EDENCHAIN (EDN) - The future of Enterprise grade blockchains

This is my first ICO review, so i will use the techniques I have outlined in my previous articles so far to evaluate Eden ICO.

Key Factors of ICO that will help if one should invest at ICO stage.

What are major ICO review websites saying about Eden

There are not many reviews for Edenchain especially by popular ICO review sites. This is surely a cause for concern. ICOdrops rates it high on Hype, low on risk and medium on interest. But on google, i am not able to find enough Hype.

Whitepaper and MVP

The whitepaper is very detailed. A large part of it is reproduced in the text below where i detail out what Edenchain is all about. A huge thumbs up for the whitepaper. Also they are very candid that they are building on top of Hyperledger Sawtooth.

Eden chain is working on 2 MVPs. The E-Explorer (blockchain explorer) and the E-Edge (developer portal providing blockchain and smart contract APIs).

The demo of E-Explorer MVP is released on April 30 2018.

https://edenchainio.wordpress.com/2018/04/30/demo-of-e-explorer-mvp-the-first-among-many-products/

The E-Edge dates are not released in the roadmap.

Team and Advisors

Eden's team is very solid with over 50 years of total experience between main team members. The CEO James Ahn is very well known in the Asian blockchain space as per some reviewers of this ICO that i read. He has been giving a lot of lectures on blockchain.

The CEO is on linkedin and has 500+ connections. He seems to be a serial entrepreneur and is CEO of all companies he started since 2008. He seems to have deep experience with machine learning. This seems like first attempt at blockchain.

The other founder Jenny Ryoo seems to have worked in same company as James Ahn.

The main developer only has 17 linkedin connections and also only 1 company listed. Seems like a new profile. can't say anything about his experience.

One developer, Brian Parks linked profile seems fishy. He is 17 years at Eden Partners Inc. His linkedin profile does not give me confidence.

The teams experience seems very minimal on linkedin. Their linkedin profile may be all new. They did do a detailed team review themselves.

https://edenchainio.wordpress.com/2018/04/13/an-opportunity-to-get-to-know-more-about-our-founders-and-core-developers-2/

There list of advisors seems solid. So along with CEO's profile and the advisor list, i will give the team and advisors a positive rating. The team may be very good, but difficult to review if they are not very active on linkedin for a while. I have no idea of Korean companies or their universities.

Token Economics.

The top 4 positives that I see are:

- With a total of 1 billion tokens and 400 million on sale at a price of 0.06 cents per token, the price has left a large room for token appreciation.

- The marketcap for this ICO is 24 million. Given that the nearest blockchain project is more than 30x away in terms of market cap and Korean blockchain front runner ICON is 70x+ ahead of Eden, there is a lot of to grow.

- Hyper-deflationary nature of the token. After 2020, there will be token burn and this will result in further appreciation of token value.

- Team and Partner tokens are locked up for 1 year.

The Presale bonus is decent and does not give any reason for pump and dump fear. 20% in Round A and 10% in Round B. This is as per the best practices to slightly reward the early investment.

Team and advisors have 33% tokens which seems normal. 10% is for Foundation. Not sure if that is again team or some other parent company. Not sure how Foundation will use the 10%. Overall it does not matter in short run as team and partner tokens are locked up for an year, so investors need not have fear of dumping from this lot.

Bounty program has 5% tokens which is a little high, but guess Eden needs to create enough Hype for its project.

12% tokens are kept aside for Platform adoption. This is a good move, but seems on the lower side to me.

Overall i feel that token metrics are good for long term token value should Eden deliver on all its promises. If Eden does deliver, then the token value may rapidly multiply to come to balance with the marketcap of other similar stage blockchains (not even talking about the live blockchains here).

Hype and social Media

- Telegram has 14000 + members (review - good)

- Twitter has 1800+ followers (review - poor)

- Medium - Could not reach their medium page (review - very poor). Maybe because Eden has its own blogs on wordpress.

- Reddit - 170+ subscribers. (review - alright)

- Facebook likes - bare minimum (review - poor)

Overall Eden has fair presence on social media, but its hype is restricted to its Telegram chat. This is not good from long term perspective for global investors who want to see the token sky rocket on exchanges. But since this is a Koren ICO, there could be a lot of hype within Korea.

Roadmap.

Eden has published its roadmap on its website. I would have preferred the milestones to be explained in some document if not the roadmap itself. I have seen better roadmaps and Edens is very brief. If its brief because they know exactly what they are doing, then great. If its brief for some other reason, then i am worried.

Summation of Edenchain ICO review

- ICO Name - EDENCHAIN or simply EDEN

- Token Label - EDN

- Token Type - ERC-20 for now. Will be exchanged 1:1 with main Eden Token once Edenchain is live.

- Investment Phase - ICO Presale round B (10% discount) followed by Crowdsale. Presale round A had 20% discount.

- Whitelist - Closed for all investment phases

- KYC - Yes

- Hardcap - 24 million USD.

- Tokens - 1 billion EDN. 400 million out of this for sale.

- ICO Review Verdict - Since i missed the ICO whitelisting, i will try to buy EDN on exchanges (if it does not shoot up very high one day 1 itself). I feel that there will be unmet demand. Similar ICOs are already more than 10x. Having said that, the fact that no one is talking about this ICO outside the Telegram network or closed Private Sale quarters worries me on its future on the exchanges. I am hoping that Edenchain will bridge this gap soon and ensure there is enough hype created to ensure the investors are well rewarded should they want to sell on the exchanges sooner (shillers) or later (long term investors)

Key terms and words that epitomize the Edenchain

- Permissioned Blockchain

- Decentralized management of the permissioned nodes via inclusion of community members, enterprises, users.

- Lack of Censorship on data just like any permission-less blockchain

- Secure Interoperability using Intels SGX enclave for running PoET, MVT and Majoriting voting algorithms and also use of HTTPS and ECC-TC cryptography for encryption of data.

- High Performance and theoretically infinite scalability using Namespaces

- High availability using Global cloud DNS

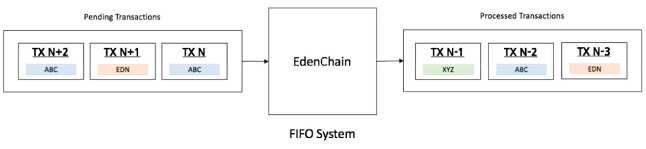

- Guaranteed execution of all transactions using FIFO algorithm

- Low Transaction Fees using FIFO and PoET algorithms

- High efficiency from running Smart contracts only on some nodes

- Developer friendly blockchain with Developer Portal (E-Edge) providing blockchain APIs that reduce learning curve to develop and deploy smart contracts on the blockchain.

- Hyper-deflationary from 2020 as Eden will be burning the tokens at a predetermined rate.

- Masternodes

- Good tokenomics

- Ethereum Virtual machine solidity language support for smart contracts

They say the devil is in the details. In case of Edenchain, the more deeper you go, the more comfort you get from their promise of a secure enterprise grade blockchain. So why wait, lets dive in.

What is EDENCHAIN

Edenchain or simply Eden is a blockchain platform, designed for global Enterprises and Enterprise users. It is a Permissioned blockchain (as against Bitcoin or Ethereum which are permissioned). To stay as true to blockchain idealogies, Eden will be implementing a decentralized committee to manage the Permissioned blockchains and promises zero censorship on the data.

What exactly is Eden solving.

With so many blockchain platforms out there and new ones springing up in quick successions, it is extremely important to know the value proposition of Eden is as few words as possible.

Eden is trying to solve the major problems that Enterprises face with existing blockchains - performance and non-secured connectivity. As read further into this article these two main aspects will be explained at every nook and corner of Edens blockchain solution.

Enterprises needing to implement blockchain solutions may want to transfer private data to the the blockchain for transaction processing. Since this data is private (like users sensitive data or data that carries enterprise secrets), it can't reside in the blockchain and must always come from Enterprise's own data stores every time the data are needed. It is important that this information is transmitted securely. Eden's key value propositions among other things lies in the secure on-chain and offchain-transactions using E-Bridge Layer (detailed out later in this review).

Eden's Vision

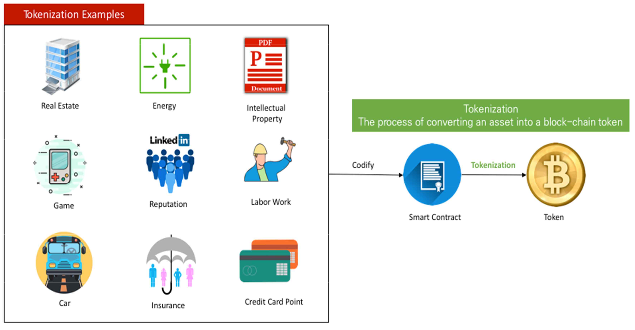

To become a programmable economy platform for the world. Eden envisions a world where you are able to employ the blockchain smart contracts to capitalize any and every tangible and intangible asset into tokens and trade freely without the interference of any middleman. On Eden anything from your reputation to your car can be an asset that can be monetized.

EdenChain can be used in a wide range of applications and industries; to provide an ICO Platform for start-ups to launch their own ICOs across all sectors such as IoT, B2B, services, P2P Finance, shared economy and etc. EdenChain supports Solidity, currently the most popular smart contract language.

How does Eden Standout?

Eden understands well that to rope in Enterprises to its blockchain it must resolve some of the issues that Enterprises face today with existing blockchains, namely, Performance, Scalability, High Availability, Secure Interoperability / Communication and Low Costs.

Eden is built on top of Hyperledger Sawtooth (a project by Intel) and plugs all the gaps to provide a robust enterprise grade blockchain.

Below i outline how Eden solves some of the Problems that plague the current blockchains, but each of these topics is a paper on its own and i suggest you read the whitepaper and other related articles (All links are in the reference section at the bottom). Before i embark on Edens solutions, it will help to understand Edens architecture first.

Eden's High Level Architecture

Edenchain is being smart and reusing the industry and globally vetted solutions. For instance it incorporates the best of Hyperledger Sawtooth (PoET, Radix Merkle Tree, Transaction Execution Scheduling to resolve transaction dependencies, Namespaces for performance), Ethereums EVM (which is already vetted by Industry as robust), Industry vetted Oracle software and also offers many features to solve the blockchain problems like Global cloud DNS for high availability, EVM smart machine executor for secured smart contract execution and secured Interoperability using E-Bridge architecture.

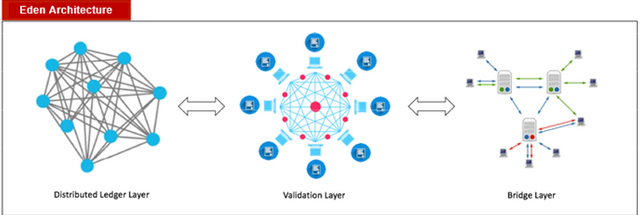

Edens architecture is based on a 3 layer structure.

*Distributed Ledger Layer - The distributed ledger layer is a place at which data used in the blockchain are separately stored, and only data of transactions agreed to in the validation layer are processed. Distributed ledger data can be added through transactions. Only validated data can enter the distributed ledger.

*Validation Layer - The validation layer is where a transaction is executed and verified, and includes an EVM to run a smart contract. The validation layer has a transaction scheduling function, which has a significant impact on the performance and scalability of EdenChain.

*Bridge Layer – Edenchains E-Bridge architecture guarantees zero-knowledge trusted connectivity between on-chain and off-chain. The bridge layer is used to securely import data needed by an on-chain smart contract within the blockchain in cooperation with an off-chain. In the bridge layer, nodes naturally exist on-chain and offchain, and an E-Protocol using ECC-TC, which is an encryption technique, is used for reliable communication between these nodes.

Performance, Scalability and Flexibility - Eden is solving these with

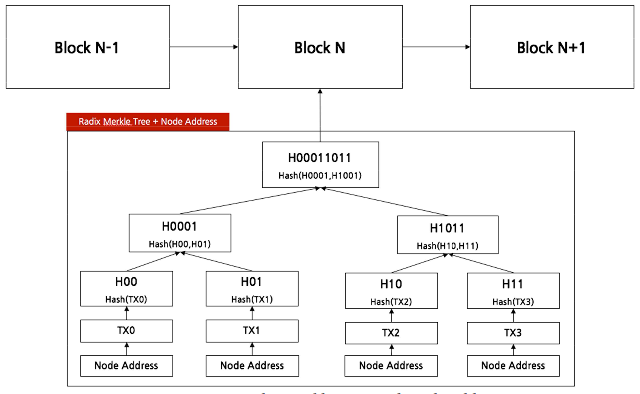

Radix Merckle tree for fast validations of block.

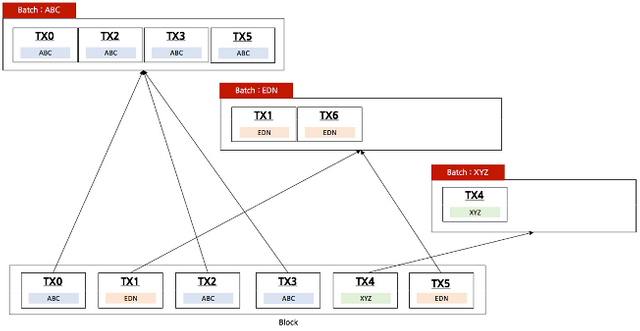

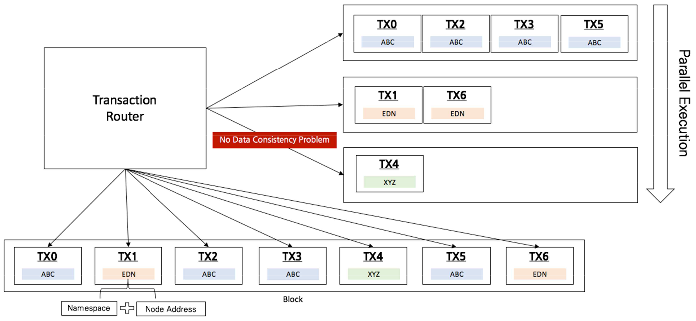

Parallel execution using Namespace technology for increased throughput. This involves

Namespaced transaction and

Transaction routing by namespace

Linear scalability - Since Namespaces can be spawned on need basis.

Each namespace can process up to 1000 TPS. Depending on the need of the enterprise, multiple namespaces can be adopted, offering flexibility over the computational resources needed. Therefore theoretically the scalability is infinite.

Interoperability and its security issues - Eden is solving these with

Secure on-chain and offchain interoperability using E-Bridge architecture, Median Voter theorem consensus for E-Oracle transactions, Intels Software Guard Extension s (SGX) Enclave for secure transaction processing and E-Protocol using ECC-TC and HTTPS encrytion for secure data communication between onchain and offchain nodes. Also onchain EVM.

Secure Interoperability is one of Edens key value proposition and an extremely important one to encourage Enterprise participation, therefore i will delve more into this topic.

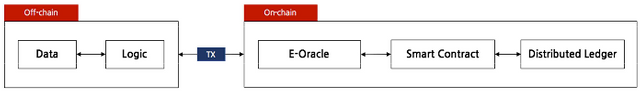

Eden uses the concept of software connectors to bridge the on-chain with the off-chain

The above diagram may be a bit off as E-Oracle server resides off-chain and only the E-Oracle client resides on-chain as per the whitepaper

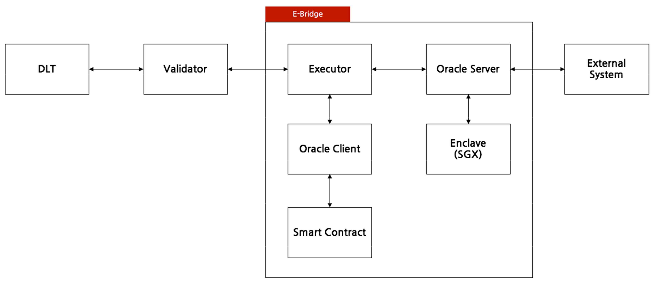

Eden calls this connector E-Bridge and its is the core technology of the Bridge Layer. E-Bridge consists of an executor that executes transactions (this is where the EVM resides), an E-Oracle client forwarding external data access requests from the smart contract, an E-Oracle server processing requests from clients, and an SGX Enclave, a Transaction Execution Environment (TEE) running E-Oracle Server programs. Executor and E-Oracle Client are located on-chain. E-Oracle Server and SGX Enclave are in offchain, so E-Protocol is used for secured connectivity to connect On-chain and Of-chain module within the E-Bridge.

EdenChain’s E-Bridge guarantees zero-knowledge trusted connectivity between on-chain and off-chain data. The architecture is designed to ensure secured connectivity that the Oracle server and SGX Enclave, are located off chain and an executor and oracle client on-chain, through the use of HTTPS and ECC-TC encryption. Furthermore, the executor that is equipped with the Ethereum Virtual Machine (EVM) is run in insolation to ensure security. To further enhance security in the E-bridge system, the E-Oracle server are operated in a separate space called the SGX Enclave, which protects data and programs running in the enclave from attacks by placing programs in separate spaces, encrypting the data, and making them unreachable by external processes

- Connection between the Oracle servers is secured using ECC (Elliptic Curve Cryptography) - TC (Threshold Cryptography).

- Connection between Oracle Servers and data sources is secured using HTTPS

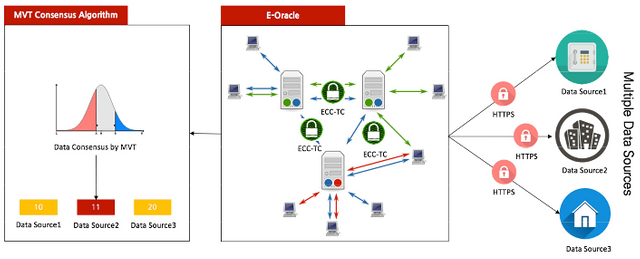

- Median Voter Theorem algorithm is used for arriving at consensus for Continuous data type and Majority Voter algorithm is used for arriving at consensus for discrete data type (these algorithms are run within the SGX enclave making them tamper proof and resistant and hacker attack).

The below diagram illustrates the security aspect of E-Bridge Layer very clearly.

Transaction Fees and fairness for leader selection issues - Eden is solving these with

- FIFO implementation for transaction execution. This ensures affordable and reasonable processing cost for smart contract execution. Uses FIFO to ensure all transactions get processed which lowers the fees.

- Proof of Elasped time for consensus algorithm which greatly reduces energy requirements.

PoET not only ensures fairness while selecting a leader, it also helps Edenchain achieve high performance and reduced costs through its efficient execution and low energy requirements.

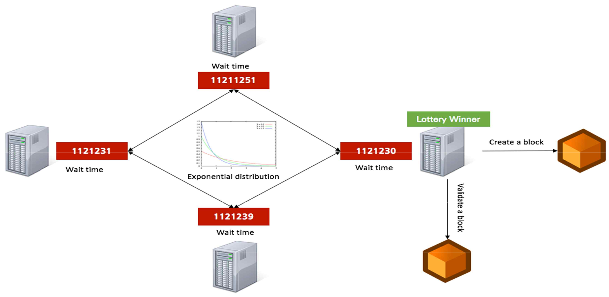

PoET provides an opportunity to become a leader with block generation authority for all nodes participating in a blockchain network with a probability similar to that used in other leader selection algorithms. PoET is implemented in an SGX enclave so as to defend against hacker attacks and allow the leader selection process to proceed safely.

At each node, PoET uses a CPU command in the SGX enclave to obtain a wait time that follows an exponential distribution as a random number and select a node having the smallest wait time as the leader.

Availability issues - Eden is solving these with

- Global Cloud DNS. Utilizes Cloud services with multi-datacenter pattern (from Amazon) using a global DNS and a load balancer to achieve high availability.

Various consensus algorithms being used by Eden

- PoET consensus algorithm for leader selection to run the block verification. Runs off-chain and in SGX enclave for high process level security against hackers.

- MVT and Majority Vote consensus algorithms by the Oracle server for data selection from multiple data sources. Runs off-chain and in SGX enclave for high process level security against hackers.

Edens Partnerships

On a technical plane Edenchain has joined the Hyperledger community.

Eden believes that the future users will be enterprise users and therefore it is very important to have an Enterprise first strategy (as users will follow the Enterprise projects - which is what we are seeing on permissionless blockchains like Ethereum as well). In this regard Eden is developing two projects to attract more industry partners.

The first project is HelloEden. HelloEden is an ICO platform that provides all the necessary services to business owners who want to launch an ICO. Although not enforced, HelloEden also actively encourages users to host their ICO on the the Eden Platform.

The second project is to secure a business partner with a extensive network. Talking with business partners within Korea reveals that ICOs and blockchain technology have a close knit relationship. Eden aims to procure more partner industries through their existing network.

As part of the above projects Eden already has the following Partners that will i After all if no one builds business on top of the blockchain then its adoption is impacted.mplement projects on its blockchain

- ICO Platform (HelloEden) - Partnered with M&K PR, the number one Tech PR / Marketing firm in Korea.

- B2B Platform - Partnered with Cleandeal. Cleandeal is a B2B open-market platform, ran by YT Corp. that has supply agreement with Hyungji Corp., KHMA(Korea Housing Management Association) Org., Embrain Corp. etc. EdenChain platform provides coin and blockchain technology that is needed for Cleandeal’s B2B service

- P2P Finance - Partnered with MyCreditChain. MyCreditChain is an affiliated company of Korea’s number one Fintech company, Finger, and it provides P2P financial service. MyCreditChain will utilize EdenChain Platform to provide coins and blockchain technology required for its P2P service.

This is just the begining. Eden recently signed an MoU with Across Asia Alliance which is a huge network of 21 incubator/accelerators with 780 traditional startup companies (AUM over $700m with more than 780 traditional startups in their portfolio). Under the agreement of the MoU, AAA will help member’s portfolio companies to conduct reverse ICO using EdenChain as their ICO platform. Hurray to fast paced adoption by business.

These partnerships will pave the way for Edens long term success

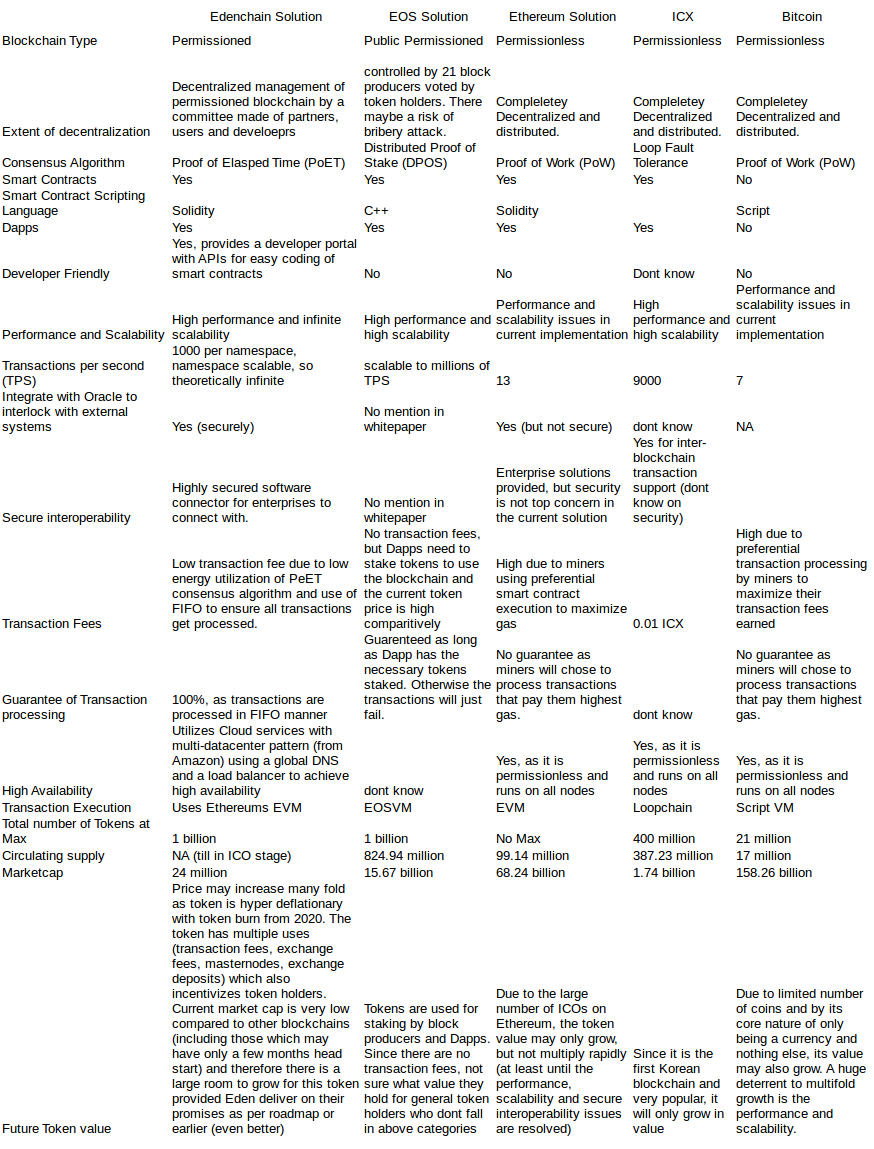

Competition and comparisons with other blockchains

As per Edens CEO Ahn Myong Ho (also known as James Ahn), the closest competition is EOS for public permissioned blockchains (though Eden is Private permissioned blockchain) and Ethereum for Smart Contract execution.

Below table is a work in progress, so I apologize for incomplete work. Kindly help me point out the gaps and also any corrections

Interesting tidbit on Eden's Logo

Eden's logo as you may seen has 3 triangles. Each of the the three distinctive triangles represent key building blocks of Eden’s blockchain. They are the distributed layer, the validation layer and the bridge layer. The three triangles are also intertwined to illustrate the interrelationship between the three layers that set the foundation of Eden’s third-generation blockchain. The tiny round dots on each of the edge of the triangle represents either a node or a masternode.

Reference Section for almost all key terms used in this article and many more

Edenchain Whitepaper

https://edenchain.io/EdenChain-Technical-Paper-v2-en.pdf

Interview with CEO James Ahn

https://steemit.com/edenchain/@mikeey89/edenchain-ico-interview-with-the-ceo-ahn-myeong-0ee5d6be47833

MVP Part 1 - E-Explorer

https://edenchainio.wordpress.com/2018/04/15/preview-of-the-mvp/

MVP Part 2 - E-Edge (Developer Portal)

https://edenchainio.wordpress.com/2018/04/20/mvp-preview-part-2-e-edge/

Eden chain, a blockchain for the Enterprise

https://medium.com/@klblee0015_6023/edenchain-a-blockchain-platform-designed-for-global-enterprises-a85bbc6ae0c

EdenChain - a blockchain platform, designed for global enterprises.

https://medium.com/@klblee0015_6023/edenchain-a-blockchain-platform-designed-for-global-enterprises-a85bbc6ae0c

Edenchain(EDN) Vs ICON (ICX)

https://medium.com/@crypto.ricebowl/edenchain-vs-icon-can-edenchain-imitate-the-footsteps-of-icon-the-korean-incumbent-2f9a5b2a7a3d

Edenchain – Solving blockchains biggest problems!

https://edenchainio.wordpress.com/2018/04/23/edenchain-solving-blockchains-biggest-problems/

Korean sleeping giant - Eden Chain ICO

https://steemit.com/ico/@dawidrams/korean-sleeping-giant-eden-chain-ico

Interview with HJ Moon, head of business development, Edenchain

Eden ICO - Interview with the CEO, Ahn Myong Ho

https://steemit.com/edenchain/@mikeey89/edenchain-ico-interview-with-the-ceo-ahn-myeong-0ee5d6be47833

Edens Official Video

https://www.youtube.com/watch?time_continue=7&v=DWl2g7RFi8A

All official Posts at one place

https://edenchainio.wordpress.com/

Median Voter Theorem and its applications

https://www.cornellcollege.edu/politics/Reading%20-%20The%20Median%20Voter%20Theorem%20and%20its%20Applications%20-%20J.%20Poulette.pdf

Median Voter Theorem simplified through animation

Pros and cons of majority-rule explained in 5 min

https://consensusg.com/2017/06/06/pros-and-cons-of-majority-rule-explained-in-5-minutes/

Merkle Tree

https://en.wikipedia.org/wiki/Merkle_tree

Merkle Tree for blockchain

https://hackernoon.com/merkle-trees-181cb4bc30b4

Blog on Consensus Algorithms being used in blockchains

https://jornfranke.wordpress.com/2017/11/18/blockchain-consensus-algorithms-proof-of-anything/

Proof of Elasped Time (PoET) Specification

https://sawtooth.hyperledger.org/docs/core/nightly/0-8/architecture/poet.html?highlight=poet

Intels SGX Enclave Homepage

https://software.intel.com/en-us/sgx

What is a blockchain Oracle

https://blockchainhub.net/blockchain-oracles/

Disclaimer - I am only sharing my limited knowledge and for the sake of

knowledge alone. This is in no way an investment advice or legal or taxation

counsel. I am not qualified to provide any of these. This is also not a

recommendation or encouragement to invest in cryptocurrencies or ICOs

Great and detailed article. However, it should be noted that Edenchain is a team that is focused on developing their business and forming real partnerships with REAL businesses that have revenue and profits, and working products that are sold.

That probably explains why they do not have that much effort focused on creating hype on their social media channels. I think that they will do very well once the cryptocurrency community starts to realise this and Edenchain will grow significantly in value.

Also, while they have allocated 5% of their total tokens to bounty/marketing, it is important to note that their pre-ICO bounty program is only distributing 1mil EDN tokens (0.1% of total token supply). It shows that the Edenchain team thinks deeply about the long-term prospects of the project and intends to use the bounty allocation wisely in the future.

Thank you for the feedback. I was not sure of their timeframe for spending the 5% bounty allocation (did not gather that from whitepaper). I completely agree on their partnerships with rea1 businesses. I do have a section on their partnerships in my article and i do believe that having real business is important than hype in the long run. The hype aspect is only highlighted for short term investors.

Coins mentioned in post: