The price of Bitcoin will collapse according to warns former IMF member

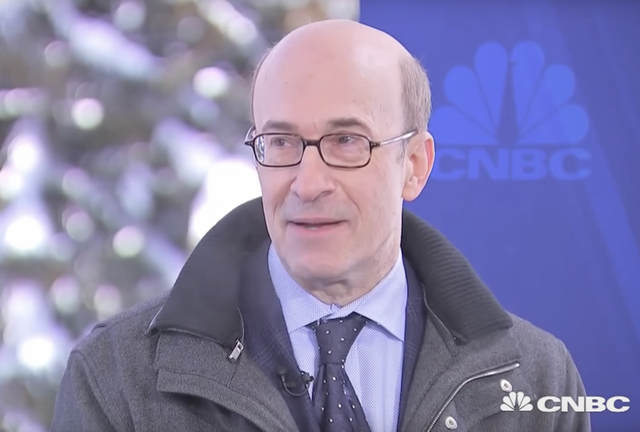

Kenneth Rogoff is a well-known finance specialist and professor at Harvard who has lately stated that the price of bitcoin "will collapse" due to continued government regulatory pressure.

In an article published by the British newspaper The Guardian, Rogoff stated:

"My best guess is that in the long run, technology will thrive, but the bitcoin price will collapse."

The renowned economist analyzed in his article some aspects of bitcoin and other cryptocurrency, even referred to the growth of 1600% that bitcoin has experienced in the last two years. In addition, Rogoff has argued that the development of bitcoin as currency and its growth in any kind of transaction will depend on governments and how they react to crypto conversion. According to his own words, a technologically superior bitcoin could emerge easily, due to the participation of many emerging companies and startups that have used bitcoin and other virtual currencies as a basis for their growth. It is necessary to remember that nowadays there exists a great ecosystem for the cryptocurrencies, in which bitcoin is the leader and this is what keeps it at the top.

However, Rogoff argued that governments can accept some small transactions with cryptography, but will not take large-scale anonymous payments that make it much more difficult to collect taxes and track criminal activity.

In addition, he argues that if bitcoin divested itself of its near anonymity, its current price would be difficult to justify, adding that bitcoin speculators may be "betting that there will always be a consortium of dishonest states that allow the anonymous use of bitcoin" .

The economist added that central banks could create their own digital currencies; even some are developing their own currencies; in addition, these central banks will use the regulations to convert the market in their favor until they win, as other specialists have stated; In particular, Rogoff stated:

"The long history of the currency tells us that what the private sector innovates, the state eventually regulates and appropriate. I have no idea where the price of bitcoin goes during the next two years, but there is no reason to expect that the virtual currency avoid a similar fate ".

As such, according to Rogoff, these regulations could contribute to the decline in bitcoin value. However, he acknowledges that it is necessary for bitcoin to improve some of its aspects because it could overcome fees charged by banks on credit and debit cards.

In his article the Harvard economist has also opined about the use of bitcoin in Japan, even declaring that the United States could follow Japan in fintech regulation, as CCN reported. Japan, according to Rogoff, has been a "big win" for bitcoin.

Last month, China banned digital currency trading (ICO) and forced local financial cryptocurrency companies to close their doors. However, it is likely that the government will resume trading in crypto extractors in the coming months, with Know Your Customer (KYC) and Anti-Money Laundering (AML) systems, Kenneth Rogoff explained.

On the contrary, Japan is implementing measures to open the markets to bitcoin and recently recognized 11 bitcoins e-commerce companies as authorized institutions for the exchange of cryptocurrencies. The measure, which Taiwan is adopting in its economy, according to Kenneth Rogoff's opinion, would favor tax evaders to use bitcoin to launder their money through Japanese accounts, despite efforts being made by the Japanese government to enforce systems AML / KYC.

The economist, however, also notes that in his recent book on past, present and future currencies, the issuance of reliable currency notes of great denomination can help evasion and delinquency.

Congratulations @jagjitsingh! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOP