Taking Money Off The Table But Keeping It In Crypto

There comes a time in every crypto bull market when you count up your gains, glance at the double digit percentages displayed in green on coinmarketcap, and something in your gut says this is too good to be true! That's about when you panic and consider dumping everything to lock in those wonderfully braggable gains.

Selling back into cash is a perfectly sound thing to do when you feel like you've made enough, but there are other ways to take money off the table without leaving crypto markets. I'm not a tax attorney, but I don't believe the IRS or other tax authorities around the world have issued guidance about whether moving funds within crypto triggers a taxable event.

Price-Stable Cryptocurrencies

An easy solution is to park your gains into price-stable cryptocurrencies, like bitUSD, Steam Dollars, or Tether. These are digital representations of USD created with smart contracts that dynamically adjust the quantity of an underlying asset to equal $1.

Bitshares and bitUSD

Bitshares is, in my opinion, one of the most undervalued crypto projects, given its capability, history, and community activity. Just swapping some BTC, ETH, XMR, Dash or whatever you just made a killing on into BTS isn't a bad idea given the relative valuations; however, some of the core products Bitshares offers are price-stable cryptocurrencies like bitUSD, bitEUR, bitCYN, bitGOLD, bitSILVER, etc. whose values denominated in BTS always equal one unit of the pegged currency or asset.

Steem Dollars

Our very own Steemit community offers another price-stable USD option, the Steem Dollar. Steem Dollars are similar to bitUSD, but the contracts are denominated in STEEM. As of now there are about 1.2 million Steem Dollars in existence, so there's some room to park funds here if you feel like crypto valuations are at relative highs and could retract.

Tether Uses Currency to Back Its Tokens

Tether is another interesting option to convert crypto into ...well, a USD, EUR, or Yen version of crypto.

Tether converts cash into digital currency, to anchor or tether the value to the price of national currencies like the US dollar, the Euro, and the Yen.

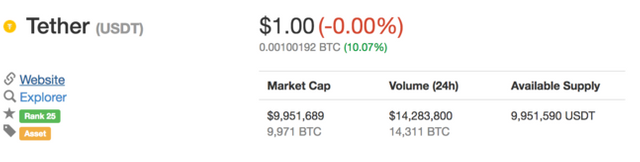

Each token has 1:1 reserves of the underlying currency backing it up. As of now there seems to be a supply of about 10 million Tether. You can see the value of such an option on a big down day for Bitcoin with this snapshot:

Bitcoin's down about 13%, but the Tether token maintains its $1.00 value.

Note: DigixDAO (DGD) does this for gold.

Diversifying Is A Good Idea

All of these products are relatively new as far as technology goes, so it's best to spread your funds across platforms. Park some in the Bitshares products, buy some Steem Dollars, and try out Tether and DGD to further gain exposure to underlying currency or metal. Volumes aren't spectacularly high either, and your safe haven loses value if your bids push the spot too far beyond par.

What are your thoughts?

If you like this post, please upvote, resteem, or share below! Please check out my other articles and follow @finpunk to keep in touch with future content.

Rob Viglione is a PhD Candidate in Finance @UofSC with research interests in cryptofinance, asset pricing, and innovation. He is a former physicist, mercenary mathematician, and military officer with experience in satellite radar, space launch vehicles, and combat support intelligence. Currently a Principal at Key Force Consulting, LLC, a start-up consulting group in North Carolina, and Head of U.S. & Canada Ambassadors @BlockPay, Rob holds an MBA in Finance & Marketing and the PMP certification. He is a passionate libertarian who advocates peace, freedom, and respect for individual life.

Image source: http://shareably.net/little-old-lady-bag-full-of-cash-joke/

Great post @finpunk. Have they fixed the issue with having five tags? I thought four was the max for now.

Thank you! I was having this talk with a friend yesterday about how to best move funds around within crypto instead of taking them off the table and triggering a tax event...this is what was born of that talk :)

Also good question re: tags...maybe i should remove one!

You're right about the tags! Just removed one and now the post is showing up in all four categories. Thank you very much!

This was a great read, I'm a noob and definitely interested in following content like this! thanks

Much appreciated @krisy! The best learning comes from doing, so i always recommend people dive right into the markets with a little to play around and get to know things first hand.

when you first started, did you just buy and sell currencies ? or did you try mining first?

i just started buying and don't have much experience with mining. my perspective has been that unless you have a competitive advantage in electricity cost, it's more efficient to buy from miners (or from markets where they dump their coins).

I understand, especially for someone like me that lives in an apartment.

But what about mining script? doesn't that alleviate those costs?

do you have any recommendations of where to buy , so far I've only really seen Poloniex

i also recommend Bittrex for some decent alt coin liquidity and access to some less traded coins, like ZCL. If you want to make larger BTC purchases to get from USD to crypto, i recommend Coinbase. Once you have crypto you can trade on Poloniex, Bittrex, or similar ...but if you're looking for simple trades without an exchange i highly recommend checking out @blocktrades and their counterpart, Shapeshift.io.

Actually, I can attest that moving moving money between cryptos is most certainly a taxable event - both in terms of gain and loss. This year I owe over 40K in taxes from buying alt coins with other alt coins that had exploded in value. On the other side of the token (heh) you can write off any time you "harvest" a loss. Harvesting is a fascinating way to mitigate your loss at tax time while still being able to buy back your investment. My advice? Get with a CPA who really knows there sh** ... several are recommended on bitcoin.tax. I was pointed to the IRS guidance and did the reading myself. Don't get caught like I did this year. Cheers. If you need a reference to a crypto savvy CPA let me know!

Wow thank you for posting this comment! I was not aware that the IRS issued guidance for in-kind transfers between cryptocurrencies / assets; i thought they just mentioned "Bitcoin."

This certainly changes the decision criteria for those looking to avoid taxable events. Thanks so much for contributing!