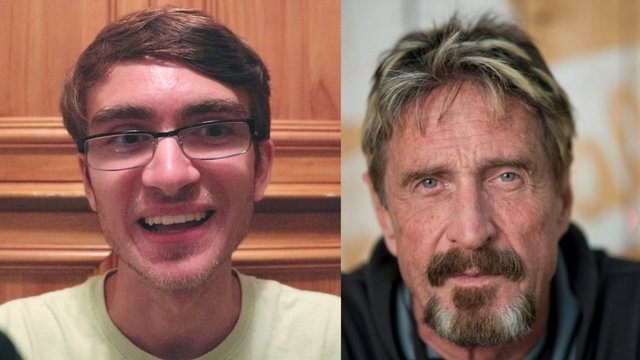

I Called John McAfee & He Won't Join Steemit Because Of This Flaw...

Last night, I published my Twitter exchange with businessman and computer programmer John McAfee. My goal was to introduce him to Steemit, as I know he’d be an extremely popular user.

I had to laugh because McAfee initially told me he didn’t have time for a phone call, but later changed his mind when I mentioned Steemit.

(I can't blame him, as I’m sure he gets hundreds of unsolicited messages per day from annoying investors.)

Despite his impressive net worth, the flaw McAfee sees with Steemit is lack of liquidity.

"In fact, the gentleman that I was looking at acquiring has about $600,000 in [Steem Power]. You just can't get it out. There's no liquidity."

At least for now, it looks like McAfee will be sticking to Facebook and Twitter.

Maybe he just prefers the fancy, blue "verified" check-mark on his profile?

Peace and love,

Andrew Demeter

Whoever this "creator" of Steem selling John McAfee one of his businesses is, it is certainly not Dan nor I nor anyone on our team.

Interesting post.

I sent John and many other libertarian celebrities DMs on Twitter asking for a phone call to explain Steemit from an Austrian Economics perspective and invite them to become users, with no solicitstion of investment or whatnot. He called me in less than an hour. He specifically mentioned that he was in talks to acquire a property of one of Steemit's founders. I immediately thought it would be awesome to see BitShares turned into John Mcafee's personal underground stock market ... he refused to name names. Very interesting... Now waiting for Mr. Tucker's call back.

I emailed Jefferey Tucker some info, and he replied saying it looks very interesting.

HMM very interesting indeed

That's funny, the thing most people are saying about Steemit is that it is a scam/ponzie scheme and that there is too much Steem and it will quickly be worthless because of it! John is saying the exact opposite.

I think he refers to cash liquidity for the exit scenario where you need $$$ to buy the steem dump.

But I don't think he gets the concept because if you buy, there's no reason to have it in STEEM. It's devaluing compared to Steem Power (which inflates in parallel to the total coin supply, to protect the investor from dilution, albeit slightly slower). So once you buy, you go to SP. And when you go to SP, liquidity (in cash) is no longer an issue because you can only withdraw 1/104th per week - so some level of cash liquidity will be able to cover a small dump like that.

this is kind of an absurd answer. The guy says "theres no liquidity" and you say "well thats the idea, there isnt supposed to be liquidity its SP"

Please explain to me how you can withdraw 600k in steem power in one go. You can't. At most you'll get close to 6k per week, and yes, there is 10 BTC liquidity to do that.

If he thinks about STEEM, instead of SP, then STEEM is the wrong investment (SP is the correct one due to dilution protection). You don't hold STEEM when you can increase them through SP at a very fast rate.

oh duh ok it was steem power, not steem im stupid. Well, i mean with the steem power its just an issue of flat out liquidity.

Youre buying something for value that you won't be able sell (for whatever reason). That non-liquidity makes it worth less than it otherwise would be.

His problem is he can't cash it out if he wants to. That decreases its value. I actually had the same issue recently when i was considering buying some old miners, but decided against it.

Im not neceessarily saying i agree, but pretending his liquidity concerns arent founded is still absurd.

Hes basically forced to hold his investment regardless of how he thinks it will perform.

Yes, hes remunerated for this with SP incentives, but thats cold comfort with double digit %age drops happening every few days.

As an example, i recently was talking to a guy about biuying a bunch of miners with around 100btc worth of SP. I passed on it for essentially the same reason... because he was only offering me a 20% discount on their steem balances and it wasnt worth it for the reduced liquidity.

Edit... im HOP. he was talking about 600K steem power.

And this is what I've been saying for a while.

Vest transfers are unnecessarily restrictive.

People should at least be able to transfer Vest ownership. Like shares.

This doesn't conflict with the objective of limiting tradeable liquid Steem, and it makes SP more liquid.

Encouraging investors to buy-in, with comfort in the knowledge that they'll be able to cash out.

While we're on the subject, could someone explain to me what my options would be if I made a post that was worth $10000. How much of that money could be cash in my pocket within a week? I plan to power up, just curious.

75% of the money goes to you, 25% to your curators. Of your 75%, half is allocated to Steem Dollars (which can be immediately liquidated to fiat via an exchange) and half is allocated to Steem Power (which are tokens that increase your influence on Steemit).

And while I have your attention, the more steem tokens and steem dollars I have, the more I get? I see in my wallet that every day I have more steem tokens. And powering up is turning steem itself into steem tokens?

I believe you're earning more STEEM tokens because they're being held and interest is accruing.

the interest rate for holding steem power is 90% per year

How is this even possible? Where is value coming from?

If you made $10000 post. $5000 of that would be SBD which you can change into steem in the local market on steemit (partnered with Blocktrades) and then you could send that steem to bittrex, poloniex or anywhere else and convert it to bitcoin (easy to do), or some other currency that you use a site that will let you sell the bitcoin for US Dollars or whatever your currency is and deposit it in your bank account. Different places report different time frames. 3-4 days is common.

I haven't done this myself though I have been researching it. I want more steem power so have mostly reinvested into that. Plus, I haven't landed any monster posts. :)

I have bought some things with bitcoin that I purchased with SBD. :) That works quite well.

The other $5000 will give you steem power based on what the current value of STEEM is in US Dollars. So if each STEEM coin were $2 your $5000 would give you 2500 steem power.

So in a $10,000 post you'd get $5000 SBD which you take steps to cash out immediately, and you'd get 2500 steem power (if in the example STEEM was going for $2/steem).

I hope that helps.

EDIT: This was also based on $10000 being the amount you received AFTER replies, votes, etc had received their cut.

I've done quite a bit of trading of Steem and Steem Dollar tokens. $5000-$10000 is not that hard to sell. If you had to do it right away you might have to take an extra 5% haircut or so. If you did it over a few days you could sell it with hardly any extra liquidity cost.

Yeah, I won't really worry about it until it happens, but I just wanted some quick info so thanks to both of you guys for giving it to me.

Good to see you curating and not just posting, respect.

That's because he's used to a world few of us know about: the part of high finance that includes illiquid investments (investments made illiquid deliberately by regulators.) Eg: restricted stock

Steem Power liquidity will be a problem if Mr McAfee only sees the platform as a monetary investment and doesn't see the value of the community benefits.

What would he say to 10% interest on his more liquid Steem Dollar?

My question is how and where is this interest coming from?

Perhaps there was an off-screen conversation we didn't get to see (email?), but I'd be careful posting phone call recordings without the explicit permission of the other person.

I believe it's illegal in most countries, even if they're your friend/spouse/whatever. Also, your friendship/reputation might erode rather quickly.

Then again, you probably did talk to him separately and asked for permission. Right?

Let´s face it, he´s as much of an idiot as kim dotcom (who as you may know earned his money betraying german BBS owners and snitching them out to the police... after that he got fucked for pumping letsbuyit stocks and dumping them on innocent europeans), so did mr mcaffee when he sold his snake oil antivirus.

TL;DR fuck them all. No one needs those hyprocites here and they aren´t steems real issue - the real issue is getting quality content, and they for sure, aren´t the ones beeing able to solve this problem.

He seems like quite a nice guy. I think he's got the Ethereum situation wrong though? sounded like he didnt realise that Ethereum itself had hard-forked. At first I was excited to think that he was going to come out in support of ETC.

The fact that he's going to purchase some #exchanges is the most exciting part of video for me.

Great share, thanks and followed!

12% of total coin supply has been created in just a few weeks and the volume is way to low when one considers the market cap. It's concerning to me.

I am giving away another $50 Steam card, come play:

https://steemit.com/steemit/@cryptobarry/i-am-giving-away-another-usd50-cdn-steam-card-on-steemit-or-pick-a-number-from-1-1000

Lol this is a pretty wild cat.

Oh, I thought you were talking about the Old man John Mcafee who writes for the NewYorker. I was all like, he'd write some great shit.

There's another John McAfee? My life is a lie!

Yes, he's a writer. Here's a link to an article with great writing advice. http://www.newyorker.com/magazine/2015/09/14/omission

I love that man. Why is he not the main candidate to US presidency?