Steemit Mentioned In: How to File Tax Returns in India for Your Bitcoin Profits—My Latest Feature In TheQuint!

TheQuint ranks amongst the top news media agencies in India as a popular digital news publication. It was founded by some of the biggest names from the Indian news media industry. In the past they have ran a story on my journey with Bitcoin and Steemit.

They have also approached me for a comment in another piece titled: Still Unregulated, Bitcoin Trade From India Jumps in Global Market!

I've been continuing my efforts on spreading the word about Steemit in India. Today, my article on filing your income earned via Bitcoin was published by TheQuint. Read it Here!

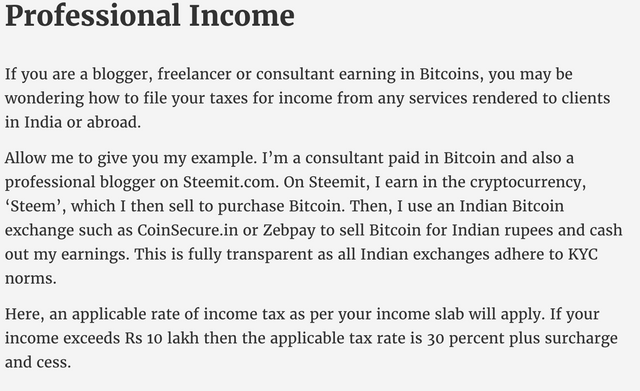

The following part of my article mentions Steemit. If you love using Steemit, then reading the entire article will give you a good insight into matters of accounting and taxation surrounding digital currencies.

In my time investing in cryptocurrencies in India, I've come across several hurdles with respect to taxation. There is so much ambiguity in this space resulting from ignorance. But mostly, it's due to the lack of any official guidelines, from any government agency dealing with matters of money, that confuses people and complicates matters.

After a lot of research, meeting different tax consultants and income tax officials, I have narrowed it down to 4 ways that you can file your returns to avoid running into the authorities for not disclosing your Bitcoin profits or income derived via cryptocurrency.

If you are from India, I strongly recommend that you take 5 minutes to read my article on TheQuint and familiarise yourself with the nuances of filing your returns. I'm sure that it will clear your doubts and make it easier for you to proceed with blogging and earning on Steemit, and withdrawing your income via Bitcoin to your bank account in India.

If you have any questions, please leave me a comment below.

Disclaimer: This is my personal experience and is not to be treated as a financial and/or accounting advice.

If you like my work kindly resteem it to your friends. You may also continue reading my recent posts which might interest you:

- 4 Tips For Steemit Account Recovery & Wallet Security!

- Steemit.Chat Contest #7 + Contest #6 Winners Announcement!

This post is a whistleblower for those who say income from Cryptocurrencies can't be taxed. @firepower

Instead blame, curse and hate - we have the power to do workarounds from our side. We can be vigilant enough not to evade taxations on our own.

As an honest citizen, instead of worrying about taxations, we should find the possible ways so to avoid any legal discrepancies in future. No matter what Govt. does/takes action with regards to cryptocurrencies, it will remain an excellent platform for budding Entrepreneurs, bloggers and all who are creative as well actively looking for some passive income (having the risk factor).

The main problem arises when someone asks - "Where can I find the information related to cryptosphere?"

Unfortunately, there is a severe lack of sources where one can find adequate information on the taxation slabs for the same. Hence, they either pretend to ignore or say - they do not need to pay tax as Govt. is not showing any interest in this regard.

In this conspiracy, thank you for opening up with some useful measures that will surely help a lot of traders, exchangers and longterm holders as well.

Again, thanks to your contributions that always come loaded with so much of valuable information that one can read and get enriched with crypto awareness.

Resteemed it, so that it reaches to my every Indian friend to create a massive appearance.

Its a new information that you have passed for us.. and thanks for detailed description of tax slabs in all the four categories with your detailed article on quint @firepower

It's great to see that you managed to get Steemit some spotlight in such as big media outlet! Good job! :D

It's also incredibly important to teach people about cryptos and tax; I think a lot of people are afraid of collecting too much crypto because of the difficulty of taxing it correctly. It can be really difficult in some countries!

Yeah, glad to your real info, for that we can achieve more benefit,,, @firepower

@firepower Good post and excelent information ^^

Thank you.

Great post and congrats for the feature. As some (and you) said, because of the KYC norms, any money we earn wont be going unnoticed. And the reason why we will HAVE to show it as income and then follow the tax rules. But I am not complaining - gotta keep a 'clean' profile under the laws. You never know what Mr Modi and his team are upto :-D

There will be much moe power, generated by Indian people. There is a HUGE market, let them STEEM into the crypto!

Congratulations @firepower

@firepower is same rules apply for Pakistan ?

If you are converting into cash via apps that require KYC, then I guess its a YES

I don't like this. Stay anonymous, avoid government intervention. But I still commend your efforts. Maybe this could bring cryptocurrencies to the mainstream