Trade pattern concern

Trading cryptocurrencies is not such difficult if you know the rules market flow follows. Even if you don't trade steems or SBD, learning some most predictable signs will be useful to save and increase your wealth. As a former forex trader I'd like to share with you some experience I have got in this field.

This time I'd like to tell about most popular candlestick patterns, that very often appears on the chart. Ok, let's save our time and get down into business.

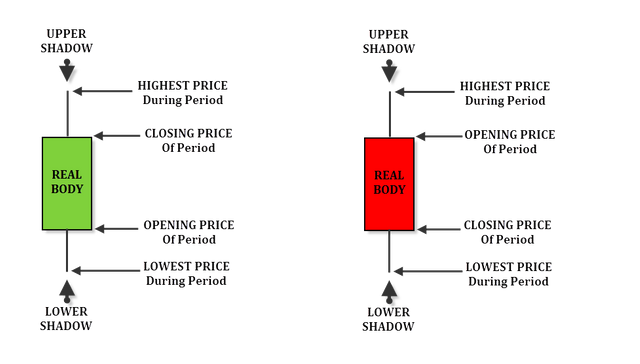

What are candlesticks?

One good picture is worth of 1000 words. Just look at this Steem/BTC chart from Poloniex exchange

Every bar is a candlestick. If it is red it means that the price at the end of chart period was lower then it was at begining and vice versa - green bar means that price at the end of period was more then it was at the begining.

The most interesting thing that there are candlestick patterns that allow to do predictions about further price growth, decline or reversal. Despite the fact that we can't know for sure what will be in future we still can notice and use the most probable variations of future price actions! Let's see the most predictable candlestics patterns.

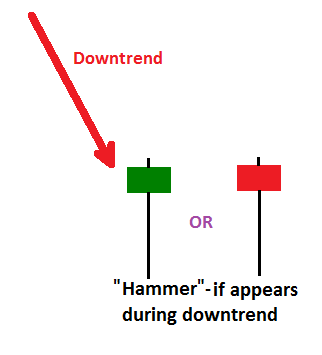

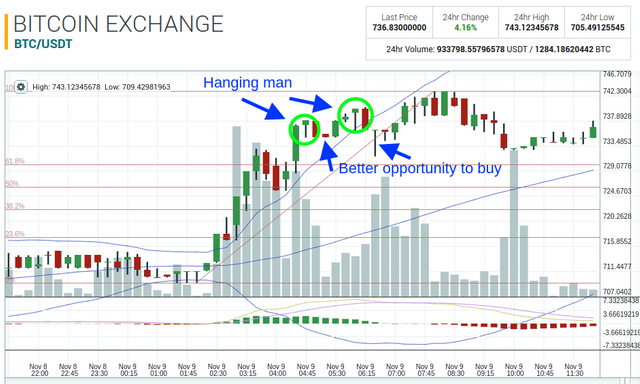

The hammer patern appears at downtrend and is strong signal that bears are exhausted and pretty soon the price will go up. Look for the real example on this picture:

There are even 2 hammers and after that bitcoin price went up.

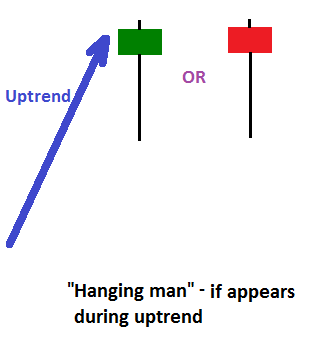

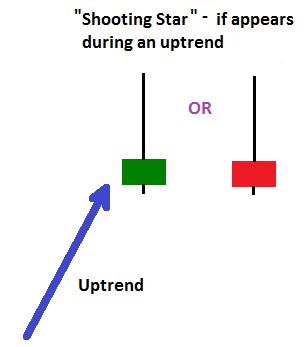

If you see this sign when price goes up, you'd better resist of buying because after some time you'll have much better opportunity to do it at lower price:

This is another good reversal pattern that indicates that bulls are exhausted and price in most cases will go down.

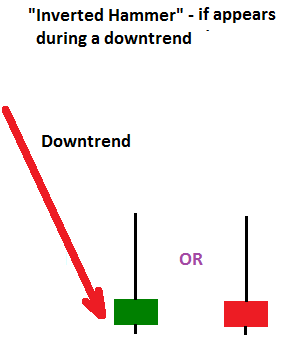

This also bullish reversal pattern that often marks support level. It shows attempts of bulls to push the price up, and that's why long shadows appears but they are not so strong to do it at the current moment. When you noticed it, stop sell because there is high probability of upcoming uptrend.

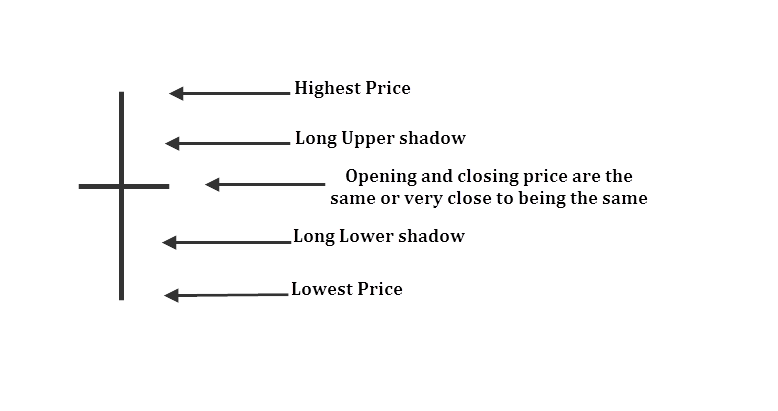

This pattern indicates that market is unsure about future movements and is waiting for some external signals. It often means reversal points but signal is not so strong as the previous ones. If you see this signs you'd better be out of trading and wait for other signs.

On the above example you can notice that first doji appeared after inverted hammer and that was a sign to close current active buy trades if they were open because bulls seemed to have lack of power. At the same time doji is not always means reversal. You can notice that after second doji pattern the price continued its downtrend movement.

Recommendations

Keep in mind that crypto exchange takes comissions for trades. It means that you'd better look for candlestick patterns in big timeframe charts (4 hours or day ) and look for great movements to be sure commision won't eliminate your income.

Don't analyse current candlestick, wait untill it will be finished and the next one starts.

Remember about probability - it is live market and anything can happens, for example, unpredictable elections result. If you decide to trade with candlesticks patterns, be sure there won't be some news on that day that can have huge impact on the market state.

Wow really great read! You explained this stuff really well.

Will watch out for these patterns more often.

thanks that you like it