order to understand Steem, it’s useful we dive into the Steemit platform and the overall problem Steemit is looking to solve.

The battle for attention:

More than two million blog posts are written and published EVERY DAY, and each has to find a way to break through the noise. Many content creators utilize some sort of combination of owning their own platform (ie. www.alexmoskov.me), guest posting or being a contributor on various other sites.

The onus of content distribution falls on the content creator, and many content creators end up finding that content distribution can take more time and effort than the creation of content itself. Then, you’ve got content creators who operate at a much larger scale and are capable of creating much bigger impressions through the use of different marketing strategies.

This means that the content you see on a daily basis isn’t necessarily the best, but it might be the best marketed.

The Steemit platform helps alleviate this problem by rewarding content curators. People who upvote and comment on posts get rewarded. The more Steem Power Units curators have, the more their vote will count, the more influence they will have, and the more they will get paid as well.

The battle for monetization:

Unsurprisingly, The current content dilemma circles around money. The Internet has provided virtually anyone a platform to voice their opinions and ideas.

The digital environment has given multi-million dollar media companies a new outlet, and content creation has developed into a full-time job for many individuals.

The problem with content is how content is monetized. The most viable ways to get paid for content for many media companies and individuals are either through advertising, affiliate marketing, or some sort of payroll.

Creating unbiased content often comes at the expensive of the content creator. The audience expects high-quality stuff but isn’t so keen to pay for it.

The Steemit platform offers a solution by directly rewarding content creators for their content. If a piece of content is genuinely popular and valuable, the writer ends up being compensated. This money comes not from the audience, but from the Steemit network itself.

Steemit: the Solution the Content World Needs

Steemit is an extremely interesting solution. Here are a few quick hits of what you need to know.

Steemit has three different currencies:

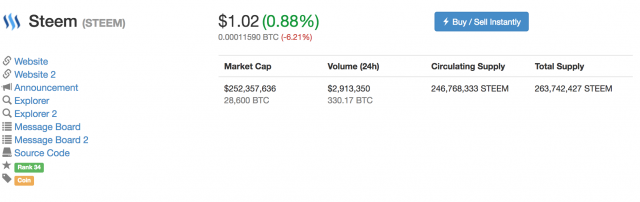

Steem: The currency that can be bought and sold on most open markets. This is how most people using the Steemit platform “cash out”. Steem currently “erodes” at an annual rate of 9.5% every year due to the production of new Steem.

Steem Power Units: Steem Power Units (SP) are a more long-term offering. When you buy SP, you’re locked into it for 2 years. This limit is meant to keep people invested in the platform long-term and stop people from suddenly dumping their units on the market. Holding SP entitles the owner to a proportionate ownership share in the network. 90% of all the new Steem made every day goes to people holding SP. Additionally, half of what content creators receive when paid out per post is in SP.

Holders of SP receive a higher weight to their upvotes, helping users to build up more of an authority and influence on the site.

Steem Dollars: Steem Dollars are pegged to the U.S. Dollar and are a bit more stable. 50% of the compensation comes in Steem Dollars. Holders of Steem Dollars are able to do one of three options:

Convert them into Steem and sell them on the open market.

Hold them and essentially earn 10% interest when compared to Steem.

Exchange Steem Dollars for SP and hold for the long term.

There’s a lot to Steem and the Steemit platform, but many of the intricacies fall beyond the scope of this article. I recommend learning more about Steemit and the role Steem plays in detail (the whitepaper is a great source).

The Opportunity

So, one of the biggest questions I had is “why would anyone hold Steem if it’s got downward pressure of at least 9.5% every year?”

SEARCH

Hacked: Hacking Finance

Hacked: Hacking Finance

ALTCOINSSteem: Long-Term Potential Worth the Risk?Published 3 months ago on November 26, 2017 By Alex Moskov

Steem is one of the three currencies created by the Steemit platform and it presents an interesting investment opportunity.

// -- Discuss and ask questions in our community on Workplace.

While leisurely perusing the Steemit whitepaper, I started seeing something valuable in Steem, despite some extensive downward pressure.

Now, this article isn’t to be taken as investment advice for any short-term or long-term gain, but it will help present a few of the thoughts I had when reviewing this token.

// -- Become a yearly Platinum Member and save 69 USD and get access to our secret group on Workplace. Click here to change your current membership -- //

The Problem:

In order to understand Steem, it’s useful we dive into the Steemit platform and the overall problem Steemit is looking to solve.

The battle for attention:

More than two million blog posts are written and published EVERY DAY, and each has to find a way to break through the noise. Many content creators utilize some sort of combination of owning their own platform (ie. www.alexmoskov.me), guest posting or being a contributor on various other sites.

The onus of content distribution falls on the content creator, and many content creators end up finding that content distribution can take more time and effort than the creation of content itself. Then, you’ve got content creators who operate at a much larger scale and are capable of creating much bigger impressions through the use of different marketing strategies.

This means that the content you see on a daily basis isn’t necessarily the best, but it might be the best marketed.

The Steemit platform helps alleviate this problem by rewarding content curators. People who upvote and comment on posts get rewarded. The more Steem Power Units curators have, the more their vote will count, the more influence they will have, and the more they will get paid as well.

The battle for monetization:

Unsurprisingly, The current content dilemma circles around money. The Internet has provided virtually anyone a platform to voice their opinions and ideas.

The digital environment has given multi-million dollar media companies a new outlet, and content creation has developed into a full-time job for many individuals.

The problem with content is how content is monetized. The most viable ways to get paid for content for many media companies and individuals are either through advertising, affiliate marketing, or some sort of payroll.

Creating unbiased content often comes at the expensive of the content creator. The audience expects high-quality stuff but isn’t so keen to pay for it.

The Steemit platform offers a solution by directly rewarding content creators for their content. If a piece of content is genuinely popular and valuable, the writer ends up being compensated. This money comes not from the audience, but from the Steemit network itself.

Steemit: the Solution the Content World Needs

Steemit is an extremely interesting solution. Here are a few quick hits of what you need to know.

Steemit has three different currencies:

Steem: The currency that can be bought and sold on most open markets. This is how most people using the Steemit platform “cash out”. Steem currently “erodes” at an annual rate of 9.5% every year due to the production of new Steem.

Steem Power Units: Steem Power Units (SP) are a more long-term offering. When you buy SP, you’re locked into it for 2 years. This limit is meant to keep people invested in the platform long-term and stop people from suddenly dumping their units on the market. Holding SP entitles the owner to a proportionate ownership share in the network. 90% of all the new Steem made every day goes to people holding SP. Additionally, half of what content creators receive when paid out per post is in SP.

Holders of SP receive a higher weight to their upvotes, helping users to build up more of an authority and influence on the site.

Steem Dollars: Steem Dollars are pegged to the U.S. Dollar and are a bit more stable. 50% of the compensation comes in Steem Dollars. Holders of Steem Dollars are able to do one of three options:

Convert them into Steem and sell them on the open market.

Hold them and essentially earn 10% interest when compared to Steem.

Exchange Steem Dollars for SP and hold for the long term.

There’s a lot to Steem and the Steemit platform, but many of the intricacies fall beyond the scope of this article. I recommend learning more about Steemit and the role Steem plays in detail (the whitepaper is a great source).

The Opportunity

So, one of the biggest questions I had is “why would anyone hold Steem if it’s got downward pressure of at least 9.5% every year?”

Well, my bet is on the opportunity outside of just market forces surrounding Steem. The Steemit platform is far from nearing how big it could potentially be, and it’s got a few big ingredients working in its favor:

Building an engaged community. The Steemit platform is doing an awesome job of not only incentivizing engagement through monetary compensation, it’s also started to attract a highly engaged and loyal community (much like Reddit and 4chan).

The call for influencers is appealing. Soon enough, influencers with large audiences will see the value of being on the Steemit platform by holding Steem Power Units. It seems like very few influencers (even in the slightly esoteric crypto crowds) are currently making use of this.

Lethal engine for growth. Users of Steemit are best incentivized to refer their friends to their site and link to their articles. The onboarding of Steemit has some serious potential.

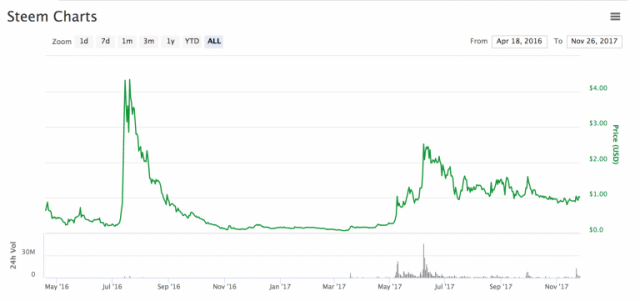

Steem’s not even close to its previous ATH. Steem was hovering around $4.00 momentarily in July 2016, and only started to slowly pick back up in May 2017.

Establishing an audience and building the Steemit platform go hand in hand. Many content owners can find a home in Steemit and are able to invest in the platform to have more influence when it comes to voting or reaching consensus.

Steem Power Units. While SP is locked in for 2 years, holders get to enjoy some pretty substantial benefits such as accumulating extra SP every day.

Final Thoughts

While I can’t and won’t make any predictions on price, I think the evidence supporting the Steemit platform is hard to overlook.

If I were to surmise a prediction, I could see Steem Power Units being a practical investment for content creators (or any other digital marketing talent) looking to explore a new avenue for their content.

A few words of caution before we close this out: Steem has the tendency to be fairly volatile. It’s been around for awhile (relative to other cryptocurrencies) and experienced a pretty sharp drop from $4.34 to $0.102 a few weeks in 2016. It has seen a decent lift starting May 2017, but this could simply be due to the general rise in most cryptocurrency prices. Additionally, the downward pressure of 9.5% can be a tough pill to swallow.

Finding a way to capitalize on the potential of the Steemit platform and the current Steem prices could be incredibly lucrative.

Your post is very nice,i m very happy reading your post,thanks for posting........

Thanks for u comments @islamkha

thanks 4 information

now see my blog this is about criptocurency i am sure that u like this https://steemit.com/bitcoin/@tanvirabedin/paypal-exec-says-very-high-likelihood-bitcoin-will-become-popular-payment-method

if u like my blog so please upvoat me

Ok thanks for u @tanvirabedin