SOMETHING BIG and STRANGE is About to Happen to the MONEY & CRYPTO-WORLD In 4-Days Time!! WATCHOUT!!!

My Fellow STEEM Members,

VOTE FOR THIS NEWS !!

,

,

Academics, economists and financial commentators have predicted it for years...

The death of the US dollar and other modern paper-based currencies.

In 1975, academic, journalist, and commentator, Adam Ferguson wrote When Money Dies.

In 2008, author and publisher, Addison Wiggin wrote The Demise of the Dollar.

And in 2014, CIA insider, lawyer, and economist, James Rickards wrote The Death of Money.

Each explained what happens when currencies ‘die’. What to look for in order to prepare for it. And how to deal with it when it happens.

Each is a great book.

But none of them had the foresight to see what’s about to occur just a few days from now, at the stroke of midnight on 21 July, 2017.

On that day, I believe a global ‘crypto coup d’etat’ will be unleashed.

It could be the final nail in the coffin for the US dollar in particular, and ‘Old Money’ in general.

Only you won’t find a trace of this reported in the financial press.

You won’t even find a hint of it in crypto-currency forums and Bitcoin fanboy forums.

After all, when you’re about to stage a global coup, you don’t broadcast it in advance.

But it’s happening.

It can’t be stopped.

And, if you ally yourself with the key players in this coup NOW — I mean within the next few days — you could make tremendous investment gains in the months ahead.

In fact, I believe this ‘coup’ will become...

A major issue for central banks...precisely because it is bound to weaken their position as exclusive emitters of money

Rarely in the financial publishing game do you come across a scoop of this magnitude...

With potential gains ranging over 5,000% in the offing, if you’re smart and make a few discrete money moves, very quickly.

But I mean quick.

Come 21 July, this coup is likely to make headlines across the world.

So time is of the essence.

I realize it sounds hyperbolic or far-fetched. But I’m going to show you all the analysis at my disposal today.

I believe...

...you’re about to witness a co-ordinated, digital strike on the old money structures that have ruled the financial world for centuries.

...it will give birth to a system like nothing the world has ever seen before.

...it will be a system that will result in the end of money as you know it.

And I believe it will be a system that will create the ultimate money...a system that CAN NEVER BE BETTERED...EVER.

It’s a system that, if exploited in the right way, now, before the ‘new money’ takeover happens, could result in extraordinary riches.

Far-fetched?

Read on. I’ll show you everything you need to know, and how to take advantage, in the report that follows...

In fact, for those already in the know, the gains have begun:

27-year old Huai Yang already reportedly makes US$13,000 per month from this ‘new money’

In 2013, brothers Cameron and Tyler Winklevoss owned 1% of all the ‘new money’ in circulation. Then it was worth US$11 million. Today, it would be worth over US$309 million

Norwegian, Kristoffer Koch, bought US$25 worth of this ‘new money’. Thought nothing of it. Four years later, it was worth US$600,000

High schooler, Erik Finman bought US$1,000-worth of ‘new money’ in 2011. Today, his stake is worth US$1.09 million

Those are incredible, life-changing gains.

But the most amazing thing about the folks who have already made a fortune in ‘new money’, is that they are regular people.

In the most part, you won’t find the names of these ‘new money’ millionaires in the paper or online.

That’s what makes this one of the most incredible profit-making opportunities of all time.

This isn’t a market for insiders only. Or for the wealthy. Or for Wall Street or City of London traders.

This is an opportunity open to all...providing they have the insight to take advantage of it now.

In the pages that follow, I’ll reveal everything.

I’ll reveal what this ‘new money’ profit opportunity is all about.

The secrets behind the ‘new money’ trend.

And how you can take part, and potentially rack up multi-digit percentage gains — after laying down as little as $500 or less.

But before I do, let me introduce myself...

Life’s work. This is what I was born to do...

My name is Sam Volkering.

I’ve been in the investment business for over a decade. But thanks to my accountant grandfather, I knew what the value of money was when I was 12.

Funnily enough, this led me to a career in financial advice. Starting out as a financial adviser in the suburbs of Melbourne, helping everyday people manage, invest and grow their wealth.

That led me to taking up a Certified Financial Planner role in one of Melbourne’s fastest growing wealth-management firms.

It was here I advised high net-worth clients on how to invest their wealth, as well as establishing and sitting as Chairman of the in-house Investment Committee.

This makes me a fully-accredited adviser in shares, options, and warrants.

But it didn’t take long to realise that the Financial Planning world in Australia is fatally flawed. So I got out. And I uncovered perhaps the most exciting job in the world, at Port Phillip Publishing — which is why I’m writing to you today.

Today, I use all my knowledge and experience to help ordinary folks profit from the most speculative (and potentially lucrative) investments on the market.

For instance, over the past two years, I’ve shown investors how to make...

891% from a video graphics chip company

151% from a tiny biotech company

65% from a clean energy battery company

354% from an innovative robotics company

114% from a driverless car technology company

129% from a giant online ecommerce company, and more...

But there’s more to it than that.

Because what I’m about to show you is much more important. It’s my life’s work. My magnum opus.

I will even go so far as to say that everything that follows is what I was born to share with you.

This is that important. And I will share all of it with you shortly.

But before I do, some context. What do I mean when I say the current currency system and money will die?

Well, I mean exactly that.

The money in your pocket.

In your purse or wallet.

The money in your bank account. In your children’s and grandchildren’s bank accounts.

One day it will have value. You’ll be able to save it, and spend it.

But the next day, it will be worthless.

It will have no greater value than any other piece of paper or foldable plastic.

Any coins you own will have some value. But not the value printed on the coin.

The value will be in the base metals used to make those coins.

But even then, the sheer quantity of coins needed to be worth anything will be so great as to be impractical to use.

Besides, even if you could, no one would accept those old coins anyway. They were part of the ‘old money’ system.

In the future — the near future — the ‘new money’ system will have no room for physical coins.

You see, when the current (old money) system dies, the transition to the new system will be like nothing that has gone before.

It will be different from the early ‘bartering’ economies, where primitive people exchanged goods like-for-like, rather than using a medium of exchange like money.

It will be different from the early ‘gift’ economies, where people would receive or provide ‘gifts’, on the understanding that they would provide or receive something of similar value in return at a later time.

It will be different from the early and crude money systems, where people used cattle, shells, grains, and beads.

And it will be different from the gold and silver coin-based systems.

Let me be clear on that. As much as it may disappoint my gold-bug friends, gold and the gold standard are not making a comeback.

Don’t get me wrong. I’m not a hater when it comes to gold.

I appreciate value as much as any free market-loving gold investor does.

But gold as money. No more.

It used to be money...

But not now.

And not in the future.

The future lies in a different kind of money. One that doesn’t require a physical trinket.

If I can be blunt, gold has only existed as a medium of exchange for thousands of years for one simple reason: the technology hadn’t existed to allow this ‘new money’ to kick gold to the kerb.

But now it’s here, gold’s days are numbered. And so is the current outdated money system.

In short...

This just made cash and gold obsolete

I’ll explain how, why, and when the money system will change forever shortly.

But before I do, I want to be clear that I’m talking about cryptocurrencies.

You may have read about cryptocurrencies or Bitcoin in the press or online.

You may have even overheard conversations in coffee shops, restaurants, or even standing in a bus stop.

I know I have.

But while cryptocurrencies have become the talk of the town, it still astounds me how little people really and truly know about ‘cryptos’.

Most seem to think that cryptos are a get-rich-quick scheme. A flash-in-the-pan trend. Or the next financial bubble, up there with the tulip mania or dot-com boom.

But none of that is true.

Yes, there is the potential to make riches from cryptos. But it’s not get-rich-quick gains. There’s the potential for life-long gains.

Yes, cryptos are a new trend. But it’s not a flash-in-the-pan.

Yes, prices of many cryptos have skyrocketed. But it’s not a bubble. This has substance.

Because what’s happening to cryptos is a much bigger deal.

It’s not about buying an investment just because you think the value will rise.

And it’s not about buying an investment because you think there will be a gradual shift from one thing to the next.

This is much bigger.

It’s about money.

It’s about the underlying infrastructure that will impact the way people and businesses interact and transact.

This is about the biggest shift in the money system, not just in the past 45 years, but arguably, the biggest shift in 5,000 years.

As Forbes reported earlier this year:

‘Where’s the cryptocurrency market heading? Well, a prediction made in January...has fully come to pass.

‘Maksim Balashevich, the Belarusian CEO and founder of Santiment based in Germany...predicted such a boom in altcoin cryptocurrency capitalization last quarter...

‘Based on the Elliott Wave theory, his prediction posited that the cryptocurrency altcoin markets would increase to over $6 billion (bn) in market capitalization. This has already come true and gone a fair way beyond. Fast forward and the combined altcoin market cap today stands in excess of $8.4bn.’

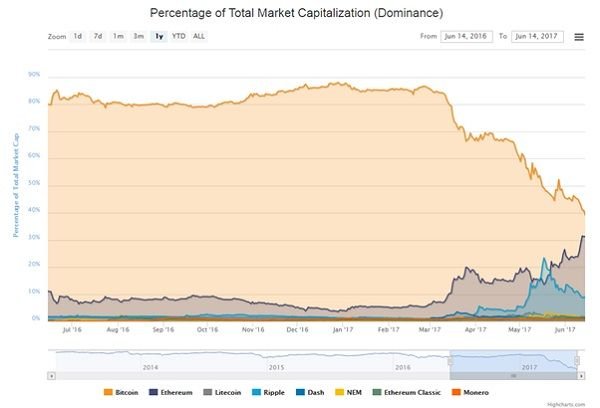

If I’m right, there are more gains to come. And this from MarketWatch:

‘Just as Wall Street is paying more attention to bitcoin, a rival is increasingly threatening to become the top dog among cryptocurrencies.

‘Ethereum’s market capitalization is nearing bitcoin’s, as shown in the chart below from CoinMarketCap.

Source: MarketWatch

You can see the growth, and maybe you can see the potential. But where did this all begin?

‘It would become the most important

financial development since the

invention of ‘money’ itself.’

As I explain in my just-published ebook on cryptocurrencies (I’ll show you how to download a copy in a moment):

‘Amongst all the turmoil of 2008/09, there was a groundswell in the digital world. A mysterious developer by the name of Satoshi Nakamoto released a white paper into the world titled: Bitcoin: A Peer-to-Peer Electronic Cash System.

‘It wasn’t long. Just nine pages in total (including references). But it would prove to be one of the most defining moments of the 21st century...that no one knew about.

‘The white paper and subsequent development of this idea would create Bitcoin. But it was really only something that pure technologists, developers, hackers, purveyors of the ‘deep web’, really knew about.

‘It was a fun, strangely exciting idea that a digital unit of exchange — separate from banks, government and financial institutions — could exists online.

‘It gained a small but loyal following. And with the aftermath of the financial crisis still in play, it was the perfect time for its arrival. It was anti-establishment. It was anti-bank, anti-financial institution. It was decentralised, anonymous, private — it was the financial instrument for the people. And it would become the most important financial development since the invention of ‘money’ itself.’

I’ve underlined the important part.

What we’re talking about here is revolutionary. It was the beginning of the end of the current, outdated money system.

And it all seemed to happen while nobody was looking.

While most folks were busy looking at the collapsing financial system, few realised that the system that would soon replace it had suddenly appeared.

But since then, people have started to catch on. A report in Vanity Fair explains why (with my emphasis):

‘As investors look for a place to put their assets amid mounting geopolitical instability, some are turning to cryptocurrency. Singapore’s government has released a report saying it has carried out a test using ethereum blockchain technology to create a national digital currency. Regulators in Japan are issuing new rules that make cryptocurrencies like Ethereum a valid form of payment. And companies such as Toyota and Microsoft, which are members of an organization called the Enterprise Ethereum Alliance, are throwing their weight behind the cryptocurrency, too.’

Take note. Microsoft and Toyota are in on this. Two of the world’s biggest companies. Do you see just how big this has become, and how much bigger it could get?

People and businesses are getting sick of the volatility and uncertainty within the current money system.

They’re sick of governments and central banks manipulating money by moving interest rates or by printing more of it.

They’re sick of the rules governments have put on the transfer and ownership of money. That governments can force the banks and merchants to hand over all transaction records.

That the government can track everything you do with your money, and trace exactly where and how you save it.

The ‘new money’ system — cryptocurrency — is an attempt to fight back against that intrusive trend.

And in doing so, the result is not only an all-new money system, but the opportunity for early-adopters to potentially make life-changing wealth.

Let me put it this way. In a way you’ll be able to understand, even if you don’t fully grasp the concept of cryptocurrencies.

Imagine that it’s 1970. The official price of gold is US$35 per ounce. You’re not an economist or a financial expert, but you’ve seen the US government is spending more money than it takes in with taxes.

You’ve seen how it has spent billions on failed wars in Korea and Vietnam.

You’ve seen how it has spent billions to keep up with the Russians in the ‘space race’.

And you’ve seen how the welfare state has grown and grown.

You look at the money system at the time. You look at the state of the government’s finances. And you look at the price of gold.

You know...you just know that something has to break. You know that either the government will stop spending and get its finances in order...at the risk of losing political power...

Or, the government will change the money system, so that it can keep spending, and (it hopes) cling on to political power.

Given that choice, where do you put your money?

A digital revolution could be just days away

Political power always wins. It’s a choice. Put your wealth in the asset (cash) that the government is about to devalue, or put your wealth in the asset that will benefit from the devaluation of cash. In other words, buy gold.

Now roll forward to today.

Governments across the world have spent big on war.

Government debts are higher than ever, and yet they refuse to stop spending.

Interest rates are at record lows, and confidence in money is at rock bottom too.

Look at Greece.

Look at Cyprus.

Look at the US and Europe.

With all that, where do you put your money today?

In cash, the asset that’s subject to seemingly endless manipulation? Or in the asset that’s outside the reach of government meddling and interference?

And we’re not talking gold.

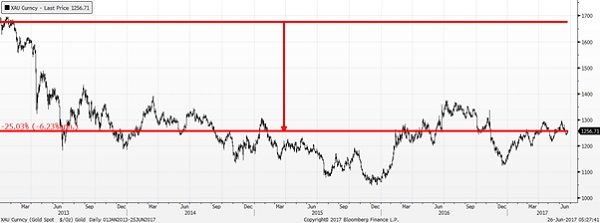

Despite the wars and spending and manipulation, the gold price has barely budged over the past four years.

Since 2013, the gold price is down 25%.

At the same time, cryptocurrencies have soared. Bitcoin alone, is up 18,666% since 2013.

Source: Bloomberg

Other cryptocurrencies have recorded equally remarkable gains:

Ethereum is up 11,716% in 20 months

Ripple is up 5,701% in less than four years

Litecoin is up 1,059% in four years

NEM is up 62,841% in two years

Dash is up 20,399% in just over three years

(Correct at 22 June 2017)

Wealth is shifting out of the current money system and into a new money system.

Like the savvy and insightful investors who bought gold in 1970, before it went on to gain 1,795% over the following 10 years, savvy and insightful investors are getting out of cash and into cryptos today.

And not before time.

Because unknown to most, a major change is happening to this new money system. And it’s due to happen this month.

It’s a change that I believe will ultimately result in the death of money as you know it. If I’m right, it will herald a new money system — one dominated by cryptocurrencies.

History is about to happen...

21 July 2017:

The day your money dies...

and a new money is born

I doubt if you’ve heard of SegWit2x.

Few have.

I’ve asked around. Most just give me a blank stare. Some think I’m referring to a character in the next Star Wars movie!

That just shows me how clueless most people are about the coming change to the money system.

So, what’s SegWit2x all about?

This can get complicated, but I want to put it as clearly as possible.

In short, SegWit2x involves a radical attempt to re-engineer the ‘blockchain’. (Again, remember I’m trying to keep this as simple as possible.)

This re-engineering will, in effect, get rid of unnecessary data, to make transactions flow faster and more smoothly.

Let me put it this way. Right now, Bitcoin transactions occur at around 3–7 transactions a second.

In comparison, transactions on Visa can occur at around 2,000 per second (and can go as high as 56,000 per second if they need to).

So in order for Bitcoin and other cryptos to become widely accepted, transaction speeds need to get to the same kind of level as Visa.

Should they do so, it will be a proverbial game-changer. That’s what SegWit2x is all about. It’s the first step to that future.

The transition from ‘old money’ to ‘new money’ won’t happen overnight.

And I’m not saying that it will happen on the stroke of midnight on 21 July this year.

What I am saying is that the crypto world has begun what I believe is an unstoppable movement towards setting up a radical new money system.

And that starts less than three weeks from now.

Can you imagine a system free from the meddling of government?

A system free from central bank manipulation.

A system where individuals and the market determine the value of money — not some stiff-necked, pin-striped fools sat in offices in Washington DC, London, or Sydney.

This is truly revolutionary.

And the SegWit2x initiative on 21 July this year is the first step in the revolution.

This is why it’s important for individuals to begin moving at least some of their wealth away from ‘old money’ and into the ‘new money’ of cryptos.

By no means do I mean that folks should ditch all their cash in favour of cryptos.

After all, despite the increased popularity, ‘old’ cash still has a wider reaching utility than cryptos — for now.

You still need cash to pay the mortgage or rent.

You’ll still need cash to buy a car, or pay for your groceries.

And there aren’t too many coffee shops or pizza places that take payment in Bitcoin — yet.

That said, it’s changing fast.

However, as excited as I am about the crypto opportunity, it’s still a relatively fledging market. And while I believe the death of the ‘old money’ system will begin this month, it could take time to fully play out.

Besides, look at the gains I’ve shown you. You don’t need to put a stack of cash in cryptos in order to reap the potential gains.

A small grub-stake of $200, $500, or $750, if this all plays out as I expect, could be more than enough to help you snag a terrific long term profit.

All of this is why, after much discussion with my publisher, I’m hoping you’ll join me in what could be...

great post..waiting to see

Sure Let Wait and see. It is not easy to dig out such information.

sure @franzucon..thank you:))

You've been UpVoted via the UpVote Experiment 002 Bot. Depending on my VP & the price of STEEM you should get a $.01-$.03 for your trouble.

Read more about this experiment here.

Thank You - @blueorgy

Thanks

Hello, read your article: What crypto's would you suggest to buy? and will your book be released soon?

Ethereum is the best crypto.

Thanks for reading. Well I would give everyone a heads up when its time . Cheers!!

Thank you

So Segwit2x is 'da bomb' and we need to HODL?

Ok with the latter and not sure about the former. But I definitely dig the idea of a big wealth transfer. This could also include gold BTW