Managing Expectations when trading SBD for STEEM

I've been meaning to post this for a few days now, but keep getting tied up with other projects and such. About a week ago, I had a series of back-and-forth comments with @valued-customer on my post from several months back, "DON'T CONVERT SBD to STEEM, BUY IT ON THE STEEMIT MARKET!" Once again, I feel this interaction is worthy of meriting its own post.

@valued-customer was upset (and I don't blame him... unfortunately, he literally bought STEEM right before the big sell-off) that after he bought STEEM with his SBD on the internal market, his account value DECREASED by $40 to $70! As such, he was asking for some insight as to what may have happened to account for this "unexpected result":

SBD was ~ $1.20 at the time, IIRC, so I thought I would increase my account value by ~ 20%, or so (Steemit valuing SBD @ $1, I thought). So, some part of my understanding was very, very wrong.

Here was my first response:

@alexpmorris: The "Estimated Account Value" that you see displayed in your wallet is calculated as the 7 day average value of STEEM, which has been going down the past few days.

However, on the internal market, the value of SBD (since they've been "printing" more of them, has been going down versus STEEM). On the internal market, it looks like from one of your trades, you sold 61.878 SBD to receive 34 STEEM, which is equivalent to a rate of 1.81 SBD / STEEM.

Now, I don't think this is even reflected for you yet, but the price of STEEM also just tanked 20% on the internal market versus where you traded your SBD as well, which can be attributed to a bit of bad timing. That's also why if you are looking to convert and can afford to wait, it's usually worth holding out for "tanks" such as these to take place before making your exchange. Of course, one never knows for sure, and it can keep going up. But usually you'll get at least a short "panic" opportunity at some point to catch a better price...

He responded as follows:

@valued-customer: Thanks very much for your insight. SBD had been steadily decreasing in value, and I expected that sooner was better than later to make the transaction. Clearly I was shooting at a target I could not see.

Where do you get that chart? Also, it is rather busy. None of the plots are labeled, so it is as opaque as my last (and first) trade was to my understanding.

I expect you are correct about the price of Steem impacting my account value. The loss seemed to be entirely caused by my trade, and I do expect further account value decrease as a result of Steem losing value.

It's true that some of the charts that I post may be a bit overwhelming for those less familiar with trading, and I do plan to post more on some of their features in the near future. However, my next response serves to better explain some of what is shown:

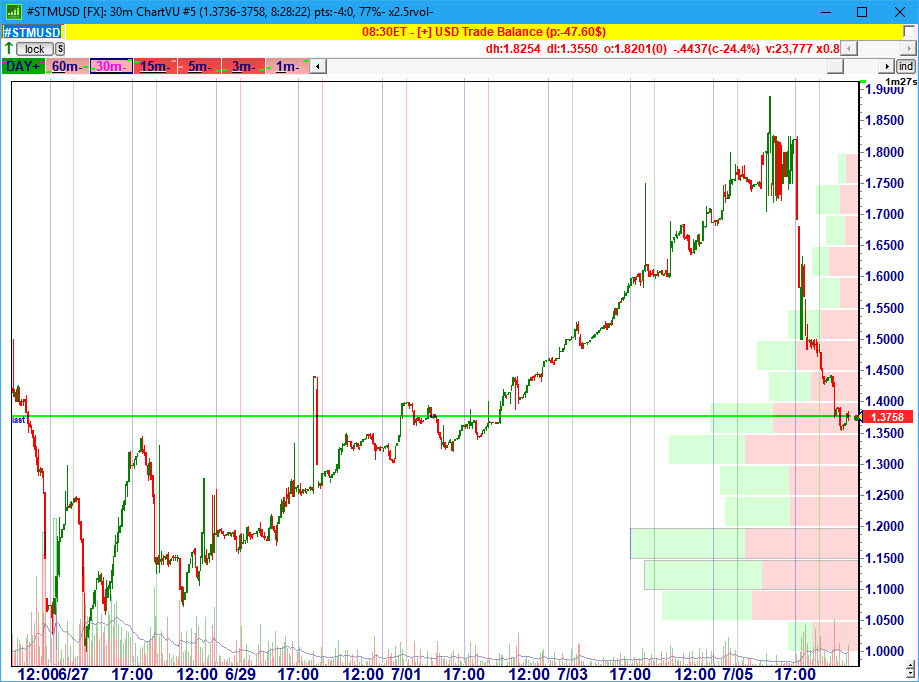

@alexpmorris: The chart is from my trading platform tymoraPRO tradeSCAN. All the indicators I use (besides following the raw price action) tend to be related to identifying a volatility distribution on the move, and also help identify when prices reach extremes on a various time frames.

This chart has lower band GMMAs (Guppy Multiple Moving Averages), 5/8/34 ohlc XMAs (Exponential Moving Averages), VolSqueeze (combination of acceleration bands and bollinger bands), VWAP, Volume/VolMA (volume moving average), VolTrails (volatility trails that track a sort of "pain point" for traders, sort of like a multi-timeframe version of Chandelier Stops), and VolByPrice (volume by price on the right). I could write several posts just on each of those!

But that should be enough for now if you want to google around a bit. Also, once you've studied trading long enough, you start to quickly get an idea all the indicators being used. Having each one listed on a chart often just takes up extra space. Here's one though with a bit less going on!

Of course, it was a bit busy on my first chart, so I do understand where he's coming from. The bigger point that I wanted to convey, however, was really to get down to the "price action". What that means is that you don't look at a chart as a bunch of bars or patterns, so much as for the "story" they tell you.

When you see a monument in a park, it doesn't signify a stone or a person, so much as the "great battle" that took place there, or the tremendous courage exhibited by these individuals. The price action creates the chart patterns, NOT the other way around...

For example, look at the wild volatility that expressed itself shortly before the price of STEEM started tanking about 10 days ago. Now think what was happening in those strange looking bars to cause them to appear this way, in this particular "combination" :

(here is the wild volatility zone, zoomed in, basically there was very little price liquidity over a 10 cent range after a slow and steady, and heavily over-extended run-up in the price of STEEM/SBD)

What you see here are people buying high offers and low bids with not much going off in between, until "out of the blue" the price of STEEM tanks. Think of it as a bit of "hot potato". Finally people just gave up, or placed stops just below that range, and when it broke, everyone piles on all at once and chases it all the way down.

So, where do I BUY?!

Now some might wonder where is the right place to consider going long again on STEEM? Well that's where some of these indicators come in. However, you must keep in mind the FRACTAL NATURE OF MARKETS! Meaning, with a move of this size and force, this is likely a large primary thrust down on a much larger time frame. What that means is that after a decent pullback, we're likely to see at least a secondary thrust lower to at best test the recent lows, and at worst, extend the first leg down in a symmetric fashion and then some...

So what's happened since then?

Well, here's that massive symmetric second thrust leg down on a 60 minute chart, but not before the first leg retraced over 50%, and nearly hit the 61.8% retracement level before resuming its downtrend:

If you're planning on holding most of your STEEM long-term because you're a big believer in the platform, you probably really shouldn't worry all that much about all these crazy volatile swings. However, you should still be okay with the "possibility" that things often don't quite play out as you hoped or expected they would.

Think of it more as a long-term option play... it could go to zero, or it could be a huge home run. And from that perspective, if you feel it would seriously hurt you (ie. you can't pay your rent) if STEEM prices go down, then adjust your holdings accordingly, and at least consider taking some off the table after a huge run-up!

That's why risk management and position size is so critical when trading and investing. Your level of "exposure" is one of the few things you can control in the markets (and in life). Of course, the other way this information can be helpful is, for example, if you've been busy accumulating SBDs at 50/50. Even better, let's say you converted a chunk of them to BitUSD or some other currency to lock in some of the recent premium, kudos to ya! :) You're now just waiting for an opportunity to increase your STEEM POWER holdings at better prices. You could do worse than just waiting out for the inevitable "dump" that always seems to come along, usually when you least expect it.

And regarding STEEM POWER as a potential long-term investment, besides the obvious ROI "dividends" you receive by posting and curating, I will make this one small point. With FaceBook valued at over $450 BILLION, and SNAP valued at over $25 BILLION, despite consistently losing more money each quarter, it doesn't seem all that far-fetched that STEEM's valuation could eventually reach and sustain at least some small fraction of that. And correct me if I'm wrong, but I'm also pretty sure that STEEMIT is cash flow positive for pretty much everyone involved!

FINALLY...

I wanted to note that with SBD trading below $1 USD again, due to all the additional SBD that's been issued recently (in an attempt to "rebalance" the system), you may also want to consider powering up a few posts again. Of course, if you still think STEEM will edge a bit lower near term (or you'd like to pull out some bucks for other purposes), stick with 50/50, as you can always exchange it for STEEM on the internal market later on. For more details on this, check @contentjunkie recent post, "Steem Backed Dollars are Below $1 Again - It Now Makes Sense to Do 100% Power Up Posts and SBD to STEEM Conversions".

Hope y'all found this post somewhat helpful and insightful, and STEEM ON, my Friends! :)

Wow man, this is an excellent post. There was a lot going on with that first chart lol, but when you cleared away all the indicators and told the story it all made sense.

I bought upwards to 1000 STEEM in the days before the collapse . . and after, I did feel a bit heartbroken. But after pondering for awhile, I came to the same conclusion you did. These volatile price swings are going to happen. This is crypto. But I believe in the longevity of the platform, and a year from now that will be a funny anecdote. "Remember the time I bought a bunch of STEEM before the market tanked and I was freaking out . . but now STEEM is 5 bucks"

Something like that haha

"after a decent pullback, we're likely to see at least a secondary thrust lower to at best test the recent lows"

Absolutely. This is typical. Thanks for keeping things in perspective and taking the emotion out of it. Emotions and trading do not mix.

thanks @shawnfishbit for the kind words. Sorry to hear you also bought a chunk just before the break down. I'm glad, however, that you found some solace in what I wrote. Happens to all of us at some point or another, and if it hasn't happened yet, you probably really haven't been trading for all that long!

BTW, I also added an extra tidbit you may find interesting as well (just above the "FINALLY..." segment), regarding the current valuations of FaceBook and SNAP.

just wanted to add this link for everyone who see this post, as @knircky wrote an excellent article that goes much deeper than my short bit towards the end of this post. He compares the valuations of STEEMIT, Facebook, twitter, etc versus active monthly users:

And remember, STEEM / SP holders collectively own the platform in this case. If STEEMIT can achieve just a small fraction of these valuations... well, here's the link for you all to evaluate for yourselves:

Link: The value of Steem and its users: 1 Steem user = 10 Facebook users!

What I do in this volatile market that I create the open orders for 1sbd/steem and it has been hit many times in the last few days, I have received more than 100 steem with 100 SBD in the internal market. This is best decision I think. You cannot be waking up the whole day to see the price fluctuations.

@alexpmorris its very intresting post, thank you for this and good luck for the future

upVoted

thank you @steemornot, glad you found it helpful!

WOOAAHHHHHHHHHH!!!!! tymoraPRO charts cryptos now....

does that mean you liked it?! lol

Yes, BOOTYFUL charts @alexpmorris ! Steemy Alizee thinks so too. So much so, she even has a minnow on her bum!

that is one really cute minnow, wonder what it tastes like! lol 😋

oh god

too much you think?! I blame all those flashy lights and spinning camera angles that may have been "trippin'" me out a bit! lol

Probably not Swedish fish...

nice analysis, I'm still learning about the difference between sbd and stm so this post really helped my learning curve.

thanks Mike, glad you found it helpful! Basically, SBD is more or less pegged to the US Dollar (should always be worth about $1 USD give or take), which is redeemable at any time in STEEM worth approximately $1 USD. STEEM is the base currency that signifies one's stake in the system (when converted to STEEM POWER), which can also appreciate or depreciate based on demand and adoption of the STEEMIT platform and blockchain itself.

Thanks, I'll definitely follow for more analysis :)

I very much like the technical analysis portion of this post.

It's refreshing to see someone who clearly understands the charts vs. someone who posts pretty charts with no real substance.

Thank you!

thank you for your kind words, @bluehorseshoe! yes, most people seem to forget, or are simply unaware, that each bar or pattern has a whole story and battle to reveal. As one digs deeper, a world of greater insight and understanding begins to reveal itself. That's why it's not only important to study charts and patterns, but to watch how the various players on each time frame "formed" those bars as well.

Oh boy I hate being the poster child for what not to do =p

However, I don't have any intention of withdrawing any Steem anytime soon, so view the volatility exactly as you recommend. I had been 50/50 SBD/SP for rewards because of the high price of SBD, and, as SBD was rapidly losing value relative to Steem, wanted to lock in the benefit of the higher SBD price.

I still do not understand how the trade on the internal market I entered into, at the price stated, caused the loss. SBD was about $1.20, and Steem was about $1.60 IIRC. Why did the trade go off at 1.81 SBD per Steem? That isn't the price I would have expected the trade to occur at, I expected ~1.25 SBD per Steem. This is why I lost value.

As SBD (last I checked) is below a dollar, my understanding is that changing my payouts to 100% SP from 50/50 SBD/SP is a better way to attain value. However, my last experience trying to use the internal market has discouraged me that I understand these mechanisms well.

The fluctuation in Steem price that followed wasn't a factor in that trade being such a loser. That's just volatility.

Any insight you can provide would be appreciated.

Thanks!

I don't think of you as a poster child. If anything, more as an example that can help others (and each other) better understand all the dynamics at play. It's still hard to pin down precisely, since I'm not sure the exact time you executed the trade, especially since there was already quite a bit of volatility around that time as we discussed. I'm also getting the feeling SBD may have already been trading back near $1 USD on the internal market around that time as well.

Something else I noticed here on steemwhales: https://steemwhales.com/valued-customer

Notice how your balance fluctuated from $268 to $199 to $255 to $211 in over those 4 days. Also notice how 13 STEEM seemed to be missing from the $199 day (total 47.189 STEEM), only to reappear the next day (60.001 STEEM). What I think happened here is that the two last transfers didn't register until the next day, and may not have been included because they were still on the order book from the previous day:

So the good news, at least, is I believe that accounts for the additional discrepancy you were seeing, and you really didn't "lose" nearly as much value as you thought! :)

Thanks again for providing a new source of good information that can help me to understand this issue. Steemwhales was not familiar to me.

The fluctuation in the reported value of my account reflects accurately my confusion over exactly how badly that trade failed, and why I had to estimate a very wide range of potential loss.

Ultimately, what I learned from this experience is that I shouldn't expect to profit from trading activity without good understanding of the underlying mechanisms, and good data, both of which you have raised.

Thanks!

@alexpmorris Thank you for this outstanding post! Your knowledge and explanation is extensive and for us comes at a perfect time.

thanks for the kind words, and glad you found it helpful @kenistyles! left you a few more comments on your posts that I hope you also find "additionally" helpful! :)

Yes I do, more so since reading through a second time and really chewing on the info. Thanks for sharing, I'm doing my best and it's a steep learning curve so I'm paying attention to everything you say man. Buy low and HODL until I'm a billionaire has been my only strategy so far LOL!

Would you mind correcting me if I'm wrong but I get that you're saying here buying STEEM with SBD right now is not a great trade on either internal or outside exchanges? Lucky I read this today, it stopped me dead in my tracks as I hadn't even thought of SBD and STEEM as different currencies before! N00b status.

Sorry if this seems like I'm mooching for free advice, I'll happily pay you. It's just a basic question, I've been looking to go long on STEEM POWER, yet with no experience in the internal market at the time it seemed safest to hold in SBD as it said it was pegged. My question is, if that's right then I'd do best to leave that SBD where it is (at least for now) and only power up using new STEEM directly from my BTC right?

This is my totally crude non-pro trader understanding btw.

Basically, the difference is that SBD is generally pegged to the US Dollar (usually should be about 1 for 1), while STEEM (and "up'd" STEEM, ie STEEM POWER) is the free-floating "investment" and staking side of STEEMIT. For example, if STEEM suddenly shoots up to $10 USD and you think that's nuts, you can lock some of that in by powering down some STEEM and exchanging it for US Dollar "pegged" SBD (which still freely floats around the peg, but is much more price stable than most other crypto currencies).

I don't like to make any outright recommendations as to when's the best time to buy or sell, as it really depends on each person's individual goals, timeframes, needs, etc. I have a feeling STEEM will probably head a bit lower for the time being, as it's not really given any indication so far of turning around so far. But you don't have to "load up" all at once either.

You may also consider exchanging a little SBD each day for STEEM, and hope for a better average price. If you suddenly get a big panic drop, you may want to increase those particular "BUYs" a bit more (that's more of an investing tactic as opposed to a trading tactic).

To answer your question about using BTC instead, that's an easy one. If you'd rather hold STEEM POWER over BTC, by all means consider selling some for STEEM. If you still believe BTC is a good investment at these prices, and think the U.S. dollar will be the one losing more value longer term, use SBDs instead! Hope this helps clarify a bit more. :)

Just for reference, here's an update for you on STEEM/SBD on a 60 minute chart:

@alexpmorris Man you never disappoint or skim on your delivery and clarity, thank you! I'm glad I understood your points as well as slightly amused that I didn't do enough thorough reading to be sure in my head what was what before making moves.

One slight redemption from my haste is that I agree with you SBD does seem more price stable than most other cryptos, however pinned on USD seems fragile in the long run and eventually obsolete since why wouldn't we all simply use STEEM? After our discussion however I feel like holding in SBD doesn't serve me in anyway, I get in the early days when no one knew what the hell Steemit was so they needed some sort of security. But obviously that's another matter and I don't know enough about it to know what other purposes it serves.

As for now and me, I'll be watching for that "story" and see if I can recognize a second STEEM dip before buying more as I learned from your post. Today's $1.06 looks great and so tempting as is, I'm excited to be watching the charts with a deeper innerstanding of the behaviors now. Either ways I won't be loading up all at once, I still have my learner wheels on. The SBD I'm holding can sit until it swings back to a better price, at least above the peg again.

We use BTC mainly as a store of value. We don't trust fiat, can't even move it around easily since we're fairly nomadic these days and as an investment it has been great to us. Verging on BTC loyalists here lol, anyway we still receive fiat from our affiliates so I will be moving that over here to STEEM. It's only our second alt-coin interest but we've stubbornly learned that diversity surely is the key! I love steemit and I am so very thankful to meet people like you who are in my eyes taking on a great role as educators and stewards of not only the platform but the trading/investing aspects that so many of us have no clue about.

Ok going on again now man, not even made time for my post this morning. What with all the reading and replying haha! It's all good, this learning is worth far more than my current $1-2SBDs per post. Thanks again brother, will be chatting again soon no doubt!

Wholeness.

just to clarify one thing though, that's the point of SBD. For now, in the "real" world, the USD is still king (ie. the reserve currency). And SBD is basically crypto fiat USD, easily transferable in the blink of an eye!

The USD is not going away any time soon, and certainly not before other fiats "topple" first (ie. japan and the EU). And while some of that money will inevitably end up in the crypto space, the BIG money will most likely end up in the safety of the highest quality USD-denominated corporate stocks and bonds (NOT government bonds). But all this is probably much more than you were asking for! lol

btw, STEEM's actually now fallen slightly below $1 USD again.

Right, yeah I noticed a few mistakes in my wording above. It was super late and I'm still getting it and re-reading slowly lol. SBD stability against USD makes much more sense now. Oh and yeah had some orders in and bought got STEEM in my sleep :)

Hey Alex, I did a little shoutout to you here: https://steemit.com/steemit/@theywillkillyou/1-000-followers-in-43-days-thank-you-thank-you-thank-you-for-all-your-support

Thanks for all the priceless advice you've dished out during my time here :)

hey no problem @theywillkillyou, as I told Rene, really glad to see you all taking STEEMIT to heart, and introducing others to it as well. Also glad your trip went well, looks like you all had a really great time! :)

Yeah it was a blast! Thanks for all your help during this amazing journey :)

I've found using the internal market is the best way to do this transaction SBD to Steem, of course you have to do this when SBD is at a high value agains Steem, I have traded there at close to 1 to 1. You just have to be up to date with prices.

thanks for the comment @gduran. I've also been told by @matt-a that he's sometimes found even better prices for SBD -> STEEM using changelly.com. The few times I've checked, the internal market's been better, however I do think it's a great option for converting to other currencies for export to FIAT via ETH and such. And it's probably worth periodically checking nonetheless!