What is Steem Dollar: The Complete Steem Cryptocurrency Guide

the cryptocurrency market has grown tremendously during the last 2 years and currently stands at a market capitalization of $406 billion. As the market grew, many altcoins gained popularity — the Steem coin being one of them.

But, what makes the Steem cryptocurrency so popular? In this guide, I’ll give you a complete overview of Steem so that you can answer that question with confidence along with many others; regarding Steem, its purpose, its team, its history, and how well it is functioning.

I will be addressing Steemit, also — Steemit is a unique, Steem-based social media platform that is by far Steam’s most famous use case. In addition to that, I will cover the various cryptocurrencies associated with Steemit i.e. Steem coin, Steem Dollars, and Steem Power.

Like all good guides, we’ll begin with the basics.

So, let’s get started!

Steem Basics

Steem coin is the cryptocurrency of Steemit — a blockchain-based social media platform founded in 2014 by Dan Larimer (the CEO of BitShares).

You can consider Steemit as similar to Reddit, where users can create and publish their content online and get rewarded for it. However, there is one major difference.

Unlike any other social network, Steemit is based on the blockchain, which allows it to be run in a decentralized manner. This means there is no censorship, no central authority, no downtime, no data vulnerability, and no data abuse. It solves a seemingly-endless list of problems seen in centralized social platforms (i.e. Facebook, Twitter, etc.).

As well as the above unique advantages, it also rewards its users using cryptocurrency! So, rather than post to social media, while the central party (Facebook, Twitter, etc.) cash in on ad revenue, you can post to social media and be paid for it yourself.

The Steemit blockchain actually has three different cryptocurrencies on its blockchain!

Let’s try to understand the function of each one of them.

Steem

Steem coin is a fundamental cryptocurrency of the Steemit network, and the other two cryptocurrencies (Steem Dollars and Steem Power) are dependent on it.

Since Steem was released in 2016, the supply of Steem has automatically increased by 100% each year. This is what it’ll continue to do indefinitely.

In this aspect, Steem is different from other cryptocurrencies, as it doesn’t rely solely on mining to create new coins.

The Steemit network creates new Steem coins on an everyday basis.

75% of the new coins are divided between the authors and curators

15% of the coins are awarded to the holders of Steem Power

Only 10% of Steem block rewards are awarded to miners

Since more and more Steem is created every day, it is not recommended to hold it for long periods of time. It should instead be converted into Steem Dollars, Steem Power or some other cryptocurrency like Bitcoin or Litecoin.

Please note that the Steem crypto coin (Steem), like Bitcoin or Ether, can be bought and sold in the open market. So, you can either earn Steem through the Steemit platform, or you can buy it on an exchange like Poloniex or Binance.

What is Steem token

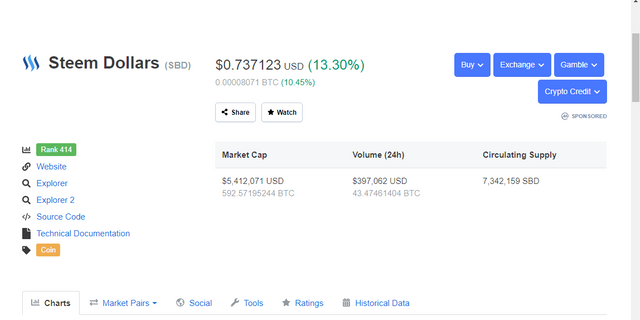

Steem Dollars (SBD) is a cryptocurrency. Steem Dollars has a current supply of 7,342,159.109. The last known price of Steem Dollars is $0.737123 USD and is up 13.30% over the last 24 hours. It is currently trading on 8 active market(s) with $397,061.846 traded over the last 24 hours. More information can be found at https://steem.io/.

It held the $1 value rather well until around November 2017 when it rocketed in price to around $13 by the end of 2017. It has since corrected itself, though, and is currently floating around the $2 mark.

As Steem Dollars are intended to be stable, 50% of the payment to creators and curators on Steemit is processed in SBD to protect them against the fluctuations of the Steem cryptocurrency. Steem Dollars can also be traded on several exchanges and it has a current market capitalization of $0.37 billion.

You can cash out your SBD by converting it to Steem or Bitcoin, and then converting it to fiat currency. You can also exchange SBD for Steem Power, another Steem currency which I will cover next.

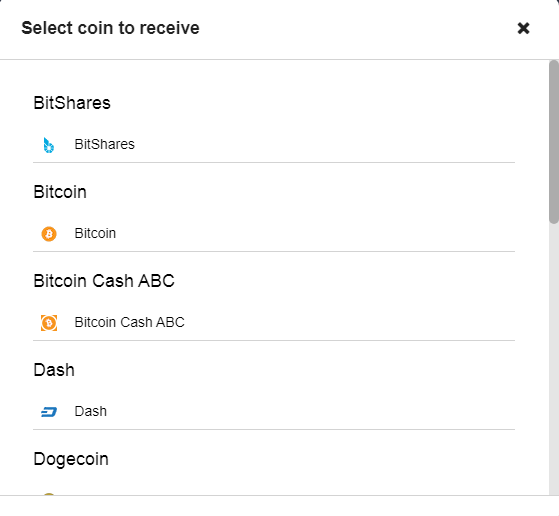

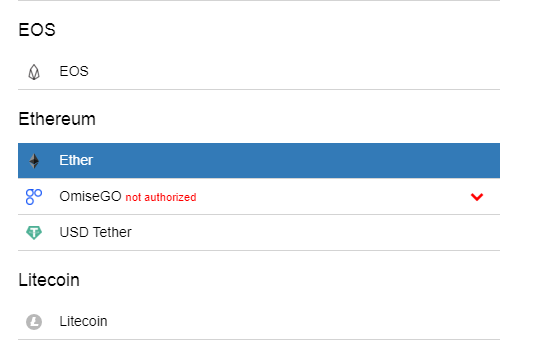

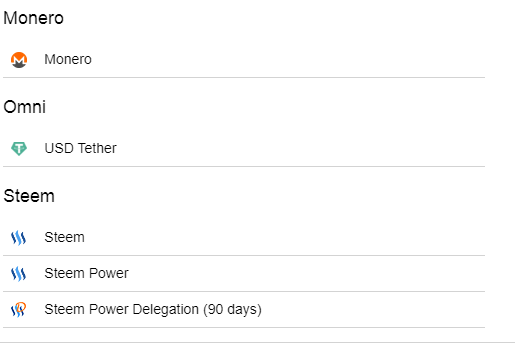

You Can Convert Steel Dollar Or Steem To These Crypto Currencies Easily Signup Now https://blocktrades.us

Or You Can Buy Steem Currencies With Upper Given Crypto Currencies

Top tip: A key benefit to Steem Dollars is that, by holding them, you earn a 10% annual interest.

Steem Power (SP)

Steem Power (SP), the third crypto on the Steemit network, is a token that symbolizes how much of an influence you have on the Steemit platform. The more SP you have, the power you have.

So, holding Steemit Power gives weight to your voting in a 1:1 ratio. For example, if a post receives a vote from a user who holds 200 SP then it is 20 times more influential than a vote from someone who holds 10 SP.

It is a very important aspect of the Steemit platform because compensation is directly related to it. A post or comment will receive more compensation when upvoted by some with more power (SPs).

As a matter of fact, you cannot vote at all if you don’t have any Steem Power. Here are a few other interesting aspects about SP:

Steem Power is considered a long-term investment. In fact, you can’t actually sell it until you’ve been holding it for at least 13 weeks.

50% of payments sent to contributors are made in SP.

Unlike the other two cryptocurrencies on Steemit, SP cannot be traded on exchanges.

You can “power up” by increasing your SP holding or “power down” by cashing it out (exchanging it for Steem coin).

Well, that’s it for Steem crypto — those are the 3 cryptocurrencies on the Steemit network! Now, let’s move on to see how Steemit, the social-media platform, actually works.

Steemit Community and Curation

Steemit is trying to change how social media platforms work. Unlike platforms like Facebook where users are not compensated financially for the content they create, Steemit rewards the platform’s contributors/creators’ directly with its Steem coin.

In addition to creators, curators are also a very important part of the Steemit community. Users who upvote and help evaluate the quality of content are called “curators” on Steemit.

In fact, curators are also rewarded on Steemit as they help in maintaining the quality of the content! Pretty neat, right?

That’s what Steemit and decentralization are all about — the power is in the community’s hands.

Like Reddit, Steemit relies on its community to self-enforce the guidelines for user behavior. As of now, the guidelines are not as mature as that of Reddit, but they are a work in progress. They are ongoingly developing a community moderation guide called Steemetiquette.

A few important points that are emphasized by Steemetiquette are:

Citing sources and giving credit is encouraged.

There is a lot of emphasis on rewarding the original creator so original content is preferred when it comes to giving out rewards.

Avoid rewarding undesirable and spammy content.

The idea is to create a genuinely decentralized platform where users themselves decide which content is valuable, how good behavior should be incentivized, and how to create and maintain a positive community.

As you can see in the chart below, the Steemit community has been growing since its inception in 2016. According to a report on Steemit, there are 110,187 active users as of January 2018.

Active users per month of Steem coin

Now that we know how the Steemit platform is run and operated, let’s try to find out whether it really works.

Does Steem Really Work?

The concept of Steem is clearly exciting, as it offers many unique benefits and edges over its traditional competitors. That’s the reason it saw a huge price surge in 2017.

However, although it is exciting, it is currently facing some rather major challenges. If it does not overcome these issues quickly then it will just be another social media platform with a lost cause. Let’s take a look at the key issues the Steemit platform is currently faced with.

Voting Game

Curations of content through voting is one of the most important aspects of Steemit. In fact, the Steem crypto that is awarded to creators is directly linked to it. Unfortunately, it is very simple to code a few lines to create a bot for spam voting.

To worsen the situation, Steemit has openly shared the measures it has taken to fight the bots. With such open calculations available to them, coders can easily make the bots look like genuine Steemers.

It would be fair to say that not enough measures have been taken by Steem coin to solve this problem.

On the other hand, if you look at Reddit, you can see that they have taken extremely complex measures to fight this voting game and stop the bots. All their calculations and measures are concealed in order to make it difficult for coders to create working bots.

Even with these concealed calculations, Reddit still faces the challenge of fake voters, and they have to keep upgrading themselves. So, if Reddit is struggling even with their concealed calculations, Steemit is really going to have to step up their game if they want to stop the problem.

Driven by Cash

Rewarding the users with Steem coin for their contributions may be a good idea but it has many downsides too. The biggest problem is that the users are so driven by the financial angle that the whole idea of knowledge sharing takes a bit of a hit.

Steemit was supposed to be a cool place to hang out with companions but it has now become a competitive space, which feels more like a workplace. Users now look at it as an opportunity to make money and so their outlook has completely changed.

People do not share freely but are rather trying to come up with a piece that would help them gain as many upvotes as possible. It doesn’t end there — money is a strong motivator and can make people do ‘wrong’ things, such as creating bots to fraudulently upvote their content.

The same is the case with curators!

Rather than appreciating something genuine and good, they are on the lookout for the article that will get the most votes and in turn will increase their chances of making more money.

When an activity is monetized, it often loses its core purpose. If sharing is monetized, then people will stop sharing what they genuinely like and appreciate. If you monetize commenting, people will likely just comment on what they believe will earn the most money.

This is the sad truth of Steemit at present.

Granted, it isn’t literally every user. But, it is a lot of them.

When cash gets involved, people typically become more narrow-minded. It can also be said that this system attracts the wrong kind of users. The kind of users who would not hesitate to turn a blind eye to morals or ethics.

This leads us to the next issue — plagiarism.

Plagiarism

One of the most unfortunate outcomes of Steem’s monetization is that even plagiarism is rewarded.

A lot of times the original stories don’t get the appreciation they should receive. However, they get replicated quickly and are able to generate significantly more interest. That’s because most of the curators just want to be part of the stories that are doing well.

So, not many of the curators are bothered about the fact that the replicated story came later than the original story. In fact, duplicate content is the least of their concerns, as their main focus seems to be on making money.

Perhaps the worst thing about this situation is that it kills the interest of genuine users. It is the expert marketers or bot creators who start controlling the platform and accumulating more of the Steem cryptocurrencies.

This could lead to a huge lack of original content. This is absolutely not what Steemit was created for — it completely goes against some of its core principles.

While Steem has been able to create a market for itself as the go-to place for ‘get-paid-to-post’, it needs to overcome these challenges as soon as possible. The way in which Steem tackles these challenges directly affects its future, and it could also directly affect the price of the Steem coin.

Moving on, let’s take a look at the investment journey of the Steem coin so far.

Steem Coin Investment History

Did you know that the Steem crypto had become the third most valuable cryptocurrency at one point in time?

Yes, Steem coin saw a massive surge in its price on 20th July 2016 as it grew from about $0.27 to $4.34 in a single week. As a result of this, Steem’s market capitalization became $384.5 million, 3rd only to Bitcoin and Ethereum.

As you can see in the chart below, it was not able to sustain the hike for too long and the price fell to a low of $0.12 in November 2016.

However, Steem coin then touched a new high of $7.28 in January 2018. That’s a return of about 4,853% if we compare it with the price in January 2017, which was around $0.15. Not bad, eh?

Steem price charts

Like most other cryptocurrencies, the price of Steem crashed later in Q1 2018. Things haven’t looked up for Steem coin since then and it is trading at around $ 2.85 currently.

Steem prices also typically go down because more Steem coins are added every day to reward creators and curators. The users who receive Steem also cash them out. This is one of the reasons for creating Steem Dollars and Steem Power, in addition to Steem.

So, this is what the historical performance of Steem looks like.

There is no doubt that it has attracted a lot of investor attention because of its unique proposition. In order to continue doing so, Steem needs to solidify its offering in terms of technology and systems. It must fix the problems that face them.

Final Words

You now know what the Steem cryptocurrency is and how it is used to power the social media platform, Steemit. You also know how creators and curators play a central role on this blockchain-based platform which rewards the users for their contributions.

In addition to Steem coin, you should have a good idea about the other two cryptocurrencies of the Steem network — Steem Dollars and Steem Power.

So, with your newfound knowledge, have you formed any opinions of your own? Are you planning to use Steemit? What do you think about the challenges it is currently facing?

Whatever your views, don’t hesitate to let us know! We’re always interested to see what you have to say.