Make money trading SBD/STEEM! Part 2: Strategies

Make money trading SBD/STEEM! Part 2: Strategies

Five days ago I had 2.249 SBD in my wallet. Now I have the equivalent of about 3.12 SBD, an increase of nearly 40% in just five days! I'm not able to retire just yet, but for five days that's a very good return on investment. In this series I will show you how to trade SBD for STEEM and make a profit.

In part 1 of this series I showed you how to go on the market place to buy or sell STEEM. In this part of the series I will show you some strategies to increase your STEEM stack by trading SBD/STEEM on the market.

Historic SBD/STEEM prices

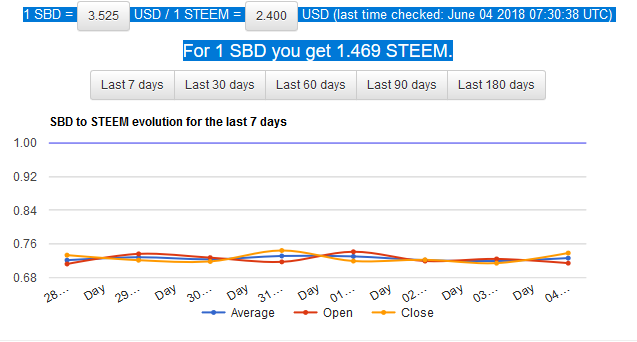

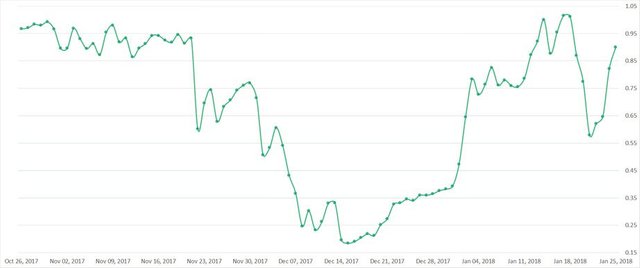

Before explaining some strategies to increase your STEEM stack, let's look at historic SBD/STEEM prices. I've taken the prices from the 26th of October until the 25th of January and graphed them below:

Click for full size!

As you can see, prices fluctuate a lot! This gives us a good opportunity to buy low and sell high, which is the first strategy.

Strategy 1: Riding the Waves

This is the easiest strategy and requires the least time spent on the market. Just put in a buy order for a low price, for example 0.80 or lower. The price will drop below 0.80 sooner or later. Then, once your order is filled, just hold until the price comes near 1.00 again. As you can see from the graph above, prices tend to gravitate towards 1.00 before dropping again. This is the strategy I've used over the past week to increase my STEEM by about 40%.

Note: even if you don't want to be bothered trading SBD for STEEM and back every day, pay attention to the price when you want to convert SBD to Steam Power (SP). Try to be patient and wait for the price to drop below 0.85, then buy STEEM and convert it to SP.

Strategy 2: Market Making

This strategy requires you to put in some time because you have to actively monitor the market. Or if you're a programmer, I guess you can build some alerts.

Remember the spread I wrote about in part 1? The spread is usually quite low, usually much less than 1%. However, sometimes it will go up to 5% or even more. This is where the 'market maker' strategy comes into play.

As part of this strategy, you'll place both a buy and a sell order, slightly above or very slightly below the best prices in the order book. This means that you're buying for about 5% less than you're selling for, so you'll be earning on the spread. People who want to buy will buy for the best price available, which is yours. The same hold for people who want to sell. You'll be able to make 5% per trade until others swoop in with better prices and lower the spread. Clearly, this strategy requires much more effort than the first strategy, but you'll make a profit much faster and much easier!

Note that if you want to trade SBD and STEEM, you can't use the STEEM to raise your voting power since it'll get locked up for some period of time if you do that. Now go out there and make some STEEM. Let me know how it went!

Related posts:

Make money trading SBD/STEEM! Part 1: The Basics

Please consider upvoting and resteeming my posts!

Thanks!

-longcat

this is wow

Ride them waves :)

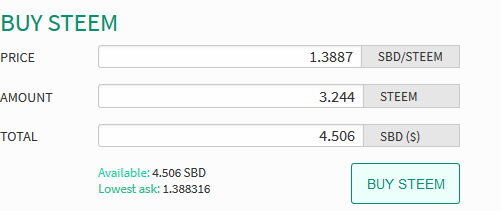

@longcat ~ I'm confused... Maybe you can explain to me why (today) the price of SBD just jumped to over $3.60 and the price of Steem dropped to $2.36, however, on the internal market, I would need to spend over 4.5 SBD just to receive 3.24 Steem. The following graphic was snipped when SBD was at $3.64 and Steem was $2.37 on the open markets.

This just doesn't make sense when SBD's prices are higher than Steem. Am I missing something here or is the internal market pricing just look upside down to me? Should I be trading my SBD for Steem when SBD's are inflated? Or no?

According to Steem.supply: For 1 SBD you get 1.450 STEEM.