GSR interviews ARCH CRAWFORD - March 28, 2018 Nugget

Highlights

Arch Crawford, head of Crawford Perspectives, outlines his technical perspective on US shares, gold, silver indexes.

Our guest continues to monitor the technical condition of the PMs sector, noting the positive inverse golden cross.

Given the sharp advance in the gold, silver, commodities, XAU and WTIC , Arch Crawford is anticipating a new bull market, music to the ears of PMs aficionados.

Regarding US equities indexes, volatility was too low for too long - he expects a return to the mean resulting in a capitulation moment.

His account remains short equities since January 15th without margin. After the 3 day Easter / Passover weekend, stocks could rebound from lows.

The new $60 billion trade tariffs imposed by the Administration on China, suggests increased tensions between the US and China / N.K.

Should relations continue to deteriorate, the potential for military conflict may add a new twist to the geopolitical / financial arenas.

On the domestic economic front, the discussion veers to the hawkish FOMC rate hike strategy.

The current Fed Funds Futures (FFF) at the St. Louis FRED website indicates low odds of another rate hike at the upcoming May meeting.

Odds are high for June rate increase to 150-200 basis points (80% odds); about even odds of a final 2018 increase at the December meeting.

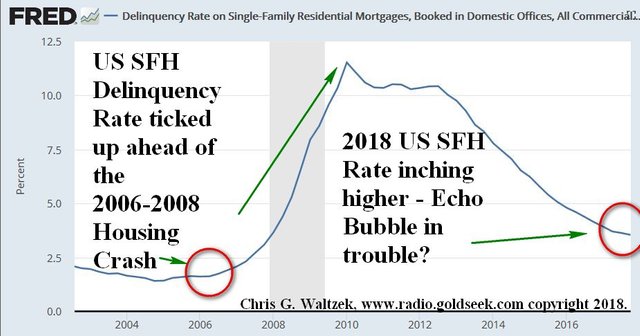

The threat of higher rates has rattled some perspective home buyers, resulting in higher SFH default rates and potentially ending the echo housing bubble (figure 1.1.).

Figure 1.1. Echo Housing Bubble Doomed? SFH Delinquency Rate Graph

Note. Graph courtesy of St. Louis Fed, FRED website.

▶️ DTube

▶️ IPFS

Hi @goldseek-radio

Excellent article. I subscribed to your blog. I will follow your news.

I will be grateful if you subscribe to my blog @user2627

Good luck to you!