An Unstoppable Force And First Compelling Mass Market Solution

Preface: I have worked several days on putting together this essay, correcting it, formatting it, and have initially posted an unfinished variation of it as a second part of my introduceyourself post. But because it wasn’t quite ready yet, after posting it, I have edited and updated it about 28 times and have put in another couple of hours until I couldn’t edit anymore.

As this seems a valuable thought experiment, and there’s an emerging movement suggesting we should move forward from introduceyourself posts and start focusing on more substantive contributions, I have felt that a complete and updated version of this essay would deserve a separate post. This is my acknowledgement and contribution to that movement, my #doyourpart if you will, as a model of how things could be done the right way (cc. @dantheman @anyx @neoxian).

I see Steemians are very thirsty for drama, but is anyone interested in intellectual gratification?

We’ll see. For now, I hope you'll enjoy the reading.

An Unstoppable Force And First Compelling Mass Market Solution

Preliminary Thoughts

Human Nature

The more we study human nature, we seem to discover that man is not as rational as he thought. In fact, he is invariably guided by a combination of conscious, subconscious, emotions and biases, which often lead to decisions that are, at best irrational, and at worst, very damaging for individuals and society.

In an ideal world, we would only have to build a great piece of technology and people would rush to adopt it immediately, simply because it would be in their best interest. Reality however, proves to be a lot more complex than that. Indeed, it has become exceedingly hard for people to make sense of things and though they may understand what’s wrong and what they might do to improve things, they rarely have the strength of character to act in accordance to what they think.

This is why mankind has learned the necessity of auxiliary precautions.

Elon Musk And The Hypothesis

Consider the story of Elon Musk, who is arguably one of the most important entrepreneur – engineer - inventor alive, and, apparently also a billionaire genius[1]. As he understood where we stand today, and what devastating future threats we could face, he came up with some ideas and plans as to how these problems could be optimally solved and threats could ultimately be transformed into powerful innovation for the benefit of humanity.

One of the problems, he figured, was that the automotive industry was rapidly advancing in the wrong direction due to unsustainable production and consumption of energy[2]. He also figured that arguably, for the immediate future, part of the solution would lay in electric cars[3] [4]. But the biggest problem with electric cars was their perception. Who wants them anyway?! They’re slow, ugly, unreliable, low range, boring and unsexy. So even if you would make an electric car, you could not beat people into buying it, and indeed, nobody would.

Electric car perception before Tesla.

Or at least, nobody until they learned about Tesla Motors[5]. In fact, Musk figured that the most effective way to solve the problem would be to radically redefine the perception about electric cars, by creating the first compelling electric car ever built which would truly capture the imagination of people. It was clear, the car would have to be better in almost every aspect than its gasoline competitors[6], but, more importantly, the car would have to be sexy, irresistibly so.

And here lays the brilliance: the burden of psychological hard work would shift from the customer to the inventor. An irresistibly attractive product would be created, and all the customer would have to do, is follow his basic instincts, passively catalyzing the solution for a very important problem in the process.

Electric car perception after Tesla.

Model S - Photo credit.

Model X - Photo credit

An Antifragile Meta-solution

It seems most solutions for big and important problems are very fragile, precisely because they are dependent on a highly unstable variable, namely, human nature. But think for a second, what if we could create a meta-solution, one that could solve or isolate a much bigger problem, rendering us resilient or even better yet, antifragile[7] to human nature?

Indeed, how would such a meta-solution even look? Well, instead of asking of people to use their willpower and self-discipline, requiring a great deal of intellectual and psychological effort to fight a cause, we should try to put in a great deal of thought at the beginning, in designing an irresistible, almost addictive product. Presumably, once launched, it would drive itself to adoption with an seemingly unstoppable force. In fact, precisely when people would lack any kind of willpower and self-discipline, acting instinctively and impulsively, epidemic growth would commence.

The Tipping Point

Lets assume we could create such a product. Henceforth, our only target would be to reach a tipping point: the point when sufficient mass and speed would coalesce into an exponential growth period. That is the same point at which epidemics become pandemics, when growth explodes in such a way that it virtually becomes unstoppable.

Steemit: Aligning Incentives For The Masses

To the best of my knowledge, Steemit is perhaps the most apt iteration of a meta-solution to date[8]. Indeed, this rather unique iteration seems to consist of two critical parts: first, there exists a powerful and fundamental built-in economic incentive which aligns private greed with public interest; secondly, on this primary economic incentive, a relatively simple yet exceedingly flexible and deceptively potent social layer is built. In fact, it is this combination that differentiates Steemit from its predecessors and competitors[9], swiftly transforming a snowball into an apparent avalanche, overruling both social inertia and reluctance to change.

The Litmus Test: An Overall Perspective On Growth Rate And Quality

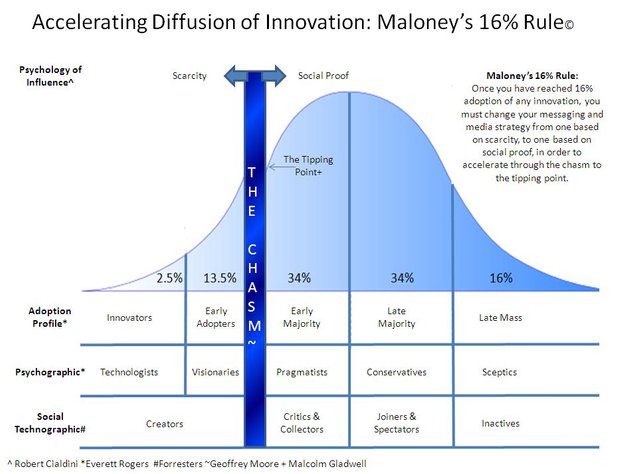

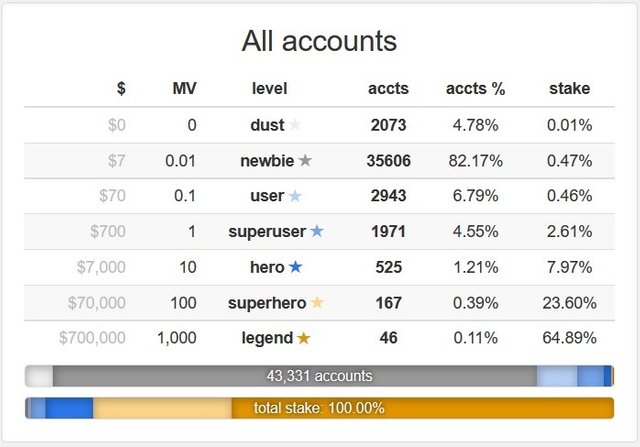

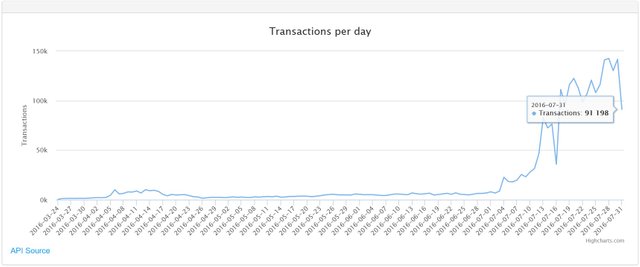

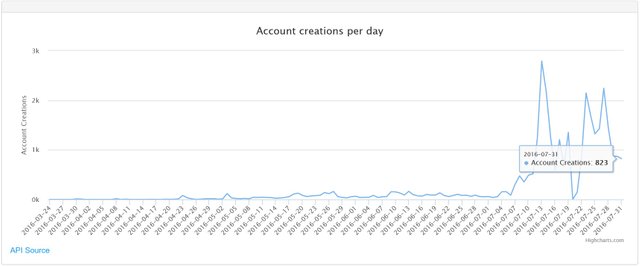

Coming back to practice, there seem to be two critical indicators worth mentioning at this point. The first one is the growth rate. Presently, Steemit has ~43,331 registered accounts and has grown with ~10000 new accounts during the last week(an impressive ~31,25 %)[10] [11]. That's ~1428 or 4,46% new accounts per day. Indeed, as others[12] have pointed out, Steemit has already surpassed Ethereum by daily transactions and is seriously chasing Bitcoin next. The exact numbers may vary from day to day, but there seems to be a healthy growth period ahead. In fact, if this rate continues, and I suspect it will, by the end of August we should see ~90,000 registered accounts. All this only 3 months after the official launch.

The second most critical indicator after you have growth, is quality. As you have probably seen, there is an ongoing discussion about identity theft, plagiarism and other forms of degenerated content and this is indeed a healthy indicator of the community immune system at work. The important thing to understand here, is that overall Steemit is moving in the right direction, albeit facing some rather natural problems which come with fast growth rates.

Secondly, this whole situation seems to be effectively caused by an obvious form of perverse incentives. Right now the steemit community pays orders of magnitude more for drama, however faked and shallow it might be, than it pays for other valuable and thought-provoking posts. Indeed, to put it simple, the incentive is vastly greater to create a fake identity with a rudimentary fictional story, throw some photos in and add a drama touch, than to spend long hours creating an original and insightful essay, correcting it, formatting it and sharing it with the community.

This is clearly wrong, and we must address it as soon as possible[13]. However, this is far from an unsolvable problem. In fact, with the right incentives in place, some clear voting best practices and much needed individual contributions, we could gradually kill the disease and allow Steemit to flourish again.

A Riveting Experiment

Though Steemit may still be an early stage experiment which could eventually fail in any number of ways, evidence thus far suggests it could be a rather wild and rare animal. Indeed, for all we know this could turn out to be a Swan. A Black Swan[14] [15]. Since I am very fond of Black Swans, and they are rare, unleash extreme impact, and seem to be only retrospectively predictable[16], the most appropriate course of action would be to maximize my exposure to areas where potentially positive Black Swans could emerge.

So, I will be here. Experimenting, nurturing and curiously examining it, patiently waiting to see what it turns out to be.

References

[1] - Elon Musk is “the founder, CEO and CTO of SpaceX; co-founder, CEO and product architect of Tesla Motors; co-founder and chairman of SolarCity, co-chairman of OpenAI; co-founder of Zip2; and co-founder of PayPal. As of June 2016, he has an estimated net worth of US$12.7 billion, making him the 83rd wealthiest person in the world.

Musk has stated that the goals of SolarCity, Tesla Motors, and SpaceX revolve around his vision to change the world and humanity. His goals include reducing global warming through sustainable energy production and consumption, and reducing the "risk of human extinction" by "making life multiplanetary" by setting up a human colony on Mars.” - http://en.wikipedia.org/wiki/Elon_Musk

[2] - I am referring to pollution and climate damage with potentially devastating consequences for the long term along a high burn rate and possible eventual depletion of relatively scarce resources.

[3] - Here is the Master Plan, Musk posted in August 2006: https://www.tesla.com/blog/secret-tesla-motors-master-plan-just-between-you-and-me

[4] - After 10 years, an updated version has been published. So here is the Master Plan, Part Deux: https://www.tesla.com/blog/secret-tesla-motors-master-plan-just-between-you-and-me

[5] - Here is a car built from the ground up to take advantage of the technology available in the 21st century: http://www.teslamotors.com/models/features#/environment

[6] - Tesla Model S was rated 99 out of 100 points on Consumer Report, the highest rating ever awarded to a car: http://money.cnn.com/2013/05/09/autos/tesla-model-s-consumer-reports/

[7] - "Some things benefit from shocks; they thrive and grow when exposed to volatility, randomness, disorder, and stressors and love adventure, risk, and uncertainty. Yet, in spite of the ubiquity of the phenomenon, there is no word for the exact opposite of fragile. Let us call it antifragile. Antifragility is beyond resilience or robustness. The resilient resists shocks and stays the same; the antifragile gets better" - https://en.wikipedia.org/wiki/Antifragile

[8] - Please note that a very early variation of this essay has been posted some time ago by me on bitcointalk. What’s interesting though, is that back then it was just a thought experiment, outlining a goal towards which I thought we should strive. Right now, I can finally see the first iteration. Quite impressive.

[9] - Although Bitcoin(and perhaps all the other crypto-currencies for that matter) has exemplified an interesting variation of the economic incentive, it has always lacked the second and equally critical part: a simple yet flexible and potent user interface. Indeed, the technical barrier of bitcoin seems to be still its main obstacle for average user adoption and the root cause for all kinds of security problems.

[10] - Data taken from https://steemle.com/charts.php

[11] - Data verified with https://steemd.com/distribution

[12] - The argument can be found here: https://steemit.com/steemit/@clayop/steem-passed-ethereum-s-number-of-transaction-and-will-pass-bitcoin-soon

[13] - This is an important subjects which cannot be seriously addressed without deviating the whole course of the essay. It certainly deserves a separate post attempting to clearly define the problem and proposing various pertinent solutions. I will try offer some thoughts as soon as I see relevant practical solution.

[14] - "What we call here a Black Swan (and capitalize it) is an event with the following three attributes.

First, it is an outlier, as it lies outside the realm of regular expectations, because nothing in the past can convincingly point to its possibility. Second, it carries an extreme 'impact'. Third, in spite of its outlier status, human nature makes us concoct explanations for its occurrence after the fact, making it explainable and predictable.

I stop and summarize the triplet: rarity, extreme 'impact', and retrospective (though not prospective) predictability. A small number of Black Swans explains almost everything in our world, from the success of ideas and religions, to the dynamics of historical events, to elements of our own personal lives.“ - https://en.wikipedia.org/wiki/Black_swan_theory

[15] - Black Swan farming is a very instructive essay by Paul Graham, emphasizing how hard and counterintuitive startup investing really is. By extrapolation, one could make a good argument that crypto investing is similarly hard and counterintuitive, if not more so. Here is a link to the essay: http://paulgraham.com/swan.html

[16] - “Hindsight bias, also known as the knew-it-all-along effect or creeping determinism, is the inclination, after an event has occurred, to see the event as having been predictable, despite there having been little or no objective basis for predicting it.” - https://en.wikipedia.org/wiki/Hindsight_bias

This is a misleading interpretation of the data, because you are not accounting for the abandonment (attrition) rate of new signups.

The data clearly shows that users active in the most recent 7 days are overall 15024 ÷ 43766 = 34% thus ~66% rate of attrition. I computed the attrition rate another way to be roughly 78% (which has now increased to (15,024 - 9479) ÷ (43,766 - 9479) = 84%!) before the recent surge of signups partially due to renewed+amplified coinmarketcap.com banner ad. Meaning that when the signup rate is significantly higher than the historic rate and the historic number of user accounts is small, then mathematically the attrition rate (in the first way I calculated it above, but not in the second way) will appear to be less than it actually is until that higher rate of signups is aged about 30 days.

I expected that my second method of computing the attrition rate would increase (as it did from 78% to 84%), because the attrition rate requires at least 30 days of history to compute accurately and the signup rate had surged in July. I expect the attrition rate to be about 87 - 94%, because this is the percentage of users who have balances less than $70. As you can see this correlates well with the attrition rate, because the entire motivation for joining Steem is to earn a lot of money. There are not other compelling reasons to be on the site. The white paper admits that quadratic vote power weighting algorithm is designed to fool users into overestimating their earning potential, so it is quite a “no brainer” to expect that most will become disappointed and quit (barring other compelling reasons for them to stay, which there are currently none other than some idealistic desire for blockchain and crypto-currency technology to gain a foothold with the masses).

This perspective is further supported by noticing from the data that the rate of attrition increases the lower the balance.

The attrition rate will approach 98% if the price declines by 90% (because that is the percentage of accounts which will have balances less than $70), which is what I expect for the coming implosion of Steem as the reality of the situation comes to roost and users power down in rush to the exits (most are powering up now because they don't realize the true situation).

Note I have confirmed some examples here and here of who and why users are abandoning Steem.

Thank you for the long and detailed thoughts @anonymint . I would say a couple of things in response.

Firstly, I think your caveat is relevant and should be taken into account when trying to present and comprehensive analysis of the data. Indeed, I would be very interested to read a thoughtful post discussing this particular data point.

Secondly, it's important to note that there is no misleading interpretation of the data. Indeed, the sentence where you quote me is just data. At worst, my analysis would be incomplete(which it might be), since it was not meant to be a complete explanation of all data points, but rather a raw overview on things.

Thirdly, while I agree with your basic premise that it's important to take the attrition rate into account in order to grasp true growth rate, it seems your other opinions regarding reasons why people would join steemit and how the algorithm might fool people and so forth, seem largely unfounded. Indeed, there seem to be lots of assumptions you make which are not warrented by data.

Lets assume for a second you are right, how long to you expect it will take until we will see Steemit breaking down? Would you be open to changing your mind if it doesn't? Do you see this as inevitable, or do you think there is any important step which if taken could prevent the "implosion"?

Anyway, as said in the essay, this is an experiment and a very interesting one. There is always a possibility that it could fail, but at the moment I can't see any good reason making this possibility a strong likelihood. Thus far, data seems to be pointing toward a positive scenario.

Agreed, I am employing a significant proportion of intuition and anecdotal data to support my hypothesis that Steem is not "crossing the chasm" (a known marketing concept) from its nerd (and one degree of relationship from it) demographic.

But you have not answered the most important part:

"Lets assume for a second you are right, how long to you expect it will take until we will see Steemit breaking down? Would you be open to changing your mind if it doesn't? Do you see this as inevitable, or do you think there is any important step which if taken could prevent the "implosion"?"

What are your thoughts on that?

I am watching for either daily or monthly uniques not growing according to the logistic function adoption of new technologies. The monthly uniques are not reported and I don't know if anyone is recording this data periodically so they can chart it. Or otherwise building blockchain analysis tool to extract the data.

Also some way to differentiate between bot (including duplicate Sybil) users and real human users w.r.t. to that data.

Also I'd like some stats on demographics, especially on females and those coming who had no interest in crypto before they arrived.

It's possible that the quadratic vote weight has changed a while ago during a fork, but I'm not sure. There were some articles and debate and then some changes to make the system more linear.

It was made more linear from the perspective of voters but the quadratic weighting across different posts remains. I think most in decision making positions see large payouts for winning/leaderboard posts to be a more useful approach overall than paying each post (to make up a number) $10. Which is not to say there aren't a lot of posts making $100-200 because there are, but overall the rewards are indeed concentrated with the top posts. It is a reasonable debate though, whether payouts across posts should be flatter.

@smooth, please contact me on bitsharestalk if at all possible. I need to round up some people with large stake to see how interested they are in an idea that would likely add a huge amount of value to steem...and maybe even a couple other projects.

I'm not on bitsharestalk. Since there is no PM on here yet you can PM me on bitcointalk as smooth or reddit as smooth_xmr

Per our discussions at BCT, I think possibly they can't be made flatter (or significantly closer to linear) in the current design of the differences between STEEM versus STEEM POWER, without causing a game theory collapse of the incentives to not game the voting.

Orthogonally the option of removing voting and paying a flat fee per blog would open a Sybil attack vulnerability.

I don't see why 'flatter' is incompatible with the game theory; 'flat' would be. Would n^1.5 rather than n^2 be a disaster? (Setting aside the marketing question as to the value of big numbers on the front page.) I don't think so.

Achilles Heel of Steem

This is a complex question and I might mess up the analysis, because frankly I am not even confident I know what the current algorithm is. I've seen mentions of curation rewards being a function of both total author reward (which is afaik a function of the square of the total votes) and of that the earliness of your vote matters in some non-linear way (note for curation rewards and afaics not for author reward). That seems to indicate that a whale who votes for his own content will earn the author reward of at least the square of his/her vote power, regardless of how early or late the whale votes.

But the overriding factor seems to be that the debasement of STEEM POWER is apparently less than 4% yearly (and note I'll probably be making a blog post soon on the precise math), so there isn't much incentive for anyone to vote for themselves because offseting that debasement by voting your share to yourself for whales is not worth the cost of failure to the system it could cause. And for dolphins, the 4% is nominally so low that it is a pita to vote for anything other than your conscience.

So it seems even a linear weighting might be safe, except there is the consideration of the power of compounding in that whales who can automate to offset say 4% compounding advantage versus whales who vote their conscience, will over time become the controllers of the system (all other factors being equal, which might not be the case).

We also have to consider that upvoting drives other voting by raising ranking and thus viewership. Thus whales can influence which content gets the most rewards, thus upvoting their own content seems to make the most sense if that content is of otherwise equal potential to receive upvotes as any other content. Thus the game theory seems to be a power vacuum that will suck in the controller who can organize stake to vote for successful bloggers (to obfuscate this from other whales who might downvote the phenomenon) which pays back some % of the author rewards to the organized voting stake (power).

From one perspective the quadratic weighting seems to make this game theory more profitable because the one who captures even a slight advantage in this power vacuum can take exponentially more of the author rewards. However, the quadratic ranking also means that the dolphins can't benefit from organizing themselves to vote for their own posts collectively, because they would be at a quadratic disadvantage compared to the whale controller.

Thus I conclude that the quadratic weighting is necessary to squelch dolphins organizing to game the system, but it hands the control (and eventually the entire system) to the deviant whale who realizes this is a winner-take-all paradigm. We end up with a system of serious bloggers who work for the master whale and the rest are subservient minnows and dolphins who are beholden to the groupthink control over economics of the system.

That is why I have redesigned this concept so there can be linear weighting which the dolphins can't profit on by organizing themselves (as I add a cost to voting but not taken from the user's wallet, yeah that will really make you think!) and which whales can't game either because I squelch whale voting power (everyone becomes a dolphin in terms of voting power); and note this depends on very strong Sybil attack resistance on account identities and that whales won't trust other people to hold their money for them.

Additionally in my design for a Steem-like system, I have also added another reward vector which greatly reduces the incentive and ability to take control of the system by gaming the voting reward algorithm.

Edit: to clarify that with linear weighting, the dolphins would be incentivized to band together in order to upvote each others' posts in order to get amplification of rewards due to raising the attention their posts get. Of course if users band together then they lose the relative amplification effect, but that is the point that the game theory incentivizes them to band together until there are too many banded and then the site's voting is one (or several) groupthink(s).

I'm really not as sure here. I don't think that the only reason people join is to earn a lot of money. I joined because @officalfuzzy told me that there was interesting tech stuff happening, and did end up earning some money. Better still though is the fact that the money causes people to:

.....

And the rest, that's not written yet. The users who abandoned, should come back for the content, and if they want to earn, they should practice, practice, and practice their writing. Writing is really difficult and we're not all going to be successful in steemit terms at it from the get-go. That's alright.

What about coming for the idealism of not giving Facebook the control to censor our content which they are doing?

So we don't build up our following and then have someone else in control of that asset we invested to build. No one else should own and control our investment of effort, time, and creativity.

That's the main thing I noticed people do understand, regardless of their background, that this is different from Facebook because it open and decentralized.

This is how you write. Quality over Quantity. Looking forward for your next blog.

Thanks for the kind words, just doing my best trying to convey what seems to be really important.

Hey what's up it's @stealthtrader from the Steemit chat :D

This is a very great post, and I'm excited to see where it goes!

did u created this steemrocket? :)

Yes @cybercodetwins

Here was the post I just did about how I made it :D

https://steemit.com/steemit/@stealthtrader/steem-rocket-with-stars

congratulations on this essay, it's very well done

Thanks a lot. Learned a lot from your posts so double thanks. :)

awesome info !! thanks for using #craigrant tag

Love this! I think NNT's antifragility theory should be spoken out more in many different ways as it seems essential in Steem/Steemit's design. Well maybe it's not consciously baked-in as part of the design, but the fact that Steemit is bringing "actual" social-identity online, is in fact, bringing the antifragile features of humanity into a high-speed network. The "old" Internet failed at this because it wasn't a crypto-socioeconomic state machine that it should've been.

I personally think Steemit's geared for solving grand challenges, but who knows right. Just add monetary incentives into Reddit and suddenly it becomes a different monster.

Sometimes I feel like I'm talking out of my ass, but I hope you geddit lol :)

Thanks. I agree, this seems by far the most intriguing design to date. Indeed, it has only been 2 months since its official launch and Steemit is already swiftly moving forward on some paths never traveled before by crypto projects.

It will be quite interesting to look at it one year from now and then again in 5 years. What's counterintuitive though, is that lots of other unforseen incentives and positive network effects kick in once you reach a critical mass, so I'm very much looking forward to how it will evolve.

This is the development of crypto id been waiting for. Thinking to myself when/if Facebook/youtube adopt bitcoin etc etc. I think this has shown me that maybe its something else entirely that comes and does it first.

Hey @Xtester

This is a very good read !

I love this " Though Steemit may still be an early stage experiment which could eventually fail in any number of ways, evidence thus far suggests it could be a rather wild and rare animal. "

Oh do we wanna ride that animal! yeee haaa

#takeiteasy

Thanks. Yeah, it will be an interesting ride to say the least.

Thanks for this essay. I really like the accurate footnotes. Will do the same at my next steemit post.

Thank you. I actually struggled a lot with those in my first post and searched 3-4 hours for a way to properly implement them, but couldn't find one. I would really love if we could have them implemented because they are quite useful.

Well put together post. Thanks!

This is an absolute sex machine of a post.

You have been followed :).

thank you for information

very good post you