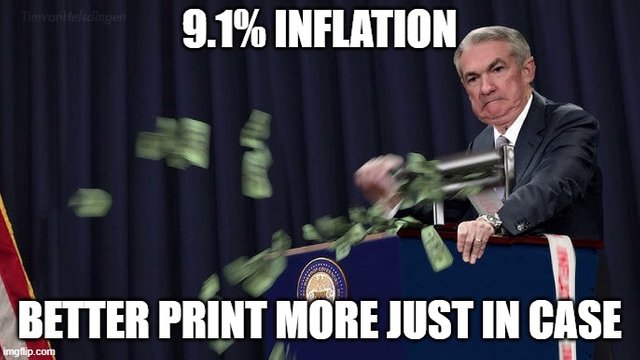

So You're Telling Me The Solution for 9.1% Inflation Is More Money Printing?

We all know where the market is heading — the goblin town. The dollar's inflation is 9.1%, and the interest rate is 2.65%. If you deposit your USD in the bank, you get -6.41% APY. Sweet money! From this time forward, I can see the FED keep raising interest rates to tame the 40-year high inflation. They already hinted that more rate hike is about to come. But what if, instead of raising the interest rate, the FED started printing money again? Yes, that's a possible scenario. Let me rephrase that: Instead of giving cures to the dying dollars, they might actually start feeding it poison, and the rest is hyperinflation.

You see, dollar is like a cancer patient; money keeps inflating like cancer cells, and the only cure, Chemotherapy, doesn't come without side effects. Enough with the metaphor. I was trying to say that rising interest rates or quantitative tightening can take a heavy toll on the financial system. The money or liquidity needs to stay liquid for the financial system to function properly. In a booming market, the economy created 'credits' out of thin air as IOUs, paying goods and services with future money, in short, borrowing. The economy keeps pumping leverages in every form possible, like derivatives, to stimulate growth. Then, the shit hits the fan, and they need money for the financial system to stay liquid, so they start printing. This is economic 101.

If you have $10 million of debt and $15 million in stocks, your net worth is $5m. Now if the stock market crash drops 50%, your $15m is now worth $7.5m, and your net worth is now -$2.5m. Notice how a 50% decline in the stock market decreases your net worth by more than 100%. That 2.5m bad debt, someone has to pay for it. Now imagine if a crucial financial system faced a liquidity or bankruptcy problem like this, the US government would need to print money to bail them out.

The obvious side effect of rising interest rates is almost everything loses its value against the dollar. Suppose we see a flash crash in the stock market because of the upcoming rate hike. In that case, the critical financial system might face liquidity problems, and the FED need to start printing money again.

Another reason for FED to just start printing again is the DXY is still pumping. Even with a 9.1% inflation rate, the dollar is still robust compared to other currencies like EUR or JPY.

If the money printer starts running again, BTC and other cryptocurrencies will be in a space shuttle ready to the moon.