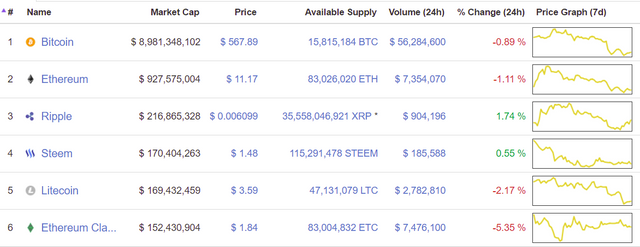

When STEEM is a cryptocurrency of $5B marketcap (or Top 10 coin)- a case study.

Wonder why STEEM suddenly shoots to rank 24 or 25 and gain 50-100%, then comes back to 30-32 and lags in bull market. But ZEC, XMR, DASH, or other cryptos are consistent in their marketcap and follows perfectly a bull or bear market. It bothered me for couple of times. Therefore, I brainstormed and found couple of reasons for the cause.

STEEM only rises on big news such as adding to Upbit.com or Huobi.pro exchanges due to sudden demand from traders and investors. But STEEM has consistent sell pressure from bloggers and some investors. Many Steemitians earn their full or partial living from STEEM Apps. Since powered up STEEM's cannot be sold directly, it has to be powered down. It takes almost a week for 1/13th of total SP to be liquid. Moreover, sellers can sell immediately their earning in SBD. SBD can be converted easily to STEEM through internal market.

Therefore, when STEEM rises suddenly, some sellers starts power down and start selling STEEM. STEEM price goes down to a low equilibrium. Since STEEM's demand can't keep up the higher sell pressure (from power down) for couple of days or a week after sudden rise (e.g. Huobi or Upbit news), it goes down.

To sustain a higher price, say hypothetical $20 a STEEM or $5B marketcap, demand for liquid STEEM should be significantly higher.

One case would be easy onboarding process so that new investors and users can open accounts immediately and buy STEEM easily for influence, income or investment.

For example, if STEEM can bring 1M users per month, then $20 a STEEM is quite sustainable. STEEM holders will sell STEEM aggressively so will buyers buy at the same rate. STEEM holders will earn less STEEM due to less SP but earn more due to high price of STEEM in fiat base. To attract 1M users STEEM's scalability has to sustain multi-fold increase in transactions which STEEM blockchain is quite capable of.

However, to bring in 1M users a month STEEM needs to pursue aggressive marketing too. Moreover, user interface have to make easier for new users too. It needs lots of developments.

Current development speed is slow either due to poor leadership, low number of expert developers due to lack of fund and technical bottleneck. It could be all of them, or some of them.

However, sudden rise of STEEM price and some level of sustainability has some advantages. Think about STEEM's and SBD's price at $1 vs their price at $4. Now STINC has four times of previous funds, can hire more developers and deliver updates fast. Now think, STEEM at $16 STINC can do things 4 times faster due to 4 times of budget.

It is chicken and egg problem. Whichever occurs first- price increase then developments or developments then price increase. Moreover, STEEM's price cycle also largely depends on bull and bear cycle of overall cryptocurrency or bitcoin.

In conclusion, it is not quite simple for STEEM while there is less selling pressure for other coins. Since for other coins only gain can be achieved by selling whole holding at higher price or HODLing.

In case of STEEM, some holders have to sell their STEEM for livings (i.e. different scenario than investing), and some investors are in vantage position to sell their current earning (e.g. extra STEEM through delegation or blogging) since they have enough SP (say, more than 30K) and they may not be interested to have significant wealth appreciation (i.e. they have enough STEEM to satisfy current need and SPs are increasing due PoS interest & curation).

Therefore, to sustain high price of STEEM, STINC needs guerrilla marketing, higher growth of users, and finally, interest of heavy traders and investors. More exchanges such as Bitfinex, OKex or Bithumb can help the cause. Hivemind will make user interface more friendly. SMT will increase STEEM's demand since businesses have to buy STEEM for their own growth (i.e. bandwidth).

Image sources: Most images are open sourced (e.g. Pixabay, Wikimedia etc.) with Creative common license. Some images are used with due courtesy to respected owners.

Thanks for reading.

@riseofth

Cryptominer since 2013, occasional trader and tech blogger

Agree with all the points you mentioned. Steem have a hard user interface. It is too difficult for a newbie to understand it. It may even took, 2-5 months. Some of the user is using the platform for a year now, they may still got puzzled by the system.

There are only few people knows about steemit. I can say, 80% of the people here, who were joined in the crypto market know about it. The percentage may be higher. Marketing is needed for this platform. It need huge marketing. To people know about it.

It would be best, if they could offer some refferal system.

Referral system is a good idea. Current problem is that every new STEEM account is given a delegation of 15 SP to start with some voting power. Steemit does not have enough SP to say, 1M users per month (i.e. 15M SP per month or, 180M SP per year). However, Steemit reduces SP delegation when a user earn some SP. If it can reach some sort of equilibrium such as return of 10M SP per month from its delegation to users or undelegate some SP on non-activity. Then some sort of referral may work.

But, for hugr marketing and make known to the people it will be fastest way i beleive. Obviously they have to work on the delegation system.

How do you do this, over $3 in less than a minute and I've never gotten up to $2 for 7months now. Please teach me. Thanks

This post has received a 0.13 % upvote from @speedvoter thanks to: @riseofth.

To listen to the audio version of this article click on the play image.

Brought to you by @tts. If you find it useful please consider upvote this reply.

Yup there is always a consent sell off to fiat it seems

This post has received a 0.16 % upvote from @drotto thanks to: @riseofth.