Steemit is NOT a Ponzi scheme. But is it sustainable?

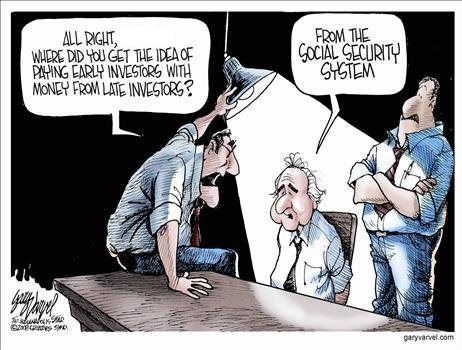

I discovered Steemit a few days ago. Like most newbies, my first reaction was "boy, this looks like a beautiful 3.0 Ponzi scheme". I started looking around to see if anyone had analyzed the issue in more details. Here's the best analysis I found so far.

And here's my own input to the discussion, divided into three questions.

1/ Is Steemit a Ponzi scheme?

Technically, the answer is no. @gavett provides a fair analysis of the question and concludes that Steemit is not a classic Ponzi scheme.

In a classic Ponzi scheme, the value of an investment derives from the continuous inflow of new investments. With Steemit, the value of an investment in Steem Power derives from the potential value of the ecosystem in the long run. This potential value remains highly uncertain because we can only speculate over the possible applications of the platform in the future, but it is not ultimately conditioned by the existence of future investments. In the first case, the average return on an investment equals the investment itself, which does correspond to a Ponzi scheme if that value is unequally distributed. In the second case, the potential value is unknown, which corresponds to the idea we should have of a regular investment.

2/ Is Steemit's funding model sustainable?

Now that we have clarified the semantics, let's get to the core of the problem. Steemit is a social network, it exists because people interact on it. On the basis of this network, Steemit has the ambition of creating a cryptocurrency that will be used by the people composing the network. So Steemit could exist in the absence of the cryptocurrency but the crypto wouldn't exist in the absence of members providing the trust component needed to back the currency [obvious but bear with me].

Steemit will grow as long as people find value in the ecosystem. Now, where does this value come from? It comes from the comparative advantage of Steemit over other options (Reddit, etc.). What is that comparative advantage for now? It resides in the possibility for authors and curators to get a financial reward for their work. And where does this financial reward come from? From people having invested bitcoins into the ecosystem. In the absence of these external investments, the creation and distribution of Steem money would have no value.

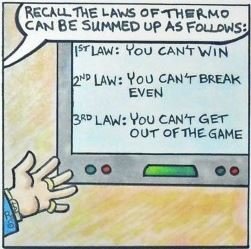

So the growth of the network depends on its capacity to reward existing and new users. This capacity remains effective as long as the inflow of bitcoins (investments) remains larger than the outflow (rewards). The question therefore is to know whether this balance can remain positive during the period required for the ecosystem to create external value needed to provide economic returns to investors. In the absence of external value creation, past investors will leave the boat, new investors will stop showing up and the balance between inflows and outflows will become negative (leading to the collapse of the system).

3/ Which assumptions underlying Steemit's vision might be problematic?

Anyone reading the white paper will agree that some considerable brain power has been dedicated to design the platform. I'm sure @dantheman & al. have thought about these issues with rigor and intelligence. So there are two options: (i) I'm missing something ; or (ii) the founders made implicit or explicit assumptions that might not be warranted. While I sincerely do not exclude the first option (please show me the light), it seems sensible to explore the second option as well. There are two assumptions that could prove to be problematic in the long term.

First problematic assumption: increases in the money supply have little effect on inflation

Several key components of Steemit's DNA rely on the assumption that an increase in the monetary base of the Steemit ecosystem will have little effect on the external value of Steem money :

At first glance, 100% annual increase in the STEEM supply may appear to be hyper-inflationary and unsustainable. Those who follow the Quantity Theory of Money may even conclude that the value of STEEM must fall by approximately 5.6% per month. We know from countless real-world examples that the quantity of money does not have a direct and immediate impact on its value, though it certainly plays a role. (White paper, p. 36)

The authors mention the significant increase in the US monetary base to illustrate their point:

From August 2008 through January 2009 the U.S. money supply grew from $871B to $1,737B, a rate of over 100% per year and then continued to grow at about 20% per year for the next 6 years. All told the money supply in the U.S. has grown by 4.59x over less than 7 years. During that same time, the value of the dollar relative to goods and services has fallen less than 10% according to the government's price index . This real-world example demonstrates that supply is only one component of price. (White paper, p. 37)

So what is wrong with this analysis? First, the increase in the US money supply was driven by the FED increasing bank reserves, to such extent that they created over 2 trillion dollars of excess reserves (i.e. reserves not needed by banks). So while the figures do show a considerable increase in the money supply, that money did not actually reach the markets because banks did not use the reserves to back additional lending in the economy.

Second, even if they had lent that money, looking at the government's price index wouldn't be enough to make that point. We would need to look at where the money went and what happened to the prices within these specific markets (e.g. if you inject excess money in the housing market or in financial markets, assets in these markets rise but other prices might remain perfectly stable).

Finally, the US dollar is an international reserve currency, which means that it the effects of an increase in money creation will have a different effect than in a closed economy. Steemit is a closed economy, Steem money can only be used within that ecosystem. If the money supply increases, that money will be used and affect prices in that ecosystem, not another.

The whole reward system and the incentive mechanisms for long-term involvement are all based on the assumption that the value of Steem money will not be affected too significantly by a massive increase in the money supply. This assumption seems unwarranted. As soon as the first signs of prolonged depreciation of Steem money become apparent, it should be expected that an increasing number of people will cash out, thus driving the value of Steem money even lower, initiating the infernal spiral.

Second problematic assumption: Market capitalization will keep on increasing until Steem money becomes useful by itself

As mentioned earlier, Steemit could generate external value allowing the system to provide economic returns to investors (how this could be achieved remains to be determined but it seems possible). Such returns are necessary to maintain a positive balance between bitcoin inflows and outflows, which in turn is necessary to retain existing users and attract new ones. For this to happen, the 10% market capitalization allocated to contributors (i.e. authors, curators and miners) needs to be large enough to compensate every single person using the platform for monetary returns.

While "innovators" and "early adopters" are here for the vision (for the most part hopefully), it would probably be wishful thinking to expect that the network will grow on the basis of that population alone. Self-interest is the only sustainable driver (it's sad but let's be pragmatic here) and, again, monetary incentives are the primary comparative advantage Steemit has over other platforms, for now. If the financial basis allowing the distribution of monetary incentives does not increase proportionally with the amount of users, the system will collapse.

The founders assume that using 10% of the market capitalization per year is realistic because Bitcoin itself used a higher rate for a prolonged period of time:

The total rate of expenditures used to reward contributors is about 10% of the market capitalization per year, a rate well below what Bitcoin sustained for the first 7 years after it launched. (Steem white paper, p. 36)

The key difference here is that the rewards Bitcoin distributes are based on transaction fees (which suck, agreed), fees that people are willing to pay in exchange for a service provided by the system. Value is therefore derived from the system itself. With Steemit, the value of rewards ultimately derives from the amount of bitcoins injected in the system. As long as the market capitalization keeps increasing, everything is fine. But the day the market cap drops for a prolonged period of time, the infernal fall downhill begins. Given the inflation problem identified above, this situation is very likely to emerge eventually.

There are some great insights underlying the vision behind Steemit. But these issues need to be further investigated in order to allow the ecosystem to survive long enough to make Steem money useful by itself, thus totally eliminating the risks of crowding out effects (which are slowed down by the two year Powering down process but not eliminated). We'll explore possible solutions for these different problems in a future post. For now, I'd be very interested to have feedback or references from people having explored these questions.

Thanks a lot guys!

The problems with this have already become apparent; as a result, they are doing away with 100% inflation: https://steemit.com/steem/@steemitblog/proposed-changes-to-steem-economy

Don't expect an update to the whitepaper. These devs are not big on documentation ;)

Great, thanks a lot for the link, I wasn't aware of these changes indeed. However, none of the modifications they mention would solve the issues outlined here. It shows that they are well aware of the problems inflation will cause in the long term but all they're doing is reducing the speed at which the car is going to crash. The inherent structure of the system remains flawed.

My impression is that the economics of Steemit need to be rethought from scratch. There are lots of ideas to keep and the overall vision is pointing to the right direction, but the fundamentals of the economic model need some serious and radical rethinking if they want the system is be sustainable.

Maybe, but a car crashing at 100 km/hr kills everybody involved; a car crashing at 9.5 km/hr is barely worth calling the insurance company about. Just because two numbers have the same sign doesn't mean they're not qualitatively different.

But who knows? Maybe you're right - time will tell. In the long run, the inflation rate isn't what will make or break Steem; the real problem is that Steem needs revenue.

As a food-for-thought comparaison, bear in mind that Bitcoin has had 4.5% inflation for the last four months and greater than 9% inflation for its seven years prior. Would you say that Bitcoin needs revenue? (I am not arguing that revenue is a bad thing.) I am merely pointing out that this is a token system and it works whether the tokens are worth $0.000001 or $10000000.

Bitcoin is generating revenue through transaction fees. I'm not saying this is the best way to do it, transaction fees suck. But Bitcoin and Steemit cannot be compared in this regard because their contributors are not compensated using the same economic model.

With Bitcoin, contributors are compensated by the users of the platform (through transaction fees) while with Steemit, contributors are ultimately compensated by the people who bought Steem money. The point is that the Bitcoin economic model relies on users (users leave, everything stops) while the Steemit economic model relies on people buying Steem money (users stay but these people leave, everything stops).

As long as you'll have more people wanting to cash out than to cash in, the fact that Steemit is a token system is irrelevant. For now, contributors will want to cash out. So again, the question is how do you create a revenue model that allows Steemit to be sustainable during the period needed for Steem money to become value in and by itself (thus making cashing out irrelevant).

I agree, two numbers of the same sign might well be qualitatively different. However, that's not the case here. The point is that there is a structural flaw in the economic model of the Steemit platform, just the way there is a structural flaw in our conventional credit-based model of money creation.

Reducing the rate of inflation is a mere bandage on a deeper wound. The money supply should not be determined ex ante by a predefined rate, it should be determined by demand. An ideal monetary model would be one in which prices are not affected by changes in the monetary base, thus keeping inflation close to zero. How to do that technically is a question that needs to be explored. But that's the direction to follow to develop a sustainable and attractive model.

On the fact that Steemit needs revenue, I totally agree with you. At least, until Steem money becomes valuable in and by itself. I'd sum things up slightly differently actually: revenue might be the short term problem (1-2 years) while inflation might be one of the long term issues (5-10 years).

I saw that the platform also faces immediate challenges with early adopters wondering whether they should stay or leave, but that should be manageable with a clear action plan and good communication.

This post has been linked to from another place on Steem.

Learn more about and upvote to support linkback bot v0.5. Flag this comment if you don't want the bot to continue posting linkbacks for your posts.

Built by @ontofractal

Congratulations @eemc2! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honnor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPBy upvoting this notification, you can help all Steemit users. Learn how here!

Congratulations @eemc2! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honnor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPBy upvoting this notification, you can help all Steemit users. Learn how here!

Congratulations @eemc2! You have received a personal award!

Click on the badge to view your own Board of Honor on SteemitBoard.

Congratulations @eemc2! You have received a personal award!

Click on the badge to view your Board of Honor.

Do not miss the last post from @steemitboard:

Congratulations @eemc2! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Do not miss the last post from @steemitboard:

Vote for @Steemitboard as a witness to get one more award and increased upvotes!