ICOs are new money making vehicles for Hedge Funds

It turns out presales are used to award Hedge Funds generous discounts on the ICOs tokens (running as high as 30%). The pre-sale funds are then used to promote ICOs to the general public at an inflated price, guaranteeing handsome returns to the Hedge Funds.

What’s the big deal you might ask?

On the surface, Hedge funds benefit only by 30% on their invested capital, while also being exposed to losses if the price dives by more than 30%. Their capital is burned on advertising budget with unknown ICO outcome. They lend their credibility on risk their reputation. You hear it long enough and sooner or later start to believe that the Hedge funds are adequately compensated for the risk. Or how the Industry likes to put it

– For believing in the Founders’ Vision.

Well, let’s examine the math behind such investments.

To illustrate the point, let’s consider a real case mentioned in the article:

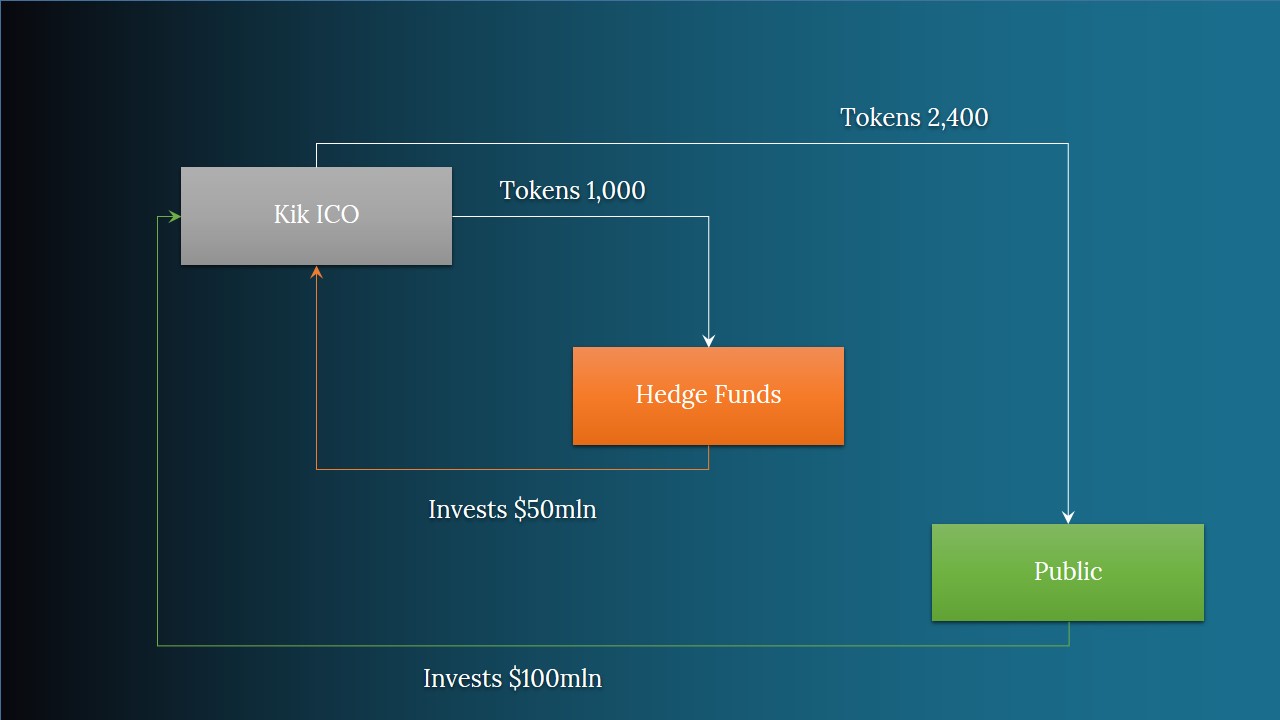

The 30% discount mentioned above was a life example of Kik ICO, where a band of Hedge Funds collectively contributed $50mln. The company then raised additional $100mln from the actual ICO to the public.

Now, let’s consider return profile of this ICO in a simple math example:

If party A sells party B tokens worth $714 with a 30% discount, then it means party B pays $500 for those tokens. So far so good.

If then party B finds party C to sell those tokens for $714, what the return would be? Right, it would actually be 43% ($714/$500 -1). Pretty powerful, is not it? But that's not the end of it, let’s go one step further.

Now instead of selling outright, let’s sell more tokens to party C to the tune of $1,000. What our tokens holding would then be as percentage of all the tokens? To answer we need to divide our $714 by the total of $1,714. We get 41.67% as the effective stake in the tokens.

Now, suppose that party B tells in a casual conversation party C that it bought $500 worth of tokens, without disclosing the actual number of tokens bought. What will be the impression of party C on the token market? Let’s examine what party C knows:

- Party B issued to party C tokens worth $1000

- Party B originally purchased on their own account tokens worth $500

What the Party C impression on their holding stake will be? Again, it is simple $1000/$1500 = 67% or two thirds, whereas in reality it is 58%.

Now let’s see what happens to party B and party C return profiles if token price declines by 30%.

To estimate the returns we use a simple formula:

Current market value of the holding less the initial investment

For Party C: $700 - $1000 = -$300 or a loss of 30%

For Party B: $500 ($741*(1-30%)) - $500 = $0 or breakeven.

See the magic unfolding? It gets even more interesting if tokens appreciate in price.

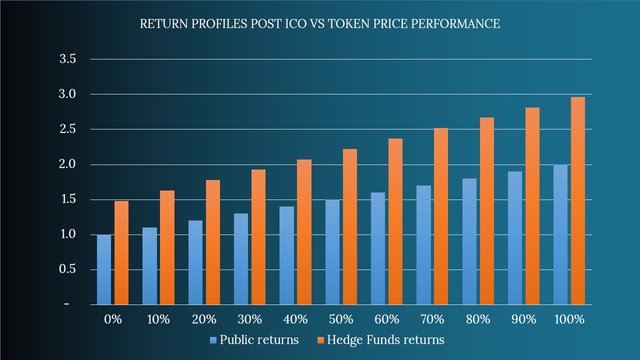

Below I have summarised the return profiles of general public vs. hedge funds given discrete token price increase of 10% post ICO.

The left axis shows the money multiple for a dollar invested. For example at 0% price appreciation public gets back their investment, hedge fund gets 1.5x initially invested capital.

If price doubles, general public gets, well, double the money invested, but hedge funds triple it!

But wait there is more in store. Let’s imagine that out of $500 invested by Party B, some but not all of them were invested in advertising to persuade the Party C to buy $1000 worth of tokens.

What if then next to it Party A and Party B have an agreement, that whatever is left of $500 will be returned to Party B in kind?

What happens to the return profiles of Party B and Party C? Well, the less Party B actually spends on ICO the higher it’s returns will be. Party C’s returns remain unchanged.

What happens to the notional amounts that Party B will be willing to give to Party A, should such an agreement be in place? The higher the announced amounts, the higher the expectation among general public that this ICO is the “next big thing” and the higher the ownership stake of Party B post ICO. The higher the ownership stake, the higher Party B potential returns and the lower Party C potential returns thanks to Party C ownership dilution.

I am not saying that it is happening, I am merely asserting the fact that there are certain incentives for such an agreement to take place.

Now replace the $500 with $50mln and $1,000 with $100mln and you’ll get the Kik ICO picture or any other where hedge funds are involved. How many are there? It turns quite a few. According to the article, over 80% of all ICOs run presales.

With such high number of ICOs, I think we, as a community, should ask ourselves two important questions:

- Do we worry about this trend and the ethos that forms around it?

- If the answer is affirmative, what can we do about it?

For me it is an answered question.

I have started a WTF series, where I assess based on the publicly available data claims made in the ICOs and try to arrive at implied valuation based on the public data. I believe that through such exchange of ideas we can arrive at the true value of the ICOs and avoid relaying on opinion of experts with vested interests.

My first post of the series is on Genesis platform.