Will individual investors have the chance to win professional fund managers "a lot of money"? - steem

In fact, it's the experts who do not win in their games, what makes individual investors want to win in someone else's game?

If long-term investment is enough to make a financially happy investor, comparing performance with a professional investment fund or a market index is no longer significant. means.

In the stock market, everyone agrees that the rate at which individual investors lose money after a certain period of time is huge. The longer the market participant's time, the higher the failure rate. Although no official statistics on the number of individual investors losses

(or less profitable than the market) after each year, but most retail investors do not achieve good results.

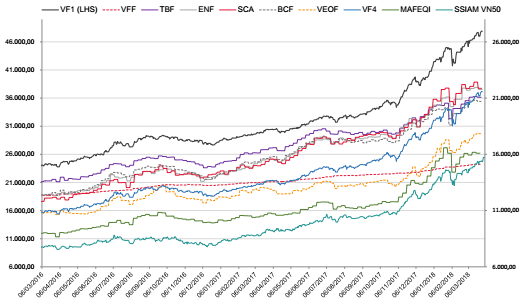

At the same time, some investment funds have stood out in the market with outstanding performance, even beat the index in a number of favorable markets. For example, SSIAMVNX50, an ETF managed by SSIAM, rose by 22.36% compared to the beginning of the year, much higher than the VN Index (around 17.21 %).

For a typical individual investor who lacks both experience and time to follow the market, choosing a good investment fund to send money is a wise decision. But for those who still want to try, is there any way they can win the market, or win professional fund managers?

Remember, in a given time period, only a very small percentage of stocks have outperformed the index. From the beginning of 2017 to the end of the first quarter of 2018, Vietnam is in the top five stock markets of the world's strongest growth.

At the same time, there must be many individual investors still do not achieve the same results although the market increased sharply. However, not all professional investment funds are winning the market, also in the same period.

In fact, professional fund managers face many obstacles in their capital allocation process. At times, and especially during the favorable market periods of the past, the pressure for these fund managers is greater than ever, leaving them virtually no other way than to rely on them. Entire market. Possible causes include the following.

First, with the huge amount of management money, investment funds are forced to focus on large cap stocks because only such stocks are appropriate for portfolio allocation. At the same time, large stocks often have good liquidity, which helps fund liquidation and structure when needed.

Secondly, the more favorable the market, the more money it pours into the funds, putting pressure on fund managers. Managers are forced to distribute these new funds into new shares, which are often large stocks in the market. This is the reason that the price of these shares is pushed higher.

This post has received a 1.51 % upvote from @speedvoter thanks to: @lecuong2290.

I send you 1 SBD but your upvote number is less than the number I sent a lot