Why I'm Not Buying Into The Bitcoin Cash Hype

Bitcoin Cash (BCH) was a fork of Bitcoin blockchain record that propelled on August first and expanded the square size to 8MB. The expressed objective of this fork is to bring down charges and accelerate exchange times. At the season of the fork, those holding Bitcoin got an equivalent number of Bitcoin Cash coins.

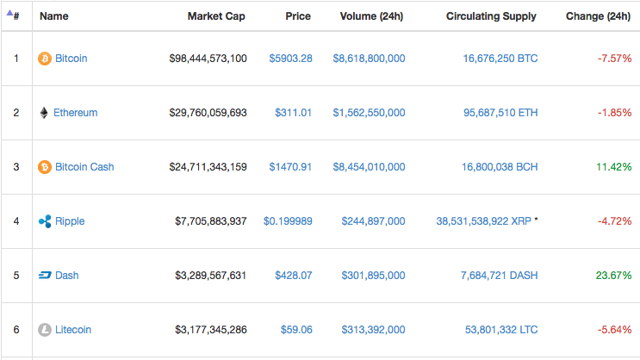

Bitcoin Cash is in the features after the cost spiked about 6x out of a matter of only 4 days. FOMO (dread of passing up a great opportunity) began to kick in and individuals offer up the cost from $400 toward the begin of November to a high of $2,450 on November twelfth. Bitcoin Cash surpassed Ethereum as far as market capitalization and many individuals began to trust it would overwhelm Bitcoin at the #1 spot. It has since dropped by to #3, yet not a long way from the valuation of Ethereum or 8x the valuation of Litecoin.

The cost of Bitcoin Cash (BCH) has dropped pointedly from the high around $2,450 to $1,200, before bouncing back to $1,450 in the course of recent hours. Lower highs and lower lows on the diagram is typically bearish for any valuing design. A breakout back above $1,500 in the close term would change this and another dip under $1,250 would likely prompt the cost smashing back underneath $1,000.

Another potential explanation behind the Bitcoin Cash pump is an up and coming fork of BCH. A few financial specialists are expecting free coins from the fork as they got when Bitcoin Cash forked from Bitcoin Core. In any case, this is truly only an element update which will endeavor to invert the crisis trouble modification (EDA) run the show.

Promotion

I didn't purchase the rally and contended against what I saw as a crazy valuation for Bitcoin Cash. I don't deny the versatility issues tormenting Bitcoin right now, yet Bitcoin Cash is an answer looking for issue. Why?

Here are my issues with this value rise and hypothesis of Bitcoin Cash strength…

Bitcoin Cash isn't taking care of any true issue and there is actually no purpose behind its reality. Litecoin, Dash and even Ethereum effectively offer quick and close to zero cost exchanges. Bitcoin Cash and those behind it are basically endeavoring to "money" in on the Bitcoin name, basically taking the marking.

Bitcoin Cash is more concentrated than Bitcoin and incorporates a CEO that issues official statements. Additionally, unending on-fasten scaling is accepted to crush decentralization.

Bitcoin Cash isn't so secure as Bitcoin. Since its system hashrate is significantly not as much as BTC, a little BTC pool can 51% assault it.

The advancement group has no place close to the competency of the Bitcoin Core group. Bitcoin Cash does not have layer 2 arrangements, for example, Segwit or Lightning Network.

Bitcoin Cash is upheld basically by diggers as they are capable benefit from an ASIC abuse (ASICBoost), which enables a little gathering to mine the coins at fundamentally more prominent productivity (20%+) than any other individual. Bitmain has an imposing business model on mining equipment and they are just tolerating Bitcoin Cash for their apparatuses.

In spite of this, it immediately overshadowed the valuation of Ethereum with no specialized advancement other than multiplying the piece estimate. Consider that for a minute. Bitcoin Cash, which actually just appeared a couple of months back and offers no obvious development, is right now esteemed at over $20 billion!

The valuation quickly obscured that of Ethereum, an organization that offers genuine advancement as the first and biggest brilliant contract stage on the blockchain. There is a reason that several new organizations have kept running on their ERC20 stage. Ethereum has a portion of the best coders dealing with the task, is rapidly enhancing their innovation and is relied upon to soon have the capacity to offer a larger number of exchanges every second than Visa, has executed private exchanges by means of ZK-Snarks and has constantly been at the front line of bleeding edge innovation.

The Enterprise Ethereum Alliance (EEA) has more than 150 individuals in the union, including ConsenSys, CME Group (NASDAQ:CME), Cornell University's exploration gathering, Toyota Research Institute, Samsung SDS (OTC:SSNLF), Microsoft (NASDAQ:MSFT), Intel (NASDAQ:INTC), J.P. Morgan (NYSE:JPM), Merck KGaA (OTCPK:MKGAF), DTCC, Deloitte, Accenture (NYSE:ACN), Banco Santander (NYSE:SAN), BNY Mellon (NYSE:BK), ING (NYSE:ING), and National Bank of Canada (OTCPK:NTIOF). Late increases incorporate MasterCard (NYSE:MA), Cisco Systems (NASDAQ:CSCO), and Scotiabank (NYSE:BNS).

However, promoters of Bitcoin Cash have figured out how to persuade speculators that it ought to be esteemed like Ethereum. Also, sadly for those financial specialists, the cost of Bitcoin Cash quickly smashed from $2,450 to only $1,200 in the course of recent hours, for a decay of over half.

I have no issue with new digital forms of money forking and attempting to contend in the market. In any case, Bitcoin Cash co-picked the Bitcoin name and is asserting to be the Bitcoin, pushing forward without the help of the center engineers that have conveyed Bitcoin to the place it is today, alongside a $200 billion market valuation.

While Bitcoin Cash offers speedier/less expensive exchanges at the present time, this is likely not economical after some time as the BCH blockchain develops. Since they don't offer second layer arrangements, this will in the long run turn into an issue for Bitcoin Cash, while the Bitcoin Core will have the capacity to scale with Segwit and Lightning arrangements.

However, as specified, there truly is no explanation behind Bitcoin Cash to exist. A few digital forms of money that are trusted and have been around longer, effectively offer close quick and zero cost exchanges. Dash has discharged another product redesign that slices exchange cost to close to zero, while multiplying system limit. The arrival of 12.2 of the Dash Core programming accompanies new highlights, changes and bug settles, the association declared recently.

Bitcoin Cash is being pushed fundamentally by diggers that can utilize the ASIC endeavor further bolstering their good fortune. Bitmain specifically would like to see bigger hinders that keep the ASIC misuse with a specific end goal to be more gainful. The protecting of this endeavor the Chinese diggers have put such a great amount of cash into is a key element of Bitcoin Cash as it keeps their leverage alive. Segwit stops this preferred standpoint, which clarifies why they are so threatening towards Layer 2 scaling arrangements.

This is fine, however what is best for the huge digital money excavators isn't really what is best for the bigger cryptographic money group.

Moreover, there is prove that a bigger level of the volume happening amid the most recent Bitcoin Cash pump was originating from Korean trades. Was the volume higher than normal, as well as a huge value premium.

With the excavators owning such a large amount of BCH, some have theorized that they can control the cost misleadingly and have either made or exasperated the value ascend in the course of recent days. Truth be told, there was an unknown digger that kept BCH alive by proceeding to mine the coin notwithstanding when mining Bitcoin was up to half more beneficial.

Roger Ver and Jihan Wu are two of the significant promoters of Bitcoin Cash and I trust they are endeavoring to persuade Bitcoin holders to dump for Bitcoin Cash. There might be philosophical contrast in how the two gatherings see Bitcoin, however this at last possesses a scent reminiscent of a basic money get and built plunge. Bitcoin Cash is likely a reinforcement get ready for those that bolstered B2x and they are edgy to pump a takeover coin that they can control.

Roger Ver told Forbes by means of email that he is offering his Bitcoin for Bitcoin Cash:

Bitcoin Cash is helpful in trade, and in this way can likewise be utilized as a store of significant worth," he composed, alluding in a roundabout way to the high exchange expenses on Bitcoin; Bitcoin Cash has much lower charges. Whenever inquired as to whether he was endeavoring to move the value, he stated, "obviously not. No dealer ever needs to be the one to move the cost.

Another enormous advocate of Bitcoin Cash, Jihan Wu, the CEO of Bitcoin mining gear producer Bitmain and mining pool Antpool, composed through WeChat, "At this moment we have both BCH and BTC, however we trust BCH has more potential." He denied that he or his organizations sold Bitcoin for Bitcoin Cash on Friday or Saturday amid the value gyrations.

As Charlie Lee, maker of Litecoin put it:

I think since excavators require a coin to continue mining utilizing Asicboost. They figured out how to trick the BCH supporters with their SegShit FUD. Without SegWit, it will never get future tech redesigns like LN, Schnorr, and so forth. No chance it can contend with BTC or LTC.

I trust that if the market was left to choose for itself, we would not see this gigantic draw in cost missing real news. The entire value pump does not appear to be normal to me, especially in light of the fact that different coins offer incredible abilities for quick and shabby exchanges, yet with better innovation and designers. Would anyone be able to truly influence a strong contention for not utilizing Segregated To witness (Segwit) to scale? For what reason does BCH decline to utilize it?

Bitcoin Cash has turned out to be fundamentally more gainful to mine than Bitcoin, taking has control from BTC. This is expanding the exchange time and expenses for Bitcoin exchanges. This could take half a month to redress, as the productivity for mining BCH drops and diggers move back to mining BTC.

In Satoshi's vision, many trust Bitcoin was never intended to be an all out cash or exchange layer. Bitcoin is an esteem layer or riches stockpiling layer and it fills this need exceptionally well. Sidechains will give the usefulness to quick and minimal effort exchanges and this tech is en route.

Then again, Satoshi Nakamoto's compatriot Gavin Andresen has said that he bolster Bitcoin Cash. He as of late stated: "Bitcoin Cash is the thing that I began dealing with in 2010: a store of significant worth and methods for trade."

Synopsis of Why I am Not Buying Bitcoin Cash

We are in an unchartered area with new innovation and new types of cash cutting out their place ever. It is without a doubt an energizing time to be alive. Notwithstanding, I don't trust that the ascent in the cost of Bitcoin Cash can be managed. I think it is being driven without anyone else serving mineworkers c

Look my freand

@a-a-a

@a-a-lifemix

@abdulla.emran

@abelanar11

@afifbou

@ahabib

@akramuddin

@alamin1

@always1success

@anarcho-pirate

@ankarlie

@arhan

@arkadiy

@arnikaakther

@arslan786

@atifhussain

@tikkh

@aymenz

@beautifulday

Congratulations @fouadahram! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOP