Steem Daily Forecast 12-07-2017

Steemit Daily Stats (Monday, June 10th, 2017)

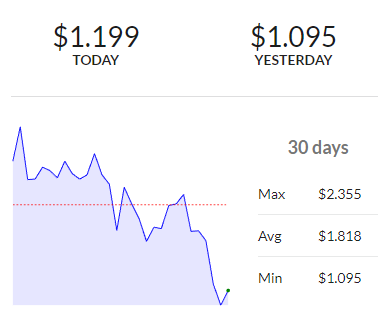

Price

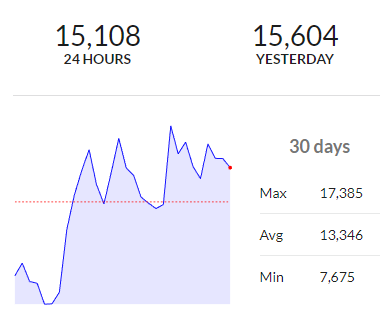

Posts

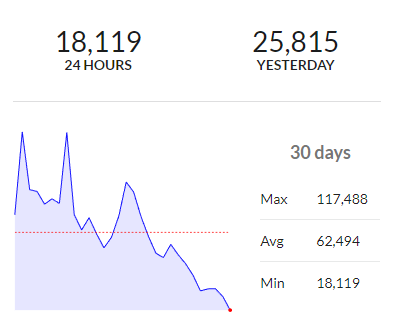

Daily Payouts (USD)

Macro Events

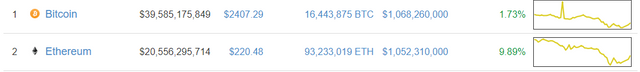

Bitcoin continues to be the most important Macro influencer of the crypto-markets. With most mid-high level cap altcoins coupling themselves to the movement of Bitcoin, the recent losses in Bitcoin have translated to even larger losses in the crypto space.

For example, ETH who once posed a thread to Bitcoin as the crypto asset with highest market capitalization has now retreated to around half of Bitcoin's market cap.

Arguably, the bubble in the crypto-markets have more dramatic effects on less mature coins such as ETH. Service infrastructure supporting ETH has largely been around scammy ICO's whilst very little around everyday use.

ETH will need to mature several magnitudes before making it's next attempt at the giant that is Bitcoin.

Meanwhile, STEEM remains un-immune to the effects of Bitcoin's uneasy position. Following a 300 dollar loss on Bitcoin, STEEM also made fresh new lows after a stunning start to the summer.

Technicals

STEEM

After making a fresh low of 36,000 sats on Poloniex, STEEM has since recovered to 54,000 sats at time of writing. Those who followed my cautioned advice to buy in the level marked by the green box would now be looking at a 20-25% gain.

The bounce from this critical area of support marked by the green box shows the resiliency of STEEM and it's fight to make longer time frame gains.

Previous weak support at 55,000 sats has now turned into resistance. Price will test this level but there is a very low (~15%) chance of breaking this level at this stage.

The likely scenario is STEEM will consolidate between 45,000 and 55,000 sats, making the equilateral triangle shown in the diagram.

Price compression in this triangle will last a few days before breaking out either above the triangle or below.

The likely scenario is price will make a complacency run towards the 63,000 sats range to form the right shoulder of the head and shoulders pattern.

Long term investors would be better off waiting for the resolve of this H&S pattern before making large bids. Remember, the price could break the neckline of 40,000 and make a full run at 25,000 sats before going sideways and back into a bullish trend.

Day traders can look at to buy in the area marked green with a stop loss just under 38,000 sats. This offers a risk of less than 2.5% with a potential reward of 10% on unleveraged positions. Look to take profit above 55,000 all the way to 63,000.

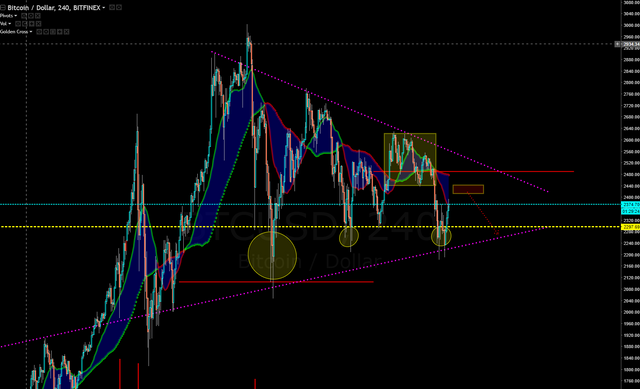

Bitcoin

Bears have made an attempt to kickstart the bear trend with sharp drops to as low as 2175. The price has quickly reversed back to it's current level of 2375. The short time spent at the lows is encouraging and marks the third time price has bounced from these levels.

Bitcoin remains in a large consolidation pattern marked by the purple triangle. An exit from the recent orderblock marked by the yellow box and sustained price below the monthly pivot means that this rally will be a short term one and will likely reverse at the box marked red.

Ultimately a break out of the large triangle will signal the long term trend of Bitcoin, as well as the crypto markets in general.

A break and close on the daily above the monthly pivot will signal the signs of a continuing bullish trend. Until then, taking profits off the table and staying mostly in fiat is the best course of action.

Shorting Bitcoin is always dangerous. Taking profit and waiting for the resolution of the triangle is the wisest move.

As always be mindful of the Bitcoin price. STEEM/USD is a synthetic pair with no active markets. This is why all of my analysis is conducted with respect to STEEM/BTC. A sharp fall in BTC price will mean a sharper fall in STEEM price in terms of USD.

Steem daily forecast is updated daily. Format is yet to be set in stone. Please upvote follow and resteem

~Bateman

Again keep up the good work. Great analysis.

Good luck with it. Check back for updates.

It's going me very volatile ... keeping an eye on it daily 😀

At this point, Bitcoin is more important. Probably wise to keep an eye out on that.

Nice post on these statistics, the info was useful to me thanks again and keep up the good work

Cheers. Steem on.

Why does bitcoin have anything to do with steem?

Bitcoin confidence compounds with alt-market confidence. The contrary is also true.

Cheers man! Bloodbath is over~ Now cryptos to the moon esp. Steem

Congratulations @bateman! You have received a personal award!

Click on the badge to view your own Board of Honor on SteemitBoard.

For more information about this award, click here

Nice post