MARKET CRASH—Are You A Good Investor or Bad Investor?

The vast majority of individuals who invest in any form of stock or financial component do so because someone “told” them to. They got wind about a “high return” opportunity. They failed to look into the backbone of that opportunity and just put their money in.

^^^^ Bad investor!!!!!

Now, we all know investing your money the way the majority do is not all that smart. But, most individuals do it anyway.

Hell, look how many individuals use an actual stock broker for their stocks—again, putting faith in others to do what they deem fit with YOUR MONEY.

Of course, for many, this strategy (if that is what you want to call it) has worked—for them.

How many people got screwed over with pyramid schemes? In crypto, most recently, how many people got screwed over in the Bitconnect scandal?

Here is a reality check…..

None of those individuals who got “screwed over” in pyramid schemes or the Bitconnect scheme truly got “screwed over.”

Fact is, they screwed themselves over because they took a leap of faith in others who, at the end of the day, cared not one iota about their individual economic situation but rather cared about their own self interests.

People hate hearing such truths but as we all know; the truth hurts sometimes and guess what? We have, at one point or another, all fell into this game of poor investing.

Here is a little bit of good news however about some observations I personally have witnessed about the crypto space—especially here on Steemit.

Steemians and crypto enthusiasts APPEAR to be much more educated about their personal investment initiatives then the average Joe or Jane investor.

Unlike traditional stock investors, whom you rarely see taking to Youtube or DTube to help educate peers, the crypto space is full of such individuals.

Every single ICO has a White Paper accessible for public review. They list their team members and the good ICO’s include links to their team members LinkedIn profiles.

Crypto conferences are continuously held around the world for people to get educated.

The list goes on and on about ways crypto enthusiasts can obtain knowledge for personalized investment strategies.

Here is the downfall however.

Crypto enthusiasts are often much younger than traditional stock investors.

Youth, like age, has its perks while also having its downsides.

Youth have not lived through much of our world’s history which as most would agree, history is one of the greatest teachers.

Let me provide a quick example about history as a teacher for those who may not grasp this principle.

An 88 year old man who served in Normandy during World War II fully grasps the horrors of war, he also grasps the horrors of economic depressions and recessions. He equally understands how these horrifying events not only unfold but also recover.

Can you say that about the 18 year old kid who just graduated boot-camp?

The obvious answer is, NO.

This takes me to the crypto space we currently live in today and a comparison to traditional stock markets and investors.

Today, one can argue that a global stock market has been built via the crypto space.

Like the stock market, crypto investors are not investing in actual currency but rather economic venture founded in business. And yes, virtually every single crypto currency is not truly a currency in the traditional sense but rather a stock in a venture capital/business.

Stock markets go up and they go down.

Today, according to most MSM pundits, the Stock Market is in a serious decline. Some have even said the stock market has crashed. But do these pundits truly know what a crash constitutes?

Let me help everyone take a deep breath of calm—the stock market has not crashed and more interesting, the stock market has not even entered a true state of correction.

A Stock Correction is defined as a 10 percent drop from the prior market peak.

I despise the Washington Post but here I must give credit where credit is due and quote them for a moment.

“The Dow was sitting at an all-time high on Jan. 26, just over a week ago. At the moment, the Dow is down 8.5 percent from that record level. So it's close to a correction, but not there yet. (The S&P 500 is down about 7 percent from its record level).”—Washington Post

Since March 2009, we've had four official corrections within the Stock Market as well as 60 panic selloffs HOWEVER, even with corrections and panic sells, historically on average, the stock market gains approximately 8% every year.

Anyone want to guess some crypto gains?

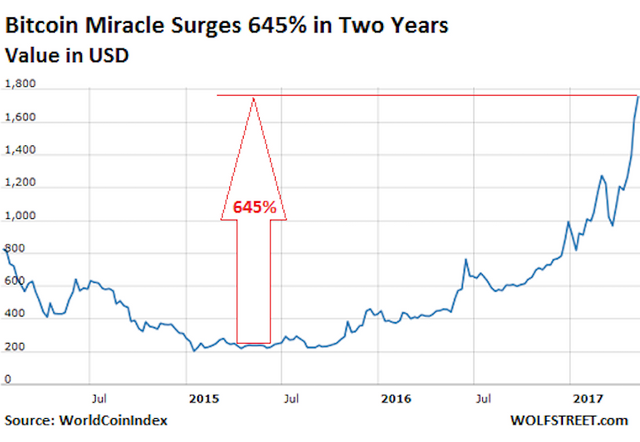

Bitcoin— Since 2015, Bitcoin surged 645%

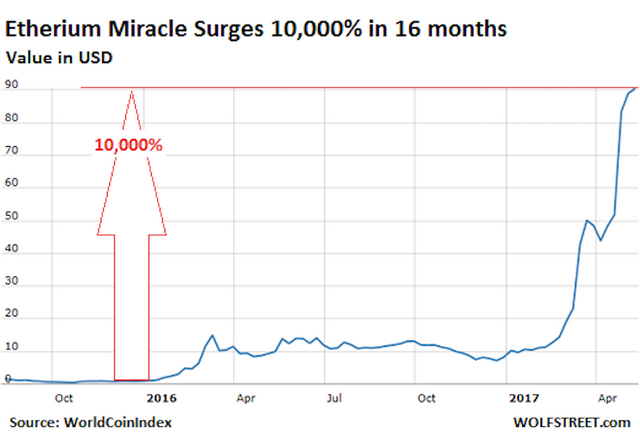

Ethereum—Since 2016, Ethereum surged 10,00%

Again, in the traditional stock market, a correction is a 10% drop from a prior market peak.

Now, in the crypto space, we should laugh at a 10% drop when one looks at 645% and 10,000% gains.

Hell, in comparison to traditional stocks, we can actually snicker at 20 and 30 and even 40 and 50% drops (not that anyone wants to see such drops).

This is the reality in which we crypto investor types live in.

Like traditional stocks, we must accept the fact we will live in times when we face serious drops. And, we must accept that unlike the Stock Market that has a clear universally accepted definition of a “correction,” our crypto correction should be viewed much higher than just a measly 10% drop considering our historical gains.

But the real questions needing to be presented right now is whether we as crypto investors understand this compare and contrast between our newly created crypto stock market versus the traditional stock market?

Are we willing to take historical lessons from the traditional stock market and assess our own crypto situation?

Are we willing to accept that we too will encounter our own crashes, corrections, and panic sell offs?

Are we willing to be better than the traditional stock investor who takes leaps of faiths in others managing their own personal wealth and take our own individualized strategies based off personal research and knowledge of the products we are putting our hard-earned money into?

Right now, I believe the Steemit community is taking a major lead in this game which I am speaking of.

But, are we doing enough in ensuring our crypto family educates the general population to see the future and its reality to our newly established global crypto market?

The ball is in our hands.

Great post.

Followed you please follow me back to help me out.

I'd say I'm a "fair" investor, as I try to do as much research as possible but also look at what others are doing to put me in the ballpark and occasionally don't do as much research as I ought to.